We are pleased to welcome this guest post by Dr. Norbert Röder of the Thünen Institute Federal Research Institute for Rural Areas, Forestry and Fisheries.

A presentation of the Commission in the Council Committee on Horizontal Questions in November 2020 caused some turmoil among some Member States and NGOs regarding the potential role of particular eco-schemes in the new CAP. What was the turmoil about? The Commission emphasized that, in its understanding, eco-schemes according to the draft Strategic Plan Regulation (SPR) art. 28 (6) a (no need to justify the payments on an income foregone / costs incurred basis) can be granted if and only if this payment is not privileging any type of land use and / or must not be linked to any form of production.

This condition is a result of the obligation that payments for eco-schemes as for other agri-environmental measures must comply with the criteria laid down in the WTO Agreement of Agriculture for payments compliant with the Green Box criteria. There are different opinions about what “no link to any form of production” and “not privileging any type of land use” essentially mean.

In this post we take a deeper look at these different opinions. We analyse what consequences the Green Box criteria can have for the implementation of an environmentally ambitious green architecture, including specifically eco-schemes and payments for environmental, climate and other management commitments (SPR, art. 65). For ease of reading, we refer to the latter as AECM in the remaining text.

First, we highlight what the Green Box criteria state, how they are conventionally interpreted, and what are the consequences for the EU’s toolkit of agri-environmental measures (conditionality, eco-schemes and payments linked to environmental service provision in Pillar 2). Second, we look whether the Green Box criteria are a necessary or sufficient condition to avoid trade distorting effects. This is followed by an analysis of the implications of the Green Box criteria for the design of an ambitious green architecture.

Based on our analysis we conclude that the Green Box criteria do not prevent potential trade distorting effects but can create serious obstacles to designing an ambitious and efficient green-architecture. These obstacles increase the more heterogenous the setting in which the green architecture operates.

We see some sound arguments for the Commission’s restrictive interpretation of the eligibility of eco-schemes with an income component (art. 28 (6) a) for the Green Box. However, these arguments only hold if these payments are implemented in a way comparable to current AECMs. This means that payment levels per ha of committed area and the management obligation discriminate according to type of land use and crop. If eco-schemes are implemented in a way comparable to the current greening payment, i.e. a maximum lump-sum payment per ha UAA and non-productive use is sufficient to claim the full lump-sum, we do not see convincing counter-arguments why an eco-scheme payment should not qualify for the Green-Box.

As the self-commitment (SPR art. 10 in conjunction with Annex II) that eco-schemes and AECMs must comply with the Green Box criteria increases the challenges to create an ambitious and efficient green architecture, we recommend Member States use the potential work-arounds and that the Commission should allow their justified utilization or preferably transparently waive the self-commitment.

What do the Green Box criteria actually state?

The so-called Green Box (Annex 2) in the WTO Agreement on Agriculture is intended to exempt support payments to farmers that are either minimally or not trade-distorting and that meet other policy-relevant criteria from the scheduled amounts that set a ceiling on the amount of support that a country can provide to its farmers.

Two (or three) separate paragraphs in Annex 2 of the WTO Agreement on Agriculture (AoA) can be used to exempt agri-environment payments from disciplines on the amount of support. These paragraphs define the conditions for payments that are at most minimally trade-distorting and define the Green Box. Payments that have an income component are eligible for the Green Box Paragraph 6 if: “(b) The amount of such payments in any given year shall not be related to, or based on, the type or volume of production (including livestock units) undertaken by the producer in any year after the base period. […] “ and ”(e) No production shall be required in order to receive such payments.” If payment entitlements are not in force Paragraph 5 becomes the relevant one but the requirements are identical.

The Commission argues that according to the WTO panel decision on the “Upland Cotton” case (DS267 US), which found that certain US agricultural support payments were inconsistent with its WTO commitments, the term “related to” in Paragraph 6 excludes the possibility to favour any type of production either positively or negatively by excluding or treating differently some production types. This excludes payments targeting with a practice a land type (arable land, grassland or permanent crops) or differentiating payments according to crop/land type. The exclusion of payments targeting practices relevant to a particular land use, in turn, is a particularly strict interpretation of the notion of ‘production’ in the WTO Agreement which would normally be interpreted to refer to output. The US lost the case as it had excluded fruits and vegetables from the challenged support program and therefore in practice the payments were linked to production.

Alternatively, payments under environmental programmes are compatible with the Green Box according to AoA Annex 2, Paragraph 12 (b) if “the amount of payment shall be limited to the extra costs or loss of income involved in complying with the government programme.” In this case, a link between the payment and specific types of production is permitted provided that the payment is limited to the extra costs or income foregone.

