Today, we are pleased to present a guest post by Lars Brink who is affiliated with the Global Issues Initiative at Virginia Tech University and a leading expert on domestic support issues in the WTO Agreement on Agriculture.

Background

Domestic support and Bound Total AMS (Aggregate Measurement of Support) may not be high priority items, compared to market access, in terms of analysing trade distortions. Still, anything that touches on farm support and limits on such support attracts attention. This may apply also in a case of Brexit negotiations. This note is about the WTO domestic support commitment of the United Kingdom in case of a Brexit. It thus concerns the Bound Total AMS of the UK and that of the remaining EU27. The EU refers to the European Communities and the European Union, and EUR refers to European Currency Units (ECU) and euros.

In his immensely insightful post on 5 January 2016 entitled WTO dimensions of a UK ‘Brexit’ and agricultural trade, Alan Matthews raised the possible need to share out the EU commitment between the UK and the remaining EU27 (no, Alan did not make me say this as his price for accepting this post). Matthews thought that: “The apportionment of the [Bound Total AMS] is unlikely to prove contentious as the UK is not likely to want to increase its use of trade-distorting support after Brexit. Some allocation key such as the relative shares in the value of gross agricultural output is likely to be used and would not meet with objection at the WTO.”

In his earlier post on 21 January 2015 he mentioned the possibility that “the EU’s ceilings for trade-distorting domestic support and export subsidies would be partitioned according to the contribution that the UK made to the EU’s base schedules in 1994.”

A brief history of EUR 72.4 billion

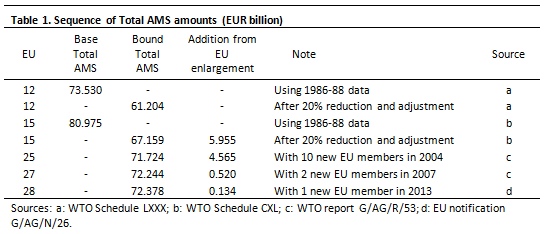

What is it that might be apportioned? The allocation key would of course be crucial, but the amount to which it is applied would also matter. One possibility is the EUR 72.378 billion that the EU28 now observes, another is the EUR 61.204 billion appearing as the Final Bound Total AMS in the EU12 schedule at the end of the Uruguay Round in 1994. There are also several possibilities in between, hence this tracking of the history of the EU’s Bound Total AMS.

Table 1 presents the Base Total AMS of the EU12, which used 1986-88 average data to measure support. As agreed in the negotiations, the Base Total AMS was gradually reduced by 20 percent from 1995 to 2000, but there was also an upwards adjustment (called a credit) to account for the reductions in support that had already been made between 1986 and the average of 1986-1988. This gave a Final Bound Total AMS for the EU12 in 2000 of EUR 61.204 billion.

In 1995 Austria, Finland and Sweden became members of the EU15. The relevant amounts from their individual WTO schedules were added to those of the EU12. The larger Base Total AMS of EUR 80.975 billion and the Final Bound Total AMS of EUR 67.159 billion of the EU15 were enshrined in the new EU15 schedule of commitments and concessions, which replaced the EU12 schedule.

Until 2004 and even later the EU15 showed in its notifications to the WTO Committee on Agriculture its Total AMS commitment level of EUR 67.159 billion. Following the enlargement by 10 new members in 2004, the EU explained to the committee how it had arrived at its EU25 commitment. Seven of the 10 new members had a Bound Total AMS, expressed in seven different currencies. Estonia, Latvia and Malta had no Bound Total AMS. The EU converted the Bound Total AMS amounts at the average exchange rates of 2000-2002 and added them to the Bound Total AMS of the EU15. The result was EUR 71.724 billion for the EU25.

In 2007 Romania and Bulgaria became EU members, and the EU25 added Bulgaria’s euro-denominated Bound Total AMS to form the Bound Total AMS of EUR 72.244 billion for the EU27. Romania did not have a Bound Total AMS. Neither the EU25 nor the EU27 Bound Total AMS appears to have been entered in any as of yet publicly available schedule, but the Committee on Agriculture was informed, as reported from its meeting in December 2008.

In 2013 Croatia became an EU member, and its euro-denominated Bound Total AMS was added to form the EU28 amount of EUR 72.378 billion. The EU28 reported this to the Committee on Agriculture in November 2015 in its notification for marketing year 2012/13.

