It has been heard and written everywhere for the last 18 months: farm incomes have gone down dramatically. After two years of carpet bombing by the media, with anything from 60 percent price fall in prices to desperate farmers spreading their milk in the fields, the consultation on the future of the CAP organized by Commissioner Ciolos suggest that many, in the civil society, are convinced that EU farmers are starving. As an external reviewer of the synthesis report of this consultation, I saw a large sample of individual contributions. My feeling is that for many people, the current low farm incomes justify subsidies, border protection and paying more attention to mechanisms to support farm prices. In France, the tone of the debates on the national agricultural law is such that for all journalists, and even more Members of Parliament, the current perception is that agriculture is a synonym for “lumpen proletariat”.

The fall in farm income experienced in 2009 was genuine. It resulted from falling output prices, while input prices had remained high. There is no question that the economic situation of many farms has been disastrous. All figures, whatever their sources, do show low incomes even when compared to period before the price peak 2007-2008. However, sugar prices have been high for quite a long time. Oilseed prices have remained steady. Butter prices recovered very rapidly in 2009. After two years of low prices, cereals prices recently reached levels that ensure a high return to most growers, and future markets suggest they will keep rising. Fertilizer prices went down. Still, most of the newspapers, politicians and the public opinion talk about farmers as the category being hit most by the economic crisis.

One explanation is that farmers’ organisations have been efficient at surfing on the agricultural crisis, stressing the low incomes and the need for assistance. It’s hard to blame them for “not missing the opportunity of a good crisis”. By playing the communication card on incomes – in particular to the ears of the European Parliament – they may even end up avoiding large budget cuts, if not complete dismantling of the CAP after 2013, something that was on the radar only 2 years ago. However, given the importance of the issue of farm income in the debates on the future CAP, we should be able to rely on good data. And on this issue, it is surprising to see that data on farm incomes are so poor and questionable.

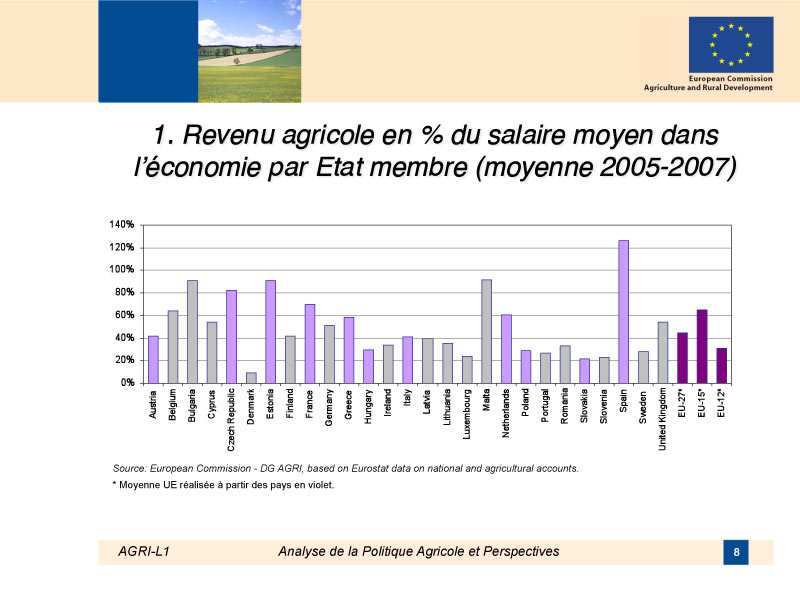

One example of the crude statistics that have been put forward in the ongoing debate on the CAP is the way the Commission disseminates figures on agricultural income. I am seldom critical of DG Agri, which has an expertise that I find impressive and a political orientation (at least under the last three commissioners) that I find rather “fair and balanced”. However, I have a hard time with the graph below, which comes from a standard DG-Agri presentation (this one was given by Pierre Bascou in Paris but I suspect this is a graph that is part of all DG Agri representatives’ toolkit).

The point by DG Agri here, seems to illustrate that farmers’ incomes are low compared to the rest of the population. Hence the need for keeping agricultural policy instruments. While I can be sympathetic with the idea, I just can’t buy the figures. Indeed Spain is the only EU Member where farmers make more money than the average worker. In the EU-27, agricultural income is roughly 43% of the average income. In Denmark it is 10%. In France, it is 70%, and it is even less in the UK. And these figures are even before the large fall in income in 2009.

First, in all cases, the figures contradict fundamentally the findings of the last extensive study coordinated by Berkeley Hill at the beginning of the 2000s, by the OECD later, that compared the income of agricultural households and the average household, even if one updates this benchmark by national indexes of changes in real income over time. It contradicts the scarce national data on “professional farms” that shows that for these farmers, farm incomes are often comparable to other incomes over the period considered. Second, if farm income is only 10% of the national average, resources should be moving away from farming at a rate that far exceeds the one observed in Denmark: these figures just do not make sense from a macroeconomic point of view.

Clearly, there are several approaches to measure farm incomes. Much depend on:

– how you define a farmer (is 1 hectare or 10 beehives really enough to qualify?);

– how you measure farm labour (something done in a terrible way in the EU by the way with very crude measures such as the Annual Labour Unit, while in the United States statisticians can control for the actual number of hours working off-farm, qualification, age, gender, etc.);

– how you defined income (result of agricultural activity? Including subsidies? Including social transfers? Including rents of land leased out? Agritourism? Work carried out for other farmers? Off-farm income?);

– and which sources you start from, e.g. farm business association data or macroeconomic accounts.