Currently both the decoupled direct payments, the greening payment (Paragraph 5 or 6) and the agri-environmental payments (Paragraph 12) are notified in the Green-Box.

Do AOA Annex 2, Paragraphs 5 or 6 constrain the EU’s toolkit of agri-environmental measures?

The challenges in interpreting the AoA rules emerge as there are only few panel decisions on the respective aspects, and none with respect to Paragraph 12. Therefore, one must basically refer to informed reasoning and the analysis of behaviour of WTO parties in the past on somehow comparable issues.

If one takes a radical point of view (i.e. the view of an economist) on ‘not privileging any type of land use’, the current CAP greening and basic payments are essentially not compliant as the net benefits created by these payments are not equal for all land types. The schemes favour implicitly the land types with the lowest obligation level. For instance, there exists no specific management obligations for permanent crops in the greening payment (in contrast to arable land or grassland).

A more moderate interpretation (the Commission’s position cited above) argues that only the level of public payments is relevant and whether a land or crop type is de jure eligible. Whether the scheme is de facto relevant, meaning that the payments influence management decisions on a specific land or crop, is secondary. In addition, when looking at the Commission’s documents the fact that a payment is non-discriminatory seems to be more decisive than the linkage to production, e.g. support for organic farming with an income component seems to be acceptable, if the payment rates do not differ between types land (grassland, arable land or permanent crops) (COM, 2020, COM, 2021). Making the payment for the entire UAA but having some technical side restrictions, which are theoretically but not practically independent of the type of land use / crop, may make the payment legal defensible but potentially at the cost of a lot of ‘red tape’.

How could a potential work-around look like (being largely incomprehensible to the uninformed and creating some red tape)?

A scheme supporting grazing on grassland with an income component does not qualify for the Green Box as it clearly favours a certain land type and one might argue it promotes production. The easiest option for a Member State would be to programme such a measure as coupled support according to SPR art. 29. Coupled support can be notified in the Amber Box. However, if a Member State objects for principled political considerations to the use of coupled instruments there is still room to manoeuvre. The Member State might offer an eco- scheme providing habitats for coprophagic (faeces-eating) animals and promoting permanent vegetation cover of UAA. Such a scheme might qualify for the Green Box if the scheme just requires a) the provision of fresh dung e.g. on average 1 kg dry matter per ha and day and b) that the biomass is removed by natural (i.e. animals) or artificial units (e.g. mowing robots), provided these units do not on average remove more than 100 m² of the average annual reference biomass production per day. Such a scheme will likely produce the same results as a coupled support. However, it is clearly not linked to production (the farmer can use a robot and buy in dung and distribute it on the land by a manure spreader) and not restricted to a certain type of land use. The same ‘trick’ was applied in the greening when leguminous crops were relabelled N-fixing crops.

Looking at the current greening and basic payments, we see that the payment levels are independent of land use and crop type but the obligation levels are not. In addition, the weighting factors in the ecological focus area (EFA) obligation of the greening payment result in a different remuneration of the specific options. Currently, 30% of the direct payments are formally attributed to compliance with the greening conditions. Due to the layout of the system for administrative penalties laid down in EU 640/2014 (art. 24-28), the share is in effect 37.5%. In addition, the sanctioning algorithm operates in a way that the payment reductions and administrative penalties are proportional to the farmers’ level of compliance to the regulation (for a detailed analysis how the mechanism works see Röder et al. (2019 p. 282-288). This means the greening payment is economically equivalent to a coupled support program.

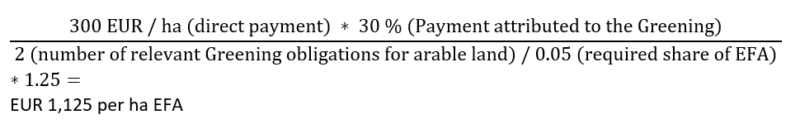

Suppose we attribute half of the greening payments for arable land (attributing the rest to the crop diversification obligation) and consider that 5% of the arable land must be dedicated to EFAs. Given for simplicity direct payments equivalent to 300 EUR per ha, this implies that each EFA hectare is linked to EUR 1,125 of direct payments.

