The Dutch Authority for Consumers and Markets (ACM, the competition authority) has recently published the second of a series of reports intended to examine if there are market failures that would hinder the development towards sustainable agriculture. Both the 2020 Agro-Nutri Monitor and the 2021 Agro-Nutri Monitor contain an English language summary on which this post is based. The reports are based on research undertaken by Wageningen Economic Research on behalf of ACM.

The reports focus on the markets for organic products, while recognising that there are other sustainability labels in the Dutch retail sector. Given the ambition in the Farm to Fork Strategy to increase the area under organic agriculture to 25%, the question asked by the ACM is of wider European interest.

Food markets are generally either oligopolistic (a small number of suppliers) or oligopsonistic (a small number of buyers). Farmers often have only a small number of processors to choose between, while retail sales are dominated by a small number of purchasing organisations, which potentially gives these organisations pricing power.

One form of market failure could be where the prices paid for sustainable products (in this case, organic products) do not fully compensate for the additional costs of sustainable production.

The suspicion behind the request to ACM from the Ministry for Agriculture for the study was that sustainable production (beyond statutory minimum requirements) does not result in an additional price for primary producers. There may also be barriers to entry for producers as well as anti-competitive practices.

As background, the Netherlands is one of the few EU countries that does not give direct aid to organic producers and growers, so they are dependent on the market price to cover their additional costs. The organic area in the Netherlands was 3.2% of the utilised agricultural area in 2018, compared to an average for the EU-27 of 8.0%.

What the research found

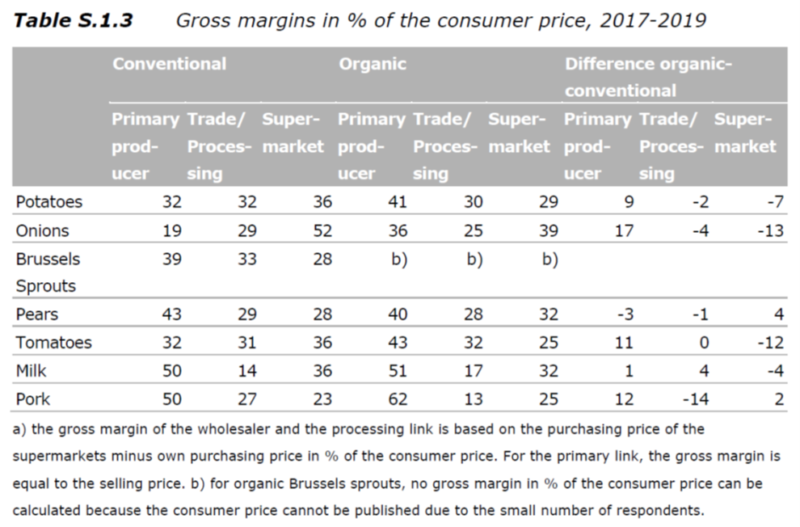

The research over the two years covered eight products (white cabbage for sauerkraut was covered in 2020 but was replaced by brussels sprouts in 2021) covering 67% of the value of Dutch agricultural production (excluding floriculture). The following table shows the distribution of value added along the food chain comparing the conventional and organic varieties for these products for the period 2017-2019.

The gross margin for the primary producer is defined as the selling price (thus it includes expenditure on input costs as well as value added). Generally, the share of the primary producer is higher for the organic alternative, reflecting higher costs of production, and indeed is as high as 62% for organic pork. Organic pears are an exception but this does not necessarily mean that organic pear producers received a lower price than for conventional pears. The other players in the chain might also have adjusted their margins. However, there is evidence in the final two columns that margins of downstream actors in the food chain are adjusted by less than the selling price of organic products relative to conventional products.

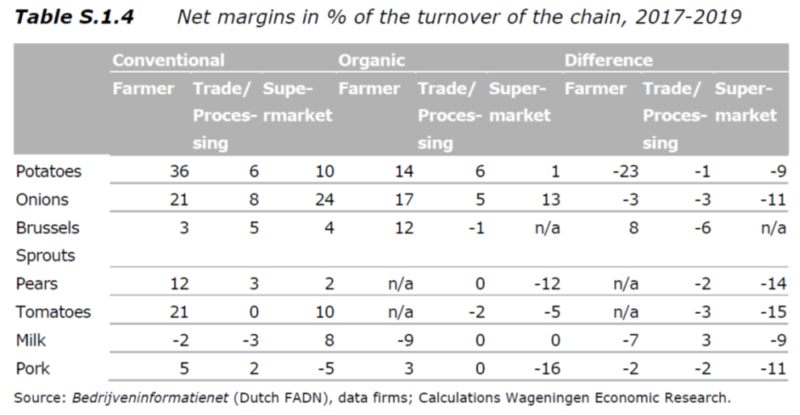

The second table below throws light on this by expressing the net margin received by each link in the value chain as a percentage of the turnover of that link (thus measuring profit as a percent of sales for each actor). The first point to note is that, during this period, even conventional milk producers did not make a profit. For the 2017-2018 period covered in the 2020 report, pork producers also did not make a profit, but their income situation improved in 2019 due to the impact of African Swine Fever on market prices.

