This guest post is contributed by Prof. Dr. Rudolf Mögele and Prof. Dr. Martin Scheele. Prof. Dr. Rudolf Mögele is Honorary Professor at the University of Würzburg; previously, he was Deputy Director General at the European Commission, DG Agriculture and Rural Development, responsible for three Directorates (Legal Affairs, Audit and Assurance and Markets). Prof. Dr. Martin Scheele is Honorary Professor at the Thaer-Institute, Humboldt University, Berlin; previously, he was Head of Unit at the European Commission, DG Agriculture and Rural Development, responsible for conception and coherence of Rural Development.

Agri-environmental payments reflecting costs incurred and income forgone

In the discussion on the CAP, more and more attention is given to the importance and functioning of environmental and climate-related payments. Such payments are established by Article 37 of CAP-Regulation (EU) 2021/2115 under the name “eco-schemes”: Article 31(7)(a) provides that eco-schemes may take the form of “green” top-ups to direct payments while Article 31(7)(b) states that they may also be granted as compensation for additional costs incurred and income foregone.

Likewise, Article 70 of that Regulation follows the latter approach by basing agri-environmental and climate payments (referred to as ‘environmental payments’) on additional costs and income losses associated with subscribing to management methods contributing to the achievement of environment and climate-related objectives. Additional costs could arise from extra efforts to apply environmentally friendly production methods or from actions to manage environmental assets. Income losses could result from choosing environmentally sound agricultural practices while forgoing technically achievable and more profitable production techniques or from using productive assets, notably land, for generating environmental outcomes instead of agricultural production.

As regards the design of CAP interventions some argue that an environmental or climate payment based on additional costs and income losses risks to fail reaching its objectives as it does not ensure sufficient participation by farmers. It is argued that farmers lack an incentive to subscribe to environmental measures if payments just cover income losses or additional costs.

Accordingly, such payments should be supplemented by an incentive component in order to deliver (Birdlife, WWF, and EEB, 2023). Others acknowledge that a separate incentive component is not compatible with WTO Green Box criteria regarding environmental payments laid down in Annex 2, Section 12, of the WTO Agreement on Agriculture (AoA). Accordingly, a solution is being sought by suggesting environmental payments should be notified as potentially competition-distorting aid under the so-called “Amber Box” (Röder, 2021).

In the light of these discussions, this post addresses the question of how environmental payments could be designed in order to be Green Box-compliant while achieving ambitious environmental targets. In particular the aspect of targeting environment and climate-related outcomes by means of environmental payments deserves more attention. Of course, the technical specification of environmental targets falls into the remit of ecological science and will not be discussed here. However, it is essential for the success of environment or climate-related interventions under the CAP to make sure that the design of payments, aiming to reach a given environment or climate-related target, is fit for purpose.

Three elements of a target-compatible measure design

Below, we will argue – based on an examination of the purpose, functioning, and design of environmental payments – that claiming the need for a separate incentive element or the reporting of environmental payments under the “Amber Box” misses the point. Before we delve into the issue of payment calculations in more depth, it should be recalled that environmental payments have a specific purpose, namely improving the environmental and climate-related performance of agricultural activities and the targeted management of environmental assets. Accordingly, EU legislation requires Member States to define envisaged results in their CAP Strategic Plans and to explain how the environment and climate-related interventions included into the CAP Strategic Plans are capable of achieving such results.

Obviously, the targeting of environment and climate measures consists of at least three components: the technical specification of the management practices to be implemented, the geographical scope in which such practices are to be applied, and the calculation of the level payment granted. The significance of payment levels for targeting interventions is explicitly referred to in Article 70 of Regulation (EU) 2021/2115 which states that “Member States shall determine the payments to be made on the basis of the additional costs incurred and income foregone resulting from the commitments made, taking into account the targets set”. The target-oriented nature of environmental payments under the CAP appears to have its correspondence in the text of Section 12(a) in Annex 2 of the AoA, requiring that such payments are to be “determined as part of a clearly-defined government environmental or conservation programme and be dependent on the fulfilment of specific conditions under the government programme, including conditions related to production methods or inputs”.

Starting from setting a specific environment or climate-related target, it would be necessary to specify management practices that are capable to achieve the underlying objectives, for example enhancing bio-diversity by establishing a certain quantity of flowering strips along agricultural fields. Hence, it is necessary to identify the geographical coverage required for achieving the respective environment or climate-related objective in a certain Member State or region. The geographical coverage determines the number of hectares on which farmers should apply the above-mentioned management methods. Obviously, farmers’ willingness to participate in such a measure depends on the level of payments received. It is worth noting that targeting eco-scheme top-up payments under Article 31 (7)(b) would require similar considerations although the legal provisions do not refer to the calculation of additional costs or income losses in relation to specific targets.