The different EFA options are weighted differently. This means that, for example, each ha of catch crops (weighting factor 0.3) is rewarded with 338 EUR, N-fixing crops (0.7) with 788 EUR and fallow (1.0) with 1 125 EUR. If we assume that the greening and the basic payment are Green Box compliant, one might logically conclude that an eco-scheme following the same principles also should be. This assumes an eco-scheme that dedicates a fixed payment per ha of eligible area, even if different specific management obligations would be rewarded differently.

The other critical aspect is the no production obligation in AoA Annex 2 (6) b. Here again one might take different views. If taken literally, this implies a scheme that could only address the provision and management of non-productive areas. A more liberal interpretation would argue that support of activities that have no implications for the provision of market outputs is fine, e.g. the promotion of catch crops, or the coverage of slurry tanks. The most flexible interpretation is that even a scheme including productive options is compliant as long as non-productive options are available. This is essentially the case for the EFAs as under this heading fallow, landscape elements and catch crops but also protein crops and certain energy crops are permitted. This leads to the conclusion that if greening and the current decoupled payment are eligible for the Green-Box, eco-schemes constructed in a similar way should also be.

An extremely pragmatic stance is advocated by certain NGOs. Their argument reflects the principle “where there is no plaintiff there is no judge (panel)”. They argue that agri-environmental payments generally lead to a reduction in market outputs and are therefore not negatively impacting third countries (at least if they are exporters of agricultural commodities). In addition, with the myriad of small and differentiated measures applied throughout the EU it would be nearly impossible to provide empirically funded evidence that these payments cause market distorting effects. They therefore conclude that the likelihood of a third country raising a dispute and obtaining a negative panel decision is negligible.

It is important here to recognise that the treatment of subsidies in the Agriculture Agreement differs from their treatment under the Subsidies Agreement. Under the latter the complainant must demonstrate an adverse trade effect. However, under the former, it is sufficient, as the Upland Cotton case showed, to find that a measure does not conform to the rules, and there is no need to demonstrate trade effects. However, the question remains, who would take a case if the schemes are basically production limiting (implying at least in theory higher world market prices) or not affecting production at all?

Must agri-environmental payments be notified in the Green Box?

No. Legally, the EU does not need to require that Member States notify their agri-environmental payments in the Green Box. Under its Schedule of Commitments, the EU can notify up to 72 bn EUR per year (prior to Brexit) in the Amber Box. In 2017 the total notified support of the EU was 73 bn EUR, of which only roughly 7 bn was notified under the Amber Box. So, the amount notified in the Amber Box could be increased significantly without the EU risking to breach its obligations.

The requirement to notify agri-environmental payments as Green Box measures is set out in Article 10 of the draft Strategic Plan regulation in conjunction with Annex II of that regulation. In contrast, the Commission’s proposal does not impose any Blue Box or Green Box requirement on interventions like coupled support (art. 29 ff.) or the risk management tools (art. 70). One can ask the question whether these additional requirements for the design of agri-environmental measures help to make the CAP greener and an effective instrument to achieve the goals of the Green Deal. In the majority of cases, compliance with the obligations of agri-environmental programmes will lead to a reduction in overall production. So, these measures are far less likely to be trade distorting than coupled support or risk management tools. In addition, the latter provide generally few public benefits outside the agricultural sector.

Do the Green Box criteria limit the payment level for a specific intervention?

No. “In practice, with a large number of measures, owing [to] the heterogeneity of costs on participating farms, there will always be some where a standard premium results in a larger or smaller share of profit. In extreme cases, when the measures do not necessitate adjustments to farming operations, the premium is up to 100% profitable. Therefore, with a standard premium, the stipulation of a cost based- premium calculation [] cannot be met. With an average calculation across all (participating and non-participating) farms, owing to cost heterogeneity it is also not possible to calculate the premiums so that on average no significant profits are generated on all participating farms” (WBAE, 2019, p. 50).