In general, it seems that the profit rate (measured as a percentage of sales) was lower for organic producers. We cannot conclude from this that their income per kilo or per hectare was lower than for conventional farmers. In fact, with the exception of milk and table potatoes, the production of organic products yielded more profit per kilo for primary producers than conventional products. Profit per hectare would depend on a comparison of the output value per hectare for conventional and organic producers (where organic producers will have higher prices but lower yields, and the relationship between these offsetting factors will vary from product to product).

What is particularly interesting in the table is that the net margin made by traders/processors and supermarkets on organic produce is frequently zero and often negative. This is the case even where the net margin on conventional products is positive. This implies that the mark-up taken by these actors in the food chain does not cover the basic costs of handling organic produce let alone their additional indirect costs (such as higher transactions costs due to lower volumes, a lower turnover rate, or a higher loss or wastage rate).

I had perhaps naively assumed that those who make a conscious choice to purchase organic products would be less price-conscious consumers and thus that demand for organic products would be less elastic than for conventional products. This would allow supermarkets to charge a higher mark-up on their organic sales if this were the case.

However, some digging around turns up evidence that the demand for organic produce can be more price elastic than for conventional produce. This is supported by the Wageningen University analysis in the first Agro-Nutri Monitor that shows high price elasticities among consumers. Another example, a paper by Dr Hanna Lindström at Umeå University in Sweden, also found that the demand for organic milk is relatively elastic, despite relatively small organic price premiums in the Swedish milk market.

High price elasticities might well lead supermarkets to take a lower mark-up on organic products though it would not justify that they would run a loss. This practice suggests the supermarkets concerned may be using the availability of organic produce as a signalling device to position themselves in the market to attract (usually high-income) consumers interested in sustainability into their stores and making up the losses through higher margins on other products.

The Wageningen analysis for the ACM found that, in general, the additional costs that farmers or growers incur for most of the organic products in the study were compensated by higher market prices, but there is strong variation both over products and over time given variation in yields and prices. The analysis concluded that the main barrier preventing conversion to organic was consumers’ unwillingness to pay the higher price for sustainable products. Conversion costs can also be significant but were not seen as insurmountable. The limited profit margin on organic products in the later stages of the food chain was also noted as a further barrier.

In sectors in which the entry into organic production is relatively large, the additional price for organic products was under pressure in the period studied (dairy farming, potatoes, onions and pork products). In some sectors, such as milk and pork products, processors for organic products work with waiting lists. Discussions with the companies showed that this is an attempt not to let the supply grow too quickly in order to protect the existing organic producers against an oversupply and falling prices.

This underlines the importance of stimulating demand if the area under organic production is to increase significantly. However, as in many other countries, Dutch agriculture is largely dependent on exports, so even a significant increase in home market demand for sustainable products would not be enough.

Conclusions

In summary, the lower or even negative net margins of supermarkets do not suggest that they have greater market power over those farmers who produce sustainably. In fact, it reflects the fundamental unwillingness of (Dutch) consumers to pay more for sustainable produce, which makes it difficult for supermarkets to charge a higher price.

Other research undertaken by ACM found that making the conventional product more expensive but more sustainable will only increase the willingness of consumers to pay for organic products if there are small price differences. In the case of large price differences, making conventional products more expensive and at the same time more sustainable appears to be counterproductive for organic products and attract fewer consumers. ACM draws the (cautious) conclusion that “that providing more information about sustainability characteristics and making conventional products more sustainable and more expensive have little effect on consumers’ willingness to pay for organic products.”

The ACM in its advice to the Ministry based on these reports considered measures both to stimulate the demand for sustainable products as well as measures to limit the supply of conventional products (thus making them more expensive). It stresses that it has not investigated the effectiveness or possible side effects of these measures.

Lowering the VAT rate on sustainable products, or higher taxes on conventional products with the proceeds used to stimulate consumption of sustainable products, are proposed on the demand side. Production-limiting measures might include sustainability agreements between producers or within the chain (here the ACM points out that competition rules provide more scope for such agreements than is sometimes assumed), or even buying-out conventional farmers for whom conversion is not possible.

In either case, the ACM points to the limited effect such measures will have in the Netherlands where exports account for three-quarters of the value added in Dutch agriculture.

This post was written by Alan Matthews.

Photo credit: Camy West via Flickr, used under a CC licence.

A really interesting piece on the challenges of making organic food production sustainable. The piece didn’t appear to consider the impact of BtoC direct sales arrangements which are emerging, i.e milk dispensing retail units etc.

It happens that in Romania, here and there is expressed some soft criticism regarding the 25% average target of organic agriculture. And probably those are not singular opinions around Europe. But looking for commercial arguments to be brought into debate I did not found, at first search, many. Of course the subject is from a specific situation in a specific country, but one of the insights is valuable: the fact that Dutch supermarkets are taking into their offer the organic products as a “bait”.

In Romania the overwhelming perception, in public sphere, is that organic food products are healthier, provide health benefits. This misconception is widespread. Not through the regulated market, retail, etc. But in seasonal markets, temporary markets, sometime in online shops, etc.

And it became so anecdotal almost anywhere in Romania, in rural area, that “my wine is bio”, “my cheese is bio”, “our eggs are bio”.