Payment levels determining participation

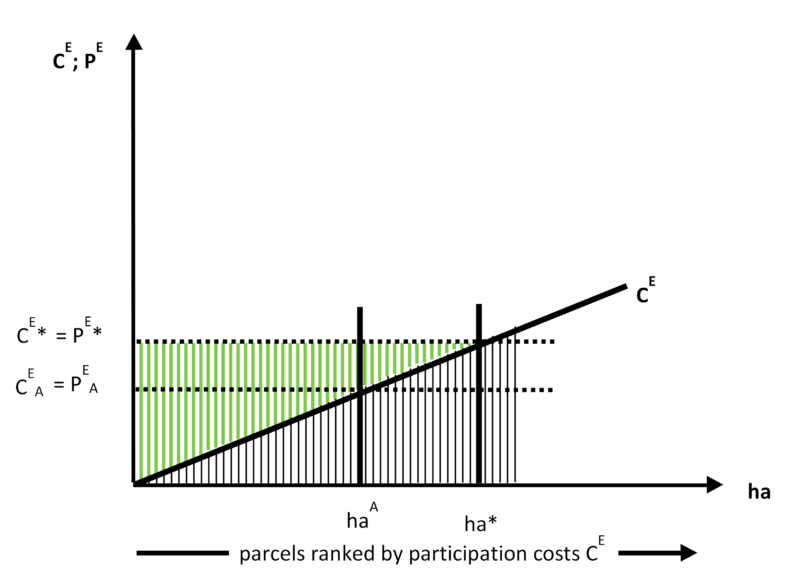

It seems plausible to assume that additional costs and income losses resulting from the application of certain environment or climate-related practices vary among farmers in a certain policy or programme area, depending on soil fertility, economies of scale, and available technology. Thus, we can rank farmers, as done in the following graphic (Scheele, 2019), by their individual additional costs and income losses per hectare, increasing from left to right. In this graph, the vertical axis shows the “costs of environmental action”, combining additional cost incurred and income forgone. This simplification is straightforward because income forgone represents nothing but the “opportunity costs” of environmental action. Thus, in an economic perspective, both additional cost incurred and income forgone can be combined in a single concept of costs of environmental action.

As regards the calculation of payment levels, it is common practice, not least in view of limiting administrative costs, not to calculate payments individually but rather to set them for an entire programme or policy area in which a certain environmental or climate-related objective is pursued. This practice appears not to conflict with the text of Section 12 in Annex 2 of the AoA which under (a) refers to the need for a “clearly-defined government environmental or conservation programme” and requires under (b) that “the amount of payment shall be limited to the extra costs or loss of income involved in complying with the government programme” without, however, requiring that the calculation is done on the basis of individual hectares or farms.

The economic principles of calculating payment levels in line with established environmental targets is demonstrated in the graphic below. Following the requirement that payments PE must be set in a given policy or programme, reflecting regionally identified costs CE, the graphic shows that any payment level is associated with a distinct number of hectares expected to participate in the environmental measure. To take two payment levels, payment PEA would result in haA whereas payment P* would result in ha*. In both cases, farmers whose individual costs per hectare are lower than the established payment per ha would join in, up to the “marginal” supplier whose individual participation costs are just matching the regionally established payment level. On all plots of land placed left of the marginal supplier’s land an infra-marginal gain would result from the difference of individual costs and the regionally established payment per hectare whereas the costs on all other plots would exceed the payment, implying that those farmers have no interest in participating.

Thus, we can draw a first conclusion, namely, that a cost-based environmental payment finally works through offering incentives in the form of so-called infra-marginal gains, depicted as green bars in the Graphic below. The inframarginal gains represent the incentive for farmers to subscribe.

Graphic taken from Scheele 2019.

ha : area (in hectare) located in a certain programme area

PE : environmental payment per ha

CE : participation costs per hectare (encompassing costs incurred and income forgone)

CEA : average costs and income losses per ha in a region concerned

PEA : payment per ha at regional average costs

haA : participating area with payments (PEA) at regional average costs

ha* : target-compatible amount of participating hectares

CE* : participation costs per ha at target level ha* (participation costs of the marginal provider)

PE* : regional target-compatible payment level at target level ha*

![]() : difference between regional target-compatible payment level and individual participation costs implying “inframarginal gains” = “incentive”

: difference between regional target-compatible payment level and individual participation costs implying “inframarginal gains” = “incentive”

Establishing target-compatible payment levels

It is often advocated that payment calculations should be based on average costs (CEA in the above Graph), observed in a given policy or programme region (Martinez, 2020). The payment would then be set at PEA, resulting in participating hectares at the level of haA. However, such an approach would reach a measure’s environmental objectives only if haA was matching with the target area of ha*. If the environmental situation is such that the number of hectares ha* needed for achieving a measure’s environmental objective is higher than the number of hectares haA associated with a payment based on regional average costs, it will be necessary to establish a higher payment at the level of PE*. Only this payment level would be target-compatible as it is needed to ensure participation by farmers in the order of magnitude of the environmental target area ha*.