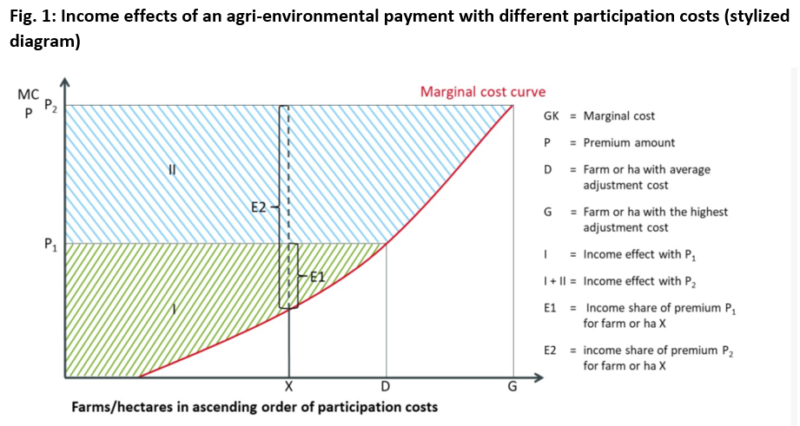

Recall that participation in agri-environmental programmes is voluntary. Farmers will only participate in a programme if the payments granted exceed their subjective costs associated with participation. An administration that seeks to enrol D hectares must set the payment level at least at level P1 (see Fig. 1). Only for the marginal provider is the condition that the payment equals the income foregone or costs incurred met. For all hectares left of D participation in the programme generates a profit compared to the normal agricultural activity. In case of hectare X, the income share is E1. If a high share of the area is enrolled the marginal cost can become extremely high, and thus also the income component for the non-marginal providers. Just for illustration, the short-term costs for idling a hectare in intensive livestock farms can easily exceed 2000 EUR per ha and in case of permanent crops or horticulture they can exceed 10,000 EUR per ha and year in Germany.

In addition, two baselines (reference situation) for calculating the payment are feasible. In case the intended environmental service is threatened due to abandonment, the payments can cover the full costs of the management. In case the service is threatened by intensification the payment shall be equivalent to the additional cost / income foregone of the more extensive management in comparison to more intensive alternative. These baselines reflect the setting in which agri-environmental payments generally operate (Röder & Matthews, 2021). Further discussion of the difficulties in estimating incurred costs / income foregone of the marginal providers with any satisfactory level of confidence is contained in this separate Annex.

So, why are the Green Box criteria viewed as problematic for an ambitious green architecture?

The Green Box criteria are challenged by many environmental NGOs and scientists for various reasons, despite the fact that they can act to limit the extent to which agri-environmental payments might suffer from green-washing. The arguments fall into various categories:

- Experience of problems induced by the maximum payment rates set for Pillar 2 AECMs in the current CAP

- The need to overcome resistance among farmers towards the shift from payments with low (basic payment, payments for areas with natural constraints) to high ambition levels(agri-environmental payments)

- Psychological arguments regarding the acceptance of agri-environmental payments by farmers

- The absence of a market-orientation with respect to the provision of public goods

- Practical problems regarding the development of a modular design of agri-environmental support measures that is logically consistent (meaning that the provided incentives for farmers reflect the environmental benefit that society receives), and compliant with the WTO criteria for the Green Box as well as regulations on “no-double-funding”.

a. Experience of problems induced by the maximum payment rates set for Pillar 2 AECMs.

While the Green Box criteria do not set limits on maximum payment rates Annex II of the current RDP regulation (1305 / 2013) does define maximum payment rates per ha or livestock unit. The payment must not exceed e.g. 600 EUR per ha for annual crops (i.e. arable land), 450 EUR per ha for other land uses (i.e. grassland) and 200 EUR per livestock unit. A back-of-the envelope calculation shows that these maximum rates are much too low in many highly productive regions and/or high wage countries to induce a substantial change in the management (e.g. rewetting of peatlands, or flower strips and areas in productive arable areas) or to ensure the management of many semi-natural habitats being extremely valuable for the preservation of EU’s agricultural related biodiversity. Either the opportunity costs of an intensive management are much higher or the management of the semi-natural habitats requires frequently much manual labour leading to high labour costs.

Higher payments are feasible in “duly substantiated cases”. Member states can use either (1) additional national funds to grant higher payments or (2) higher rates with full EU co-financing are possible. Both options are only partly attractive for Member States. Both require to dedicate substantial additional resource to build up a strong argumentation during the notification process (a time when most administrations hardly complain about an excess in the available qualified labour force). The first option reduces in addition the EU-co-financing rate, it locks in national budget expenditure for a time span longer than normal budget cycles (annual / biannual) and the national funds due do not count towards the 30% target for environmental measures.

b. Overcome resistance among farmers towards the shift from payments with low (Basic payment, Payments for areas with natural constraints) to high ambition levels (agri-environmental payments)

The second argument is a strategic one. From an environmental perspective the Green Box criteria split support payments for farmers into two large pools. The first includes payments for low or zero conditionality support programmes like the basic payment or payments for areas with natural constraints. In this case, farmers are given funds essentially just because they are farming within the general legal obligations and the generation of income is even a declared political goal. The second pool includes payments for the voluntary or obligatory fulfilment of additional standards (agri-environmental payments or payments to compensate area specific restrictions induced by the Water Framework, Birds or Habitats Directives).