Discussion

The process of arriving over time at the EU28 commitment level of EUR 72.378 billion underscores the artificiality of this number. Applying the default allocation key of the UK share in value of output in agriculture in recent years is also artificial, since this share need not correspond at all to the UK share of the applied AMS support in the EU28. The UK share of the EU28 value of output was 7.3 percent in 2013-15 (agricultural goods output at producer price). Taking 7.3 percent of EUR 72.378 billion gives EUR 5.3 billion as a UK Bound Total AMS.

It could be argued that the EU28 Bound Total AMS results from summing two amounts: (1) the EUR 61.204 billion for the EU12, in which it is not possible to identify the UK share, and (2) the sum of the Bound Total AMS amounts of the enlargement members from 1995 onwards. This latter amount is EUR 11.174 billion, and it could be said that it was explicitly contributed by individual and identifiable EU members other than the UK and should therefore be retained by the EU27. If the same 7.3 percent value-of-output proportion (EU28 in 2013-15) were applied to the EU12 amount of EUR 61.204 billion, the Bound Total AMS for the UK would be EUR 4.4 billion. Alternatively the EUR 61.204 billion could be multiplied by the UK share of the EU12 value of output, which was 9.1 percent in 2013-15 and about 8.4 percent in 1986-88. This would give a UK Bound Total AMS of EUR 5.6 and EUR 5.2 billion, respectively. A rationale could no doubt be crafted for any one of these quite arbitrary combinations.

The UK contribution to the EU12 Final Bound Total AMS of EUR 61.204 billion resulted from the support provided in 1986-88. Public data on each EU member’s AMS support in 1986-88 does not seem to be publicly available. Using EU budgetary data for 1986-88 to estimate the UK share of AMS support would not necessarily be right, since so much of the EU’s 1986-88 support was in the form of price gaps. The price gaps were multiplied by the EU total production to arrive at the market price support component of the product’s AMS. The non-product-specific AMS in 1986-88 was less than 5 percent of the value of production and did not contribute to the Base Total AMS.

Several alternatives are nevertheless conceivable. One is to apply the UK shares of the EU12 production quantities in 1986-88 to the 55 product-specific AMSs that make up the Base Total AMS (most of them are actually what are called equivalent measurements of support). The Eurostat data do not report UK production quantities of many of the minor crops, especially fruit and vegetables, in 1986-88, so a first attempt to estimate the UK share of the Base Total AMS relies on some judgement and inference regarding production quantities.

It appears that, after reducing the UK part of the Base Total AMS by 20 percent and adding in the UK part of the “credit”, the UK production-share-based part of the 1986-88 Final Bound Total AMS of EUR 61.204 billion could be EUR 6.4 billion.

Another possibility would be to multiply the price gaps underlying the 1986-88 Base Total AMS by the UK production quantities. The price gaps are reported in or can be calculated from the EU’s so-called AGST tables referred to in its WTO schedules (G/AG/AGST/EEC). This method would give the major part of the Base Total AMS but it would also need to adjust for the payments and levies that are accounted for in the individual AMSs, and no result is reported here.

The Bound Total AMS of the EU28 is a WTO commitment. Agreeing on an apportionment would therefore involve all WTO members, not just the UK and the EU27 and its members. If the UK wished to take its Bound Total AMS in its local currency (pound sterling), agreement would be needed on the exchange rate. Depending on how apportioning was carried out, details for discussion could include an average exchange rate for a period of time, e.g., 1986-88 or 2016, or the exchange rate at an instant in time, e.g., the moment of withdrawal from the EU. A Bound Total AMS of an assumed illustrative EUR 5 billion could amount to GBP 3.4 or 4.2 billion, simply using 1 July exchange rates for 1986-88 or 2016.

The recent EU28 applied AMS support is much below its Bound Total AMS. The EU28 Current Total AMS (the sum of all AMSs that are larger than 5 percent of the product’s value of production) was EUR 5.9 billion in 2012/13. It consisted almost totally of market price support for common wheat, skimmed milk powder and butter. The de minimis AMSs were very small.

Conclusion

The allocation key would matter in determining the UK Bound Total AMS, but the amount to which it is applied would also play a role. The amount of Bound Total AMS that would be apportioned between the UK and the EU27 is huge and vastly exceeds recent AMS support in the EU. The UK may not see value in having a Bound Total AMS as large as between EUR 4.4 and EUR 6.4 billion (see this post). It or its equivalent in sterling would be the fifth largest Bound Total AMS in the WTO after the EU27, Japan, USA and Mexico. Based on history the UK would not see itself in need of room to accommodate large amounts of AMS support.

The relevance for the EU of keeping a large Bound Total AMS as space for future AMS support is much reduced if the EU stays the course on shifting away from trade-distorting support. Even its value as negotiating coinage in WTO negotiations declines if the EU makes it clear that it is serious about staying on this course. While the apportioning is unlikely to be contentious, the above figures may help to see the magnitudes involved.

