I have long puzzled over the timeline, processes and trigger points that could lead to the next revision of the basic CAP regulations. As long ago as September 2014 I wrote a lengthy post on the prospects for the next CAP reform before even the ink was dry on the 2013 reform. This highlighted the mid-term review of the 2014-2020 Multi-annual Financial Framework (MFF) as a possible trigger point. It also discussed the complications of the parliamentary timetable for concluding a new MFF for the post-2020 period and the implications this might have for a further round of CAP reform.

I returned to this issue in a post in November 2015 in which I asked whether there would be a proposal for a CAP reform in 2017 to coincide with the publication of the Commission proposal for the next MFF? My conclusion was that we were more likely to see a rolling series of proposals for incremental changes in the various basic acts over the period of the Commissioner’s tenure, designed to address specific problems and issues, but without fundamentally changing the structure of the 2013 reform.

During the past two weeks a number of processes which might lead to further revisions of the basic CAP regulations have become clearer, although there is still much uncertainty over how these trigger points might be activated. I review what I believe are the three main processes and their trigger points in this post, and whether they are likely to lead to incremental or ambitious revisions to the CAP basic acts.

Building on the Omnibus Regulation

The first process is already underway. In mid-September as part of the promised mid-term review of the 2014-2020 MFF the Commission published its proposal to amend some of the MFF ceilings (referred to as the MFF Regulation). In a companion draft Regulation, it proposed simpler and more flexible financial rules to enhance the EU budget’s ability to adapt to changing circumstances and to respond to unexpected developments. This Regulation would revise the general financial rules accompanied by corresponding changes to the sectorial financial rules set out in 15 different legislative acts concerning multiannual programmes (referred to as the ‘Omnibus Regulation’ which with its 250 pages lives up to its name).

The focus of the Omnibus Regulation is on revisions to what is called the Financial Regulation. This Regulation sets out the principles and procedures governing the establishment and implementation of the EU budget and the control of EU funds. However, in addition to revising the Financial Regulation, the Commission also proposed changes to the sectorial financial rules, including the rules governing disbursements of payments under the CAP. These measures are justified as “further simplifying the policy with a view to easing the burden on and making life easier for both farmers and national authorities”. While some of the changes are technical in nature, others have a more substantive impact.

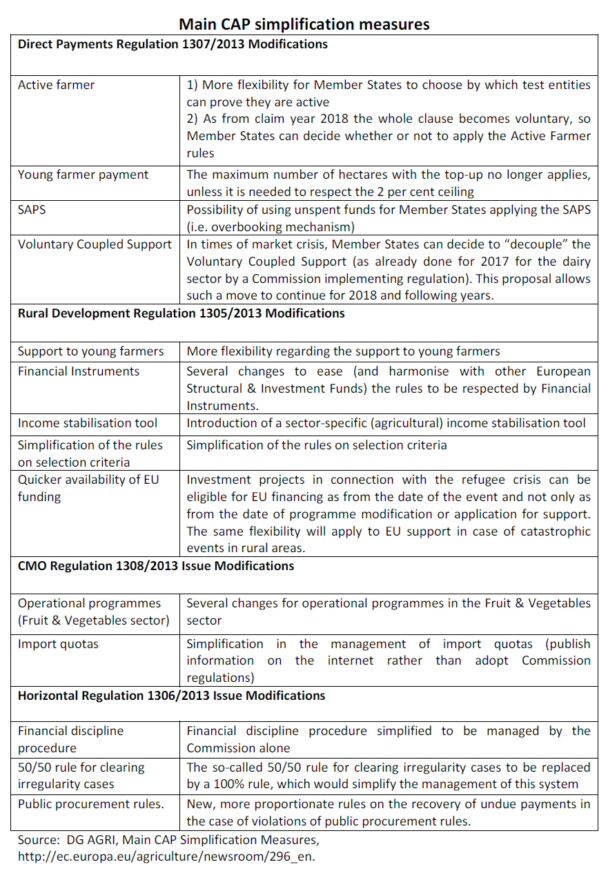

The DG AGRI summary of the CAP-related measures included in the Omnibus Regulation is shown in the table below. Three changes in particular are highlighted by DG AGRI:

• A change to the Rural Development Regulation to provide for a sector specific Income Stabilisation Tool. This will give Member States the possibility to design a tool tailored for a specific sector, which it is intended will make it more attractive for both farmers and administrations.