In this pool farmer are just compensated for the costs to behave in a way more desired by society and the income generating effect is generally communicated as a nuisance that should be mitigated. As the same budgetary source fills both pools, an extension of the second pool implies that farmers have on average less disposable income (if market effects due to a reduced supply of agricultural commodities and the inelastic response of the demand for agricultural products do not lead to overcompensation).

Question: Assuming rational behaviour, for which kind of payments will farmers’ associations lobby? Therefore, the Green Box criteria deepen the trench between farmers and environmental NGOs. As one can generate income for ‘just’ farming or as only a compensation for additional costs. It is illogical that ceteris paribus the income share is inversely correlated to the degree of environmental services provided by a farmer. The Commission’s view on the Green Box criteria has led to the consequence that even some very mild environmental commitments had to be waived by the German Länder for the payment for areas with natural constraints to preserve the income generating effect of the payments. This induced a shift in the relative competitiveness of different crops that can be linked to higher potential erosion in low-mountain areas.

c. Acceptance of agri-environmental payments by farmers

The next argument is closely related to the previous one but focuses more on the psychological implications on farmers’ side. Despite the fact that for the individual farmer agri-environmental payments can have a substantial income generating effect (see above), they are marketed under the heading of compensation of income foregone / cost incurred. This suggests that the farmer is not better off economically and that participation should be basically for altruistic motives. This will deter many farmers from giving a second thought to participation in agri-environmental measures. In addition, it communicates the message that it is not sensible to specialise in the provision of environmental services as the profits which are necessary to cover the entrepreneurial risks in a market economy cannot be generated. Further, positive effects of participating in agri-environmental payments like diversifying income and hedging production risks are barely communicated as this might induce a reduction of the payment.

This is aggravated by the fact that other grazing livestock farms, the type of farming that has the highest share of dark-green agri-environmental measures and manages a widely over-proportional share of high-nature value farmland, is performing strongly below average regarding economic indicators. And some of the most valuable farming systems from an environmental point of view, e.g. transhumance and low input agroforestry systems, are on the verge of extinction due to their low economic performance. This situation conveys the implicit message: “You can behave in a way that is claimed to be in concordance with societal demands but this will be at the expense of your material standard of living.”

Furthermore, it is hard for administrations to justify incentives for actions which might dramatically increase the effectiveness of the programme but hardly induce additional costs to the farmers. Instead, these actions must be “forced” by adding obligations in the measure. This can result in a very extensive list of obligations, which can be a deterrent for the farmer (esp. new entrants).

All in all, if we assume that social preferences are really revealed at the cashier (for private goods) and with the support rates (for public goods) then farmers must regard policy makers as at best schizophrenic when publicly asking and demanding an increased provision of public goods in soapbox speeches but actually paying (with an income component) for production (e.g. risk insurance tools, coupled support programmes) or just for the continuation of farming without specific management obligation.

d. The absence of a market orientation with respect to provision of public goods

One heavily criticised aspect is the focus on the costs on the supply side ignoring the other side of the market: the value of the public goods created by the measure for society. The neglect of the values created is not a practical problem as long as one of the following conditions are met. Either the measure provides a homogenous good and the benefit is independent of the location. Or alternatively the cost function is based on the costs of the environmental result (i.e. tons of mitigated greenhouse gases or additionally fledged Lapwings (Vanellus vanellus).

However, truly result based schemes are frequently not economically feasible as the high interannual and local variability of the results would imply disproportionate monitoring costs given typical farm sizes in Europe. Therefore, practice-based approaches are still dominant. Frequently the same environmental target could be achieved with different measures, which are likely to differ with respect to their cost structure. Establishing a payment level based on one particular measure with its associated costs can induce biases that can lead to inefficiencies in achieving the environmental objective.

Additionally, a standard economic assumption is that the marginal benefits (for the public) of the provision decrease with increased provision levels while marginal costs (for the farmer) increase. So, from the demand side decreasing payments with increased level of production would be preferable. A decreasing marginal payment with increasing implementation level (e.g. 800 EUR per ha for the first five percent of arable land dedicated as wildlife habitat, 700 EUR for the next five percent) is further dampening ‘over’-specialisation effects on the farm and regional scale. Overspecialisation could result in a situation where low-input forms of agriculture are found and are dominant in marginal areas only.