This post was written by Lars Brink.

Picture credit: Italian Insider

This is fascinating piece. My current interest is the tariff aspects following Brexit. As I understand it, WTO requires that import tariffs should not be increased. Obviously the UK has been part of the EU group. My query is what might be argued to apply post Brexit? Would there be a requirement to remain within the tariff limits the EU currently applies? (Or even on whether the UK could legally apply higher tariffs on the EU?).

Simon Ward

Lars, thank you for this.

Simon: in a speech at Chatham House on 7 June 2016, before the referendum, the WTO’s Director-General Roberto Azevêdo said:

“…, the UK would also need to re-establish its terms of trade within the WTO. The UK, as an individual country, would of course remain a WTO member, but it would not have defined terms in the WTO for its trade in goods and services. It only has these commitments as an EU member. Key aspects of the EU’s terms of trade could not simply be cut and pasted for the UK. Therefore important elements would need to be negotiated.

There is no precedent for this — even the process for conducting these negotiations is unclear at this stage.”

https://www.wto.org/english/news_e/spra_e/spra126_e.htm

I presume this statement was carefully vetted by the WTO Secretariat.

The prospect of the UK having to negotiate its MFN tariffs is alarming! My presumption, however, is that the UK would simply inherit the EU’s existing MFN tariff schedule; although of course it could unilaterally reduce its applied rates. I very much doubt that the UK could negotiate higher tariffs.

Lars has addressed one aspect of what might be termed the WTO constraints imposed on the EU (its AMS limits); but what about the EU’s obligations? How are the Tariff Rate Quotas (TRQs) the EU has committed to in its schedule of commitments going to be shared out post-Brexit?

Alan Swinbank

@Simon

I agree with Alan Swinbank’s assessment above that, with respect to the UK’s post-Brexit WTO tariff bindings, the most likely outcome is that it would inherit the EU’s tariff bindings, this was my view in the previous post http://capreform.eu/wto-dimensions-of-a-uk-brexit-and-agricultural-trade/. However, as this useful article on the ICTSD blog http://www.ictsd.org/opinion/nothing-simple-about-uk-regaining-wto-status-post-brexit makes clear, there is nothing simple about the UK clarifying its WTO status post-Brexit. This is because the UK’s terms would not just be a matter for the UK and the remaining EU members, but also for all the other WTO Members with their different interests. It should be noted that acceding Member States have had to accept much tougher commitments than the original GATT Members when negotiating their terms of accession. While the UK is and will remain a WTO member, it must still negotiate its new commitments with all the other WTO Members.

The Matthews reference to Ungphakorn is useful in pointing out the absence of a formal, or ‘certified’ EU28 Schedule of concessions and commitments, and Swinbank’s reference to Azevêdo is useful in underscoring the lack of clarity. A couple of these murky bits concern how WTO members value any difference in their opportunity for market access to EU27 as compared to EU28, and where the negotiations between the UK and other WTO members would start.

Successive enlargements of the EU, as in 2004 and 2007, have invoked the rules of Article XXIV of the GATT (the GATT 1994 is one of the multilateral agreements annexed to the Marrakesh agreement establishing the WTO). That article lays down, among other things, the rules for the formation of a customs union, such as the EU. It says nothing, however, about rules for the separation from a customs union, as would be the case in a UK withdrawal from the EU. Article XXIV also refers to Article XXVIII, which is headed “Modification of Schedules”. It and its Ad Article XXVIII allow for renegotiating the commitments in a WTO member’s Schedule.

The EU15 has a Schedule to which other WTO members have agreed – an EU28 Schedule may be in process. When the EU28 becomes EU27, the value to the other WTO members of the market access opportunity that they had to the EU28 declines: EU27 is a smaller market than EU28. Would the other WTO members, when the UK withdraws, want to invoke Article XXVIII in order to negotiate compensation for the shrinking of their EU market access opportunity?

The GATT Schedule of the UK was withdrawn on 1 August 1974, as part of the 1973 enlargement process. The UK would need a new WTO Schedule. What rules and process would apply to establishing a UK Schedule, i.e., a Schedule for a WTO member withdrawing from a customs union? Would it require a simultaneous negotiation involving the EU27, the UK and other WTO members with an interest in the matter (technical considerations, such as ‘initial negotiating rights’ would also enter the process)? Would it lead to WTO accession territory, as mooted by Matthews, involving bilateral market access negotiations and a multilateralization of the results? Are there legal experts out there who can clarify this?