I had been planning to take a deeper look at how DG Agri figures were calculated before posting anything. However, before having time to do so, I came across the recent text by Berkeley Hill, which I find very interesting. His comments are more general, but I find them particularly relevant to the DG Agri figures. He points out that the current approaches to measure farm incomes are not satisfactory, and he wonders why the different projects of measuring the income of the agricultural household have not been pursued further. I fully agree with Hill on his different points. I could also add critiques to the current approaches that he does not mention, for example:

– The EU does not do a good job with the measurement of farm income using macroeconomic accounts for methodological reasons. For example, you can pretty much get the net value added or the sectoral income you want by adopting a convention on the decay of the equipments and buildings (maximum service life, shape of the decay curve over time, e.g. geometric, linear, hyperbolic or “one hoss shay”, and if you are very smart, assumptions on the statistical distribution of the age of the buildings). All of these will affect your figure for depreciation and hence the net value added and income. There are also many possible assumptions on how you remunerate land in property by farmers, and massive assets such as plantations. For example, last time I looked at this (years ago, they may since have changed it) some member states used for the same building a depreciation period that ranged between 12 to 50 years, generating considerable differences in economic depreciation and hence in agricultural income just because of unsubstantiated assumptions. Perhaps not a big issue in time series comparisons, but so much for consistency and comparability across member states.

– Regarding microeconomic sources, the RICA (Farm Accounting Data Network sometimes called FADN) is representative of the all farm sector in some member states but much less in others. Part time farmers are not included. Large farmers refuse to cooperate and are simply not represented in some member states where collection of data is on a voluntary basis. And off-farm income is not included while it is now a major source of income in many EU agricultural households. The measurement of labour is particularly crude, with simplistic assumptions on the work of the spouse and other family labour. This is not a criticism: I am happy that this source exists since we have nothing else, and I often use it. But it hardly allows comparison of farmers’ incomes with the rest of the population.

The issue is complex and there is no simple solution from a methodological point of view. Other countries such as the United States face similar problems in defining what a farm is and what farm income amounts to. For example, USDA figures show that 87 percent of what the USDA defines as farms have less than $10 000 annually in agricultural revenue. No doubt that in the EU, such a figure would be used to show how poor farmers are. But US statisticians have managed to measure the actual income in a much more satisfactory way. And USDA figures indicate that the average household income of these farms that have less than $10 000 in agricultural sales is actually $71 000, once off-farm income and social transfers are taken into account. Something we seem unable to do in the EU, opening the door for journalists to publish dramatically low figures without the necessary precautions.

If the CAP moves towards a farm income support policy, which it did with the progressive decoupling of payments, and if farmers’ organisations stress the need for support on the basis of low incomes, one should be able to collect reliable information on farm incomes. And to see how these incomes compare to those of urban poor or other categories that are also hit by the economic crisis.

Photograph: Migrant Mother (1936) by Dorothea Lang. Lang’s photograph of a destitute 32-year old migrant farm worker and her children is among the most famous images of rural America during the Great Depression.

Jean-Christophe Bureau’s comments are a welcome sign that, at last, there is some broader awareness of the gross misrepresentation that the Commission’s figures can so easily give. If farmers are claimed to be poor, then we have to have a measure of income that looks at all their sources, and probably of their wealth as well. Reasons why there is a continuing information gap are not hard to suggest. Farmers and their representatives are not likely to want their full income position to be revealed, as fragmentary evidence suggests that as a group they are a relatively high income group in society, and of even higher relative wealth. This rather undermines the case for CAP income support. Furthermore, it raises the question whether we need such a large agricultural bureaucracy. The rest of society might start asking embarrassing questions, such as, if farmers are poor why do they not benefit from the same poverty safety net as the rest of society? What is the justification for a special system for agriculture? Though there are other reasons for supporting farming, the case for doing so to provide a fair standard of living or prevent poveryy is now so weak that it should not be defended in the next round of CAP reforms.

Jean-Christophe Bureau reminds us of a very pertinent question, which has been ignored for some time, despite the efforts by Berkley Hill and the OECD to shed light on farm incomes. That farm organisations sound the poverty trumpet is not surpriing to me, that is their job. But that the Commission continues to accept a gross misreprentation of incomes accross individuals is deplorable.

The problem with those statistics is that they do not come with a clear description of the limitations and assumptions that can be understood by any reader. The figures are revenues from farming, not activities in the farm. This has two consequences: When Eurostate publishes “farm” incomes, it does often not reflect the total income of the “farm”, thus it is a wrong representation. When it presents income by individual farm employee, it also misrepresents their income, as it does not take into account non-agricultural activities. Ironically, the non-farm income of the agricultural households are accounted in the average national income, thus contributing in lowering the farm income as a national average. The bigger the non-farm income of farms… the lower their relative income in the statistics!

There are enough worthy reasons for supporting the agricultural sector, but the misrepresentation of the income distribution just perpetuates the present highly distorted policy, undermining many important EU objectives in the area. It is quite shocking to see e.g. the Netherland’s farm sector as low income, when the average farm household income was estimated by the OECD to have incomes above double the national average. Interestingly, the best performing were large specialised agricultural farms without other income sources.

It is always good to question things as it is good to use the right facts and figures. My small contribution to correcting 1 misrepresentation in this article and a more phylosophical question:

– Misrepresentation: “However, sugar prices have been high for quite a long time.” What period are we talking about? the text implies in the last 3 years or so. This is certainly not true when you look at the cut by 40% of the sugar beet price -thus a loss in revenue for farmers- and 36% of the sugar reference price!

– Phylosophical: it is not because you have two part-time jobs that, together, allow you to survive that neither of both activities is sustainable.