Such an ‘over’-specialisation is not an economic problem as long as the environmental response variable is ‘spatially ignorant’, meaning that e.g. a hectare of agri-environmental management creates the same environmental benefit regardless of the location. A classical environmental good where location barely matters is greenhouse gas mitigation, as the greenhouse gas concentration balances out quickly in the atmosphere. Unfortunately, for most environmental goods spaces matters as the goods are either not perfect substitutes (e. g. reducing nutrient inputs in aquifers with an already good quality is little help, if high nutrient loads in intensive regions are the problem). In addition, threshold and saturation effects on the local and regional level are not uncommon especially when addressing biodiversity issues. Under these conditions an additional hectare at the ‘wrong’ place creates little added value.

However, using costs as an argument for setting payment levels leads one on to thin rhetorical ice in public debates with farmers. Remember, legally even for the first unit of production the payments must only cover the production costs set for the reference situation (that should depict the ‘truth’). This means that the payment levels can be only reduced if the paid share of the reference costs declines. However, from the farmer’s point of view the costs will likely increase with higher implementation levels. Consequently, it is a challenging communication exercise to use a cost-based argument to advocate for decreasing payment levels with increasing implementation levels. Changing the framing to the demand side perspective would not necessarily alter the resulting payment levels but would be easier to communicate as it would follow standard market logic (i.e. that prices decline if the offer increases and the demand function has not shifted).

As the implementation of agri-environmental measures reducing agricultural output is generally limited in more intensive regions one standard recommendation of the Commission and many agricultural economists is to regionally differentiate payment rates. Given budget constraints this would result in higher payments for the same physical activity in high-input regions and lower payments in more marginal ones. Politicians and administrations do not welcome this idea for political reasons, despite the fact that such an approach raises the efficiency of public payments. To the non-economist’s ear such a distribution model that follows “the ones who got (the high market revenues) will get (the high payments)” just seems unfair, especially taking into consideration that the income levels in regions with marginal production conditions are lower than in more intensively farmed regions. It is politically difficult to argue that these higher payments in high-income regions are only compensating costs incurred and thus not necessarily raising incomes by more. In addition, because the way the AECM payments are calculated the payments hedge production risks (market and weather) and the income stabilising effect is working at a higher level in the intensive regions.

However, if it is socially acceptable that implementation rates vary regionally, different regional average payments could be the intrinsic result of a scheme in which marginal payment levels decline with increasing relative implementation levels. Such a scheme would allow payments to motivate farmers in high-intensity regions to implement at least some measures, while the income effect of these first hectares and the overall implementation level would be larger in less productive regions. Nevertheless, an explicit differentiation of measures and payments will still be needed if problems are specific for certain setting or region, e.g. the preservation of hamsters (Cricetus cricetus) in highly productive loess areas.

e. Practical problems regarding the development of a modular design of agri-environmental support measure that is logically consistent (the provided incentives for farmers reflect the environmental benefit), and compliant with the WTO criteria for the Green Box as well as regulations on “no-double-funding”.

A last argument stresses the practical implication of the Green Box criteria for the design of agri-environmental programmes by national and regional administrations. Problems emerge if the programme should be logically consistent in itself and differentiated. Logically consistent means that the provided financial incentives are proportional to the realized environmental benefits. The differentiation and in many cases modular design of the programme results from the intention of policy makers to address the different environmental needs and to provide realistic options for a wide range of farms facing different constraints to reach a wide implementation. A modular design means that the program consistent of an entry-level scheme and some modules addressing specific environental needs or reflecting different ambition levels. In such a scheme the single farmer is relatively flexible in selecting the program that suits him best. The administration can define modules for larger areas (including setting up the IT and control system) and the regional adaptation is largely limited to the unlocking of specific modules.

Example of a modular scheme

A typical example of modular scheme would consist of an entry-level scheme for grassland, prohibiting the use of mineral fertilizer and prescribing a stocking density on the grassland between 0.3 and 1.2 LU per ha for the entire farm’s grassland. An additional animal welfare package with two levels would promote the grazing of the entire cattle stock for at least 120 or 180 days per year. Other modules would focus on the plot level and address biodiversity issues e.g. by banning the 1st utilization prior to the 15th of June or water protection issues banning the application of organic fertilizer at all.

As we have shown above the Green Box criteria do not practically limit the allowed payment rate in the majority of cases. However, the Commission demands comprehensive justification that the assumptions made for the calculation of the payment rates are somehow consistent with each other. This means that the imputed wage must be comparable if measures are offered in the same region or that the assumed opportunity costs for the provision of land are comparable. As we have highlighted before the measuring of true costs is fairly problematic and this has implications which will be highlighted in two examples in the following box .