From this we can draw a second conclusion, namely that reaching a measure’s environmental objectives requires a payment level high enough to encourage participation in line with the established environmental target. A target-compatible payment level would offer, via infra-marginal gains, a sufficient incentive for farmers to join. If this condition is met, there is no need for a separate incentive element. This is the economic rationale behind the requirement formulated in Article 70 of Regulation (EU) 2021/2115 that payment levels must reflect the environmental target pursued.

Whereas the consideration that a certain payment level is associated with a specific level of participation can be confirmed by past experience with agri-environment and climate measures, it is also true that administrations often do not have the necessary data at their disposal to allow them to exactly calculate the marginal costs of participation. Accordingly, it will be difficult to identify up-front exactly which payment level is needed to encourage participation in line with established environmental targets. Thus, the fine-tuning of environmental payments is unavoidably a matter of trial and error.

However, these limitations do not call into question the validity of the reasoning developed above. Should a certain environmental payment level turn out to be too low to encourage participation in line with an established environmental target, it will be necessary to adjust the payment upwards in order to install a target-compatible payment level. The latter will work through matching regional payments with the costs of the marginal supplier at the level of the target-compatible participation (see also Matthews, 2021). From this we can draw a third conclusion: any payment level that is necessary to reach a measure’s objectives is a compliant and target-compatible payment level.

Would the implementation of target-compatible payments under the CAP lead to WTO issues?

The following takes a closer look at the legal aspects of the compatability of environmental payments under the CAP with the AoA (see also Mögele, 2023). It should be noted that this compatibility is not at stake as such. Even if environmental payments were notified as trade-distorting domestic support, falling within the Amber Box, there would be no problem under WTO law, because the EU’s commitment is to not exceed an Aggregate Measurement of Support (AMS) of €72 billion per year (see the Commission’s notification for marketing year 2019/20, WTO G/AG/N/EU/79 of 7 July 2022). This amount is high enough to cover the entire current CAP budget.

However, the EU will most likely opt for notifying this type of payment under the Green Box in order to keep them out of its current AMS. Therefore, there is an interest in ensuring that such environmental payments comply with the Green Box criteria in Annex 2 of the AoA and, in particular, those referred to in paragraph 12 and paragraphs 5 and 6 thereof. In this respect, it should be kept in mind that the interpretation of these provisions is inevitably subject to a certain degree of uncertainty due to the lack of relevant case law from the WTO Dispute Settlement Body (Brink, Orden, 2023).

To qualify for green box status under paragraph 12, in addition to being in line with the criteria specified in the overarching chapeau clause in paragraph 1 of Annex 2 AoA, a measure must be:

- “part of a clearly-defined government environmental or conservation programme and be dependent on the fulfilment of specific conditionsunder the government programme, including conditions related to production methods or inputs.” and

- “limited to the extra costs or loss of income involved in complying with the government programme.”

The first condition is pretty straightforward. However, as shown above, meeting the requirement to base payments under environmental measures to extra costs or loss of income is far from being trivial, in particular as the functioning of such measures depends on whether at least some sort of incentive is possible.

In the Commission’s WTO notification of 7 August 2023 reference is made to environmental payments being “granted as compensation for carrying out practices beneficial to the environment and climate [that] comply with paragraph 1 of Annex 2 to the Agreement on Agriculture as well as with the relevant criteria of paragraph 12.” (WTO G/AG/N/EU/88 of 7.8.2023)

Of course, if an environmental payment compensated on an individual plot for “the extra costs or loss of income involved in complying with the [environmental] government programme”, this would be a priori consistent with paragraph 12 of Annex 2 AoA. However, calculating the payment level for each individual plot, be it per hectare or for even smaller units, would not be administratively manageable. In fact, the wording of Annex 2 No. 12 AoA does not contain any provision according to which a specific area unit must be used as a basis for calculating payments. In practice, the calculation of the payment amount is based on the costs determined for the respective program area and not the costs for each individual farm or hectare.

Accordingly, it is both workable and appropriate to pursue a target-compatible participation by establishing, for a certain programme or policy area, a payment matching the cost of marginal providers at target level, as shown above. This payment would encourage a sufficient number of farmers to join the programme or measure. These are farmers whose individual costs per hectare are below the per-hectare payment level set for the entire policy or program area. Participating farmers, except the “marginal provider”, enjoy an income benefit which is equivalent to having an incentive to participate. Thus, the payment calculation does follow both the requirement of basing the calculation on costs incurred and income forgone and the need to achieve the programme’s environmental objective.