• A change to the RD Regulation to introduce simpler rules for accessing loans and other Financial Instruments intended to provide greater access to capital for farmers, particularly young farmers for whom access to credit is an ongoing problem.

• A change in the Direct Payments Regulation to allow Member States greater discretion in the application of the definition of an “active farmer”. In effect, Member States will be able to decide whether or not they wish to continue applying the existing definition of “active farmer”.

Because the Omnibus Regulation deals primarily with technical adjustments to the Financial Regulation, the lead European Parliament committee is the Committee on Budgets (corrected 22 December 2016 from Committee on Budgetary Control). However, COMAGRI was successful in making the case to the Parliament’s Conference of Parliamentary Committee Chairs that it should be given exclusive competence on all CAP-related provisions in the Regulation.

According to reports in the agricultural press, the Conference has recommended that Albert Deß (EPP) and Paolo De Castro (S&D) should be appointed co-rapporteurs on the agri-related aspects of the dossier. COMAGRI’s fear was that giving the Budgetary Control Committee oversight could set a precedent for future CAP-related reforms.

The question is whether the co-rapporteurs, or other AGRI Committee members through amendments, might seek to broaden the scope of the Regulation beyond what the Commission has proposed. The most obvious area where expansion might occur is in the risk management area. The recital on this in the draft Commission proposal reads as follows:

Nowadays farmers are exposed to increasing economic risks as a consequence of market developments. However, those economic risks do not affect all agricultural sectors equally. Consequently, Member States should have the possibility, in duly justified cases, to help farmers with sector-specific income stabilisation tools, in particular for sectors affected by a severe income drops, which would have a significant economic impact for a specific rural area, provided that the international obligations of the Union are respected….

It is easy to imagine that some COMAGRI members might want to build on this to go beyond the possibility of sector-specific income stabilisation tools to mandate, for example, a voluntary or even mandatory supply management scheme in the dairy sector. Other extensions of the risk management toolkit in Pillar 2 might also be envisaged.

In the same way that the Commission has proposed changes to the rules governing young farmer payments, it would also seem open to AGRI Committee members to amend the rules governing other CAP payments, for example, the rules governing the greening payment. I would not be surprised to see a concerted effort by some political groups in the Parliament to relax some of the requirements for receipt of the greening payment.

The Commission hopes that the Council (with the Parliament’s consent) will approve the MFF Regulation before the end of the year (the Parliament’s first reading is expected on 30 November 2016). The time horizon for the Omnibus Regulation is longer, with Commissioner Hogan hoping that any changes can come into effect by 1 January 2018. This provides one obvious trigger point for more far-reaching changes to the basic CAP regulations than what the Commission has proposed.

The CAP post 2020 timetable

The second process which could lead to changes in the basic CAP regulations is Commission-led. It is mandated by the inclusion in the Commission’s Annual Work Programme for 2017 to “take forward work and consult widely on simplification and modernisation of the Common Agricultural Policy to maximise its contribution to the Commission’s ten priorities and to the Sustainable Development Goals”.

What is noticeably absent from this formulation is any reference to CAP policies after 2020. If anything, this mandate is about revising the 2014-20 CAP so that it is better focused on the current Commission’s existing ten priorities during the remainder of its mandate, while also taking into account any new measures necessary to implement the EU’s commitments under the UN Sustainable Development Agenda. On this reading, this Commission-led process would be very narrow in scope and focused on a few specific modifications designed to address some of the more obvious weaknesses of the last CAP reform. It would de facto be a mid-term review of the 2014-2020 CAP.

On the other hand, if the notion of ‘modernising’ the CAP is interpreted expansively, and given that implementation of any changes agreed as part of this process could hardly be implemented before 2020, then it is possible that this review process will become a discussion of the type of agricultural policy we want in the EU after 2020. I label this more expansive option the ‘post-2020’ option to distinguish it from the ‘mid-term review’ option described in the previous paragraph.

Further details on the timetable for the Commission process have been reported in the agricultural press. According to AGRAFACTS, the Commission is expected to launch a 12-week consultation process on future farm policy in early January. The scope and ambition of the options outlined in the consultation paper will play a crucial role in defining the possible parameters of any further revision of the CAP arising from this process, in particular, whether it will take shape more in a ‘mid-term review’ rather than a ‘post 2020’ framework.