Flowering areas with differing ambition levels

Baden-Württemberg offers two different options for flowering areas on arable land. The first option (FAKT E2) was introduced in 2016 where the area paid for must be mulched and reseeded annually. The second option (FAKT E7) was introduced in 2019 where only roughly half of the area must be mulched and reseeded annually. While there is ample evidence that E7 provides a higher ecological benefit compared to E2, the payment calculated on the basis of costs incurred is substantially lower 540 vs. 710 EUR per ha. The difference can be explained by the fact that only half of seeds are required and fewer management activities and consequently labour are needed (labour costs for the additional management are included in the calculation). However, given the typical size of arable farms in Baden-Württemberg, the maximum commitment area (2 or 5 ha per farm), labour and machinery are no hard constraints for the farmers. Therefore, it is not surprising that farmers generally prefer E2 compared to E7 as it provides the better remuneration of the ‘really’ limiting factor land. The reduction in the compensation for the farmer’s labour input would result in lower payments and consequently a lower acceptance of both measures.

High value biodiversity structures in organic farming

Fallow area, flowering stripes or unused grass strips frequently provide a higher benefit for biodiversity in organic farms compared to conventional farms as negative edge effects due to the application of pesticides are smaller and the living conditions for many wild species in the organically productive area are better compared to the conventionally managed counterpart. However, we see hardly any such practices on organic farms in Germany, despite the fact that organic farms can participate in the programme. The problem is that for both measures the reference for the calculation of the payment is the normal conventional management. Gross payment for a hectare of such grass strip practices is the same for conventional and organic farms.

Organic farms anyway receive a premium for organic farming which would be fully deducted from the payment for the grass strip. The organic payment reflects the lower yields, higher market prices and higher management costs (both labour and machinery) and leads to higher remuneration of the production factor land, if labour costs are not accounted for. This shifts the baseline for the manager of an organic farm evaluating the implication of participating in a scheme supporting grass strip practices, if labour is not constraining. In addition, agronomic restrictions are more pressing in organic farms. For example, dairy farms are much more dependent on high quality roughage, as the costs of concentrates are proportionally much higher compared to their conventional counterpart. Some noxious weeds, that might spread from unused areas, are much harder to control in organic farms. The outcome is that applying the costs incurred principle makes the scheme less effective.

When one designs a modular programme with an entry-level option and a more ambitious one, the entry-level will have to cover the opportunity costs of the constraining factor. Otherwise, no farmer will participate. However, in these opportunity costs the necessary implicit economic incentive for the farmer to participate is largely hidden. The top-ups will frequently only cover the costs of additional management steps, which can be relatively accurately determined. As the top-ups will cover only the additional costs and with any additional obligation the risk of an infringement rises, the incentive declines to participate in higher-level programmes. Especially in the context of eco-schemes many representatives from the environmental administration fear that farmers will quit existing high level measures as the additional payment for these measures may not be in a reasonable relation to the additional obligations.

Does the option to include transaction cost mitigate the problem?

In principle, yes. The Commission’s proposal does not require anymore that the top-up for transaction costs is proportional to AECM payments (art. 65 (6)). Currently this share is limited to 20% of the payment. This increased flexibility on setting the transaction costs could help to overcome some problems in a modular designed agri-environmental programme. However, we are sceptical that problematic cases with perverse incentives as described in the previous sections can in any case be mitigated. It is worth noting that a reimbursement for transaction costs is not mentioned with respect to the eco-schemes.

Summary and Recommendation

We see some sound legal arguments for the Commission’s restrictive interpretation of the eligibility of eco-schemes with an income component (art. 28 (6) a) for the Green Box. However, most of these arguments also apply to the current direct payments including the greening payment as well as the future basic income support for sustainability. If these payments are Green Box compliant it should be possible to design eco-schemes in a comparable way. In our view the essential common feature of the current greening payment and the future basic income support for sustainability is that the maximum payment per ha is fixed (i.e. the payment is not dependent on either price or production) and there is an option for no productive use is sufficient to claim the full payment. The example of EFAs shows that payments per hectare can be effectively different for different sub-measures. Regarding the design, such an approach has an important implication: farms would not compete with each other for the funds in the national eco-scheme budget.

Based on our analysis we conclude that the Green Box criteria hardly limit hidden income support and market distorting subsidies in case of an unambitious CAP with respect to the green architecture. However, these criteria create serious obstacles to design an ambitious and efficient green architecture. These obstacles will tend to be larger in Member States where a heterogenous agricultural structure faces heterogeneous environmental challenges.