So far, this approach has not led to disputes at WTO level, and is unlikely to do so in the future. It is in a certain way inherent to the functioning of agri-environmental support. If, however, the compensation was set so as to include a specific additional income component, be it calculated e.g. as a percentage above the actual cost level or flat rate, they would very likely be incompatible with paragraph 12 of Annex 2 AoA. Such arrangements would overstretch the ordinary meaning of the text of paragraph 12(2) AoA. However, as stressed by the Commission in its latest WTO-notification, such payments could qualify under paragraphs 5 or 6 of Annex 2 as decoupled income support, provided the measure specification does not incentivize higher levels of production.

Notwithstanding their compatibility with the rules of the AoA, environmental payments may conflict with the Agreement on Subsidies and Countervailing Duties (SCM). Although the relationship between the two agreements under Article 21 AoA may not have been fully clarified yet, both the Appellate Body report in US Upland cotton (Appellate Body Report) and the Panel report in the EU table olives case (Panel Report, WTO) point in that direction (Brink, Orden, 2023). Therefore, if an environmental payment qualifies as a specific subsidy under Articles 1 and 2 SCM and it adversely affects the interests of another WTO member, it could be actionable under Article 5 SCM. Whereas green box payments, by their very nature, are unlikely to be treated as actionable subsidies (Mögele, Möhler), it cannot be ruled out that, for example, agri-environmental measures within the meaning of Annex 2(12) AoA which turn out to be product-specific could come into the focus of the SCM. However, we may usually expect environmental payments to reduce agricultural production, which will make it unlikely for them to adversely affect interests of other WTO members.

Thus, we can draw a fourth conclusion, namely that WTO rules do not stand in the way of designing environmental payments in line with ambitious targets (see also Matthews, 2021 for a similar conclusion on the “compensation principle”). The latter are well achievable by means of a cost-based payment design (see above), whereas there is no need for a separate incentive top-up which would be in conflict with “green box” rules. Accordingly, nothing pleads against the established approach of notifying environmental CAP payments under the “Green Box”.

References

Birdlife, EEB, and WWF, A brighter future for EU food and farming, September 2023.

Brink, Orden, Agricultural Domestic Support under the WTO, 2023, p. 43 et seq.

Röder, Payments for the environment – new turmoil around an old issue, March 2021, http://capreform.eu/payments-for-the-environment-new-turmoil-around-an-old-issue/

Martinez, Die „Tierwohlprämie“ – eine beihilferechtliche Bewertung, Agrar- und Umweltrecht 2020, Vol. 8, p. 282 et seq.

Matthews, Are WTO rules an unreasonable constraint on the design of EU agri-environmental-climate policy?, CULTIVAR – Cadernos de Análise e Prospetiva N.º 23 | Impactos agroambientais: metodologias de quantificação e valorização económica, Agosto de 2021

Mögele, Möhler, in Krenzler, Herrmann, Niestedt (ed.), EU-Außenwirtschafts- und Zollrecht, Nr. 40 Landwirtschaft, Sec.115.

Mögele, Public money for public goods from an EU perspective, presentation at XXXI European Congress and Colloquium of Rural Law, September 2023 in Cardiff. Agrar- und Umweltrecht 2024, Vol 1, p. 6 et seq.

Scheele, Payments for Agri-Environmental Services – Do We Need an “Incentive Component”? Summer University of the Thaer-Institute, Humboldt University, Berlin, 1. July 2019.

This post was written by Rudolf Mögele and Martin Scheele.

Photo credit: © Copyright Christine Matthews and licensed for reuse under this Creative Commons Licence.

Thanks a lot for this very clear presentation of an important topic that, unfortunately, is still not well understood even by (some) policy makers and those in favour of a stronger focus of agricultural policy on the remuneration of public goods. The lack of data to calculate the marginal costs of participation is a persistent problem, and, indeed, the only way to go about it seems to be by way of a pragmatic trial-and-error approach. From an efficiency point of view as well as in the interests of the taxpayer, it would of course be desirable if the spread between the premium fixed based on the marginal costs and the mode costs (i.e., the costs of the relative majority of participants in the scheme) is not too big, but policy makers can achieve this through a differentiation of the premia along, e.g., regional or other relevant criteria.

There is a typing mistake: It should be Article 31 in the sentence: “Such payments are established by Article 37 of CAP-Regulation (EU) 2021/2115 under the name “eco-schemes”” – appart from this, many thanks to the post!

Maybe it would be possible to have one post, if possible with a similar figure, explaining the consequences of lowering the GAEC requirements and how this impacts the individual participation costs and (future) uptake of agri-environmental and climate payment schemes?!