Commissioner Hogan is likely to give some indication of his thinking, and the issues he would like to see addressed in the consultation, before the end of this year, possibly in connection with DG AGRI’s annual agricultural outlook conference in Brussels next week. AGRAFACTS reports that the consultation may cover up to five policy options ranging from retaining the status quo to a radical reform. If this proves to be the case, it would support the view that the Commission is preparing the post-2020 CAP and not simply a mid-term review of the 2014-20 CAP. This should become clear by early January at the latest.

As part of preparing potential legislative changes, the Commission services must prepare an impact assessment which is scheduled for the months April through August 2017. This would allow the publication of a Commission White Paper or Communication later in the year, perhaps between September and November 2017. A further period of a few months would then elapse before the Commission came forward with specific legislative proposals, possibly in the first quarter of 2018.

At this stage, as I explained in my earlier post, the proposal is running against the clock counting down the remainder of the current Parliamentary term. Elections to the European Parliament will be held in May 2019 and the house will not sit after March 2019. This would point to a maximum 12 month period for the co-decision process involving the present Parliament and the Council on any Commission legislative package.

Even if the legislative proposal is framed as modifying the 2014-2020 CAP as part of a mid-term review and is confined to addressing two or three specific issues, leaving all other aspects of the current structure of the CAP unchanged (extending the risk management toolkit, strengthening producers’ position in the food chain, revisiting greening and managing crises being the most obvious candidates), it would be challenging to conclude a co-decision dossier within this time period.

In addition, there are some specific issues arising from the 2013 CAP which must anyway be addressed in the period post-2020 regardless of any other developments and which must also form part of the Commission’s proposals. These include external convergence of Pillar 1 payments, internal convergence of these payments, the future of capping and the continuation of SAPS in the newer Member States. With these issues on the table, it is hard to see how what might start out as a Commission legislative proposal to modify the CAP as part of a mid-term review could avoid morphing into a full-blown review of the CAP post-2020.

The MFF constraint. There is another reason to doubt that there will be an appetite to complete a post-2020 review of the CAP before 2019. This concerns the parallel negotiations on the MFF for the post-2020 period. The Commission must make a proposal on this future MFF by the end of 2017.

If the timetable for the 2014-2020 MFF is followed, preparatory work would initially take place in the General Affairs Council with the first meeting of the European Council to agree this MFF scheduled for Spring 2019. If, as must be considered possible, the European Council cannot agree at this first meeting (recall here also the uncertainty over Brexit negotiations) it could be at least a further 6 months until Autumn 2019 before the parameters of the post-2020 MFF (and thus the CAP budget) are known.

It is possible that the next MFF might be agreed under a quicker timeframe by the European Council than on the last occasion, although I find it hard to find reasons why the next MFF would be easier to negotiate.

In the 2013 reform, the Parliament was clear that it did not wish to discuss the shape of the CAP until it knew the level of future resources that would be available. If it held to the same position for the post-2020 reform (and why would it not?), then it would not be in a position to discuss expansive changes to the CAP regulations until the Autumn of 2019. This is another reason not to anticipate major CAP changes in the term of the current Parliament.

The Parliament’s rules of procedure are relevant here. All votes taken by Parliament in plenary before the elections, whether at first reading, or second reading, or under the consultation procedure, remain legally valid for the next Parliament. This means that after the elections the new Parliament would pick up the files where the previous Parliament left them and would continue with the next stage of the decision-making procedure.

However, for legislative business that has not reached the plenary before the elections, there is no legally valid Parliament position. Parliament’s rules of procedure stipulate that in these cases the work done on them (in committee) during the previous parliamentary term lapses. However, the new Parliament’s Conference of Presidents may decide, on the basis of input from the relevant parliamentary committees, to continue the work already done on those files (rule 229 of the EP’s rules of procedure).

On the basis of the above timeline, it seems highly unlikely that the Parliament would have adopted a first reading position on the Commission’s CAP legislative proposals published in early 2018. It would be possible for the AGRI Committee in the new Parliament to take over rapporteurs’ reports plus any amendments that had been accepted. But I doubt the AGRI Committee would have got that far in its work. In any case there must be a high probability that there could be significant changes in the composition of the Parliament after elections in 2019, and the new members may be unwilling to simply carry on as before.