These obstacles can be mitigated in two ways. The first option would operate in the framework of the Commission’s proposal. It requires from Member States a smart combination and coordination of very different instruments: they include basic income support and enhanced conditionality, eco-schemes (with and without an income component), AECM (with transaction costs) and coupled support (the last is not considered to be a part of the green architecture but could be linked with environmental obligations and does not require to be notified in the Green Box under the SPR Annex II). In addition, the targeted exploitation of the flexibility within the instruments must be backed by the Commission during the Strategic Plan approval process.

The second option is to waive the self-commitment to the Green Box criteria (art. 10 of the draft Strategic Plan regulation in conjunction with Annex II) for measures related to the agri-environment (i.e. eco-schemes and agri-environmental measures). As Member States can largely manoeuvre around the limits imposed by the self-commitment within the current proposal with respect to setting actual payment levels, this self-commitment at best only creates red tape with respect to the design of ambitious green architecture. However, severe communication challenges associated with promotion of agri-environmental payments and the Green Box criteria remain. If one is concerned that such a carte blanche would have market distorting effects one could ring-fence the total share of payments (including e.g. coupled support) that could be notified as Amber Box payments by the Member States.

In addition, we recommend to waive the maximum payment levels included in the Parliament’s proposal as these levels are constraining the implementation of more effective measures at least in large parts of North-Western Europe.

When approving the national Strategic Plans the Commission should ensure that Member States select effective measure in effective programmes. This means that if the needs assessment for the Strategic Plan clearly establishes a need for minimum implementation levels to sufficiently address certain environmental challenges, the requirements on the internal consistency of the payment calculation should be relaxed. This could allow the inclusion of indirect and psychological costs in the payment calculation for eco-schemes and AECM, if the member states provide sufficient evidence that these deviations will increase the environmental impact.

In addition, we are intellectually challenged to align the Commission’s emphasis on the cost-incurred / income foregone principle in the CAP for elements of the green architecture with the objective to create new green business models for public goods in the farm-to-fork strategy (COM, 2020, p. 8). Who is going to establish a business on the supply side if he officially must not make a profit? And who is going to pay for public goods if not the society via the state (or some associated bodies)? Our difficulty is underlined by the Commission’s recommendation for the German Strategic Plans that recommends to design “income support to reward environmental performance” (COM, 2020). The recommendation for the Netherlands contains a similar statement.

The CAP will only make a significant contribution to address the environmental challenges related to agriculture if the selected measures are efficient and implemented to a significant extent. One should keep in mind that effective measures are a necessary (but not sufficient) condition for an efficient policy.

As creating a sound and effective green architecture is anything but trivial and Member States are currently designing their Strategic Plans clarification of some technical issues regarding the interplay of the different instruments (enhanced conditionality, eco-schemes, Pillar 2 payments) is urgently needed e.g. how the income component in eco-schemes based on art. 29 (6) must be considered when Pillar 2 payments are implemented on an area already covered by an eco-scheme to raise the environmental outputs.

This post was written by Norbert Röder.

Acknowledgement

I want to warmly thank Alan Matthews for the fruitful discussion on the matter and on his explanations regarding how the WTO Agreement is conventionally interpreted.

Image by Capri23auto from Pixabay under a Creative Commons licence.

Thanks for this very informed and informative assessment.

One question in relation to your example of a modular scheme. Don’t you think that requiring a minimum stocking rate would go against the WTO text for Green box that says: “(e) No production shall be required in order to receive such payments” ?

Dear Jabier,

A minimum stocking rate is against WTO Green-Box rules if the scheme has an income component, but not if the payment is based on cost incurred / income foregone.

The practical problem with modular design is that is really hard to create the wright incentives for high value measure in case the payments are calculated on income foregone.

Best Regards

Norbert

Dear Norbert

Thank you very much for this very informative piece. Do you think that auctioning for the adoption of certain farming practices with environmental benefits, could contribute to increased ambition if the auctioning is stratified according i.e. to the level of changes required to adopt these practices? In this way the revealed price might contain components beyond costs/income forgone. Would this fit under the WTO green box?

Thank you very much

Dear Costas,

Payments levels determined by auctions are basically compliant with WTO green box. According to economic theory in perfect markets with sufficient bidders and no strategic behaviour the realized payment levels should be equal to the costs of the marginal bidder. However, auction of environmental services face some other problems (some are described in the Annex to the post).

Best

Norbert