One option under discussion in Brussels is that it may make sense simply to extend the current MFF for a further two years, in order to allow a decision on the next MFF and associated EU programmes to be made by the newly-elected Parliament after 2019. If this view gains ground in the coming year before the Commission is legally required to make a proposal on the next MFF by the end of 2017, then this would push the discussion on the ‘post-2020 CAP’ out to 2022 or even 2023. It would make it more likely that the outcome of the Commission process in 2017 would be a very limited ‘mid-term review’ of the current CAP.

These arguments are made purely on the basis of the difficulties created by the legislative timetable. It is also possible to argue that political economy considerations also militate against anything other than incremental changes, also possibly in the direction of more protection, in the CAP basic acts.

Brexit impact on the MFF

While the two previous processes which could lead to revisions in the CAP basic regulations are deliberative, the third is disruptive. This is the possible impact of an early Brexit, specifically on the financing of the current MFF. The presumption that the CAP status quo can more or less continue until 2022 or 2023 is likely to be overturned by Brexit. The impact of Brexit on the EU budget is thus the third process which could lead to a revision of the CAP regulations.

Under the current Brexit timeline, the UK government plans to trigger the Article 50 process to leave the Union in March next year. Given the two-year timetable set out in Article 50, this would imply that the UK would leave before March 2019. Admittedly, there is an increasingly widespread view that this timeline may not be feasible, but until it is updated it remains the UK government’s stated position.

I have previously calculated that Brexit is likely to leave a hole in the EU budget of the order of €10 billion, which is around 7% of the €138 billion EU-27 budget (without the UK). If the UK were to leave in early 2019, then funding for the CAP (and other EU programmes) would be in jeopardy in the last two years of the current MFF.

There are various ways in which this funding gap might be met. First, under the Article 50 withdrawal agreement, the UK might agree/be required to continue contributions to the EU budget for some years to come, to cover various future liabilities resulting from its EU membership to date.

Second, if the UK leaves without some transitional trade arrangement to avoid the reintroduction of tariffs on UK-EU trade, levying EU tariffs on UK exports to the EU could raise several billion euro which would offset at least some of the budgetary gap.

Third, even if the EU budget as a whole were cut, there is no reason to assume that individual spending programmes would be cut proportionately. I have previously argued that there is likely to be much less appetite for cohesion spending among the contributor Member States next time around given the stated positions and actions of some of the major cohesion fund beneficiaries over the past year. Thus, the European Council might agree to make deeper cuts in cohesion spending in order to protect the CAP budget. Of course, the converse would also be possible, where deeper cuts in CAP spending might be demanded in order to maintain the level of cohesion or other spending programmes.

Fourth, the remaining 27 Member States could agree to maintain the same level of spending on EU programmes by increasing their respective net contributions to fill the gap left by Brexit. However, as pointed out in my previous post on the impact of Brexit on the EU budget, the demand for additional net contributions would not be felt proportionately across all Member States. It would fall heaviest on Germany, the Netherlands, Sweden and Austria because these countries currently benefit from a rebate on financing the UK rebate. Whether these countries would be prepared to increase their net contributions by the anticipated 10-15% to offset the impact of Brexit is an open question.

If there is a budget financing gap for the last two years of the current MFF, and if the agreed ceilings on CAP spending are reduced as a result, then a critical question will be where the cuts would be made. It is likely that Pillar 1 payments would be the most vulnerable. The financial discipline mechanism was put in place precisely to address this situation.

It provides that direct payments (over €2,000) should be reduced by means of an ‘adjustment rate’ whenever there is a risk that forecast expenditure under the MFF sub-heading ‘market-related expenditure and direct payments’ might exceed the applicable annual MFF ceiling.

Interestingly, in the conclusions on the debate on the future of the CAP held during an informal working lunch during the last AGRIFISH Council meeting in early November the Slovak Presidency reported that “[Ministers] also considered that the second pillar of the CAP, the rural development in particular, is the one element worth investing in because of its effectiveness and visibility”.

If Ministers really meant to say this, it is perhaps the one piece of positive news to hold on to when surveying the processes which could lead to the next round of revisions to the basic CAP legislation.

This post was written by Alan Matthews.

Photo credit: © eu2015lu.eu / Charles Caratini

As always interesting. More radically:

1. Why vary payments nationally given free movement of labour and capital?

2. A recent straw poll of young farmers showed a majority against subsidy since it reduced land availability increasing cost.

3. A decoupled payment is a land subsidy inflating rents and land value to little purpose.

4. Tax averaging is a simple low cost means of managing risk

Thoughts!