Last week the Commission proposed at the July AGRIFISH Council meeting a further aid package for farmers worth €500 million of EU money (and up to €850 million if Member States take up the opportunity to add national financing). This brings the total additional EU financing to support farmers since 2014 to €1.5 billion. The money for the latest package comes from unspent funds in the CAP budget and does not involve making use of the crisis reserve. In his address to COMAGRI outlining the package the following day Commissioner Hogan thanked President Juncker and the budget Commissioner Vice-President Georgieva for their support in making the package possible.

The July 2016 support package

The package contains three main elements:

- A EU-wide scheme to incentivise a reduction in milk production (€150 million)

- Conditional adjustment aid to be defined and implemented at Member State level out of a menu proposed by the Commission (€350 million that Member States will be allowed to match with national funds, thus potentially doubling the level of support being provided to farmers)

- A range of technical measures to provide flexibility (e.g. on voluntary coupled support), cash-flow relief (e.g. through an increase in the amount of the advances for both direct and area-based rural development payments) and to reinforce the safety net instruments (by prolonging intervention and private storage aid for skimmed milk powder).

In this post, I examine the first element of the package, the voluntary milk supply reduction scheme. According to Hogan, this will be “a simple, direct EU-wide scheme, designed to provide a direct financial incentive to farmers who voluntarily reduce production”. One unfortunate aspect of the announcement is that it was not accompanied by any impact assessment setting out the Commission’s assessment of the likely impact of the scheme. I try to fill the gap in this post.

It should be noted that only the principles of the scheme were announced at the AGRIFISH Council. Much detail remains to be fleshed out over the summer in discussions with Member State representatives. The Commissioner’s plan is to have the necessary legislation in place by mid-September.

It seems that the temporary supply reduction measure, seeking to address the current milk glut, will work on a first come first served basis. DG AGRI officials are quoted as saying it could remove around 1.1 million tonnes of surplus milk.

According to details published in AgraFacts, individual dairy farmers can submit applications via paying agencies already on Sept 19. Producers would commit to a voluntary reduction in output for the first allocation period (Oct 1-Dec 31) compared with the same three months last year – which the national agencies would then notify to the Commission.

The EU’s executive would continue to accept applications in further tranches – on a first come first served basis – on Oct 17 (for milk delivery reduction in Nov/Dec and Jan 2017) & subsequently on Nov 14 (Dec 2016 & Jan/Feb 2017) & Dec 12 (Jan-March 2017) until the available budget is exhausted.

Commissioner Hogan has indicated that farmers would receive 14 cents per kilo of milk not supplied on the market. Member States can complement this amount “to make the scheme even more attractive”. Some of the measures adopted by Member States using their conditional adjustment aid (the €350 million part of the package, plus any national top-ups) might also result in lower production depending on the options chosen.

Initial reaction from the European Milk Board, whose raison d’être is the reintroduction of supply management as a permanent feature of the dairy common market organisation, was critical. It identified four weaknesses in the scheme in its response:

- €350 million of the total €500 million package, that is, the majority, was allocated to measures that are not clearly defined.

- The envisaged reduction period of 3 months during which willing producers will receive financial compensation is too short

- There is no simultaneous volume capping for other producers. Therefore, there is a great risk that the achieved reductions will be neutralised by increased production by other producers and the effect on milk prices will be minimal or insignificant.

- The equivalent 14 cents to be paid for each litre of milk not produced is not enough of an incentive either.

We take note of some of these criticisms in the analysis that follows.

Likely effects of the voluntary supply reduction scheme

Paying producers money not to produce is, in principle, not a good use of public funds. It results in a significant cost to the overall economy compared with using this money to achieve something of value. The only justification for the measure is that it leverages the initial budget transfer to farmers (in this case, the €150 million) by also requiring consumers to make a contribution (by raising the price of milk). It is thus primarily an income transfer measure which has been justified on the basis that current milk prices are about 20% below the past five years average.

In saying that the purpose of the measure is to also require consumers to contribute to the income transfer, by ‘consumers’ I refer to those agents in the milk supply chain beyond the farm gate. Whether or not the ultimate consumer buying milk in the supermarket will pay a higher price or not depends on price transmission along the milk supply chain. As readers will know, this is a murky topic, with the potential for higher raw milk prices to result in either lower or higher margins for the processors, dairy product manufacturers and retail chains.

What I want to examine in this post is how effective the voluntary supply management scheme is as an income transfer mechanism. To answer this question I use an EU milk market model that I developed together with Rosella Soldi for a study to evaluate the impact of the EMB’s Market Responsibility Programme for the Committee of the Regions (CoR) (the study and description of the model can be found in this report).

There are a number of crucial parameters which determine the effectiveness of a supply management measure in raising milk prices. These are:

The price elasticity of demand. In response to a sudden shock (such as the reduction of milk supplies under the EU programme), the size of the resulting price increase depends on how responsive consumers (milk buyers) are to a change in price. The more responsive (elastic) is demand, the less effective will be the scheme. On the whole, the demand for raw milk in the EU is relatively inelastic, although demand by processors producing for export markets will be more elastic than demand by processors producing for the internal EU market. For these calculations, I assume that the price elasticity of demand for raw milk for domestic uses is -0.16 and for export products is -2.0.

The extent of slippage. The DG AGRI officials note that it is hoped to attract producers to reduce production by 1.1 million tonnes over the period of operation of the programme (this is the total budget of €150 million divided by the proposed incentive bonus of €140 per tonne). However, there will be a difference between the amount of foregone milk which will be paid for and the net reduction on the market as a result of the scheme. This difference is referred to as slippage.

The EMB critique above refers to one source of slippage. Some producers who might otherwise have reduced or exited production will now hold on, while others will expand production by even more, because of the higher milk price due to the scheme. This ‘rebound’ effect is one reason why the net reduction in milk supplies will be smaller than the amount paid for.

A second, and likely more important, reason is that many of the producers who will be attracted to apply for the scheme would have intended to reduce production in any case. This ‘deadweight’ effect is a second reason why the net reduction in milk supplies will be much smaller than the amount paid for. Based on US experience with voluntary supply management schemes, the overall amount of slippage is likely to be as high as 50%.

In the calculations I have made, I have assumed two slippage rates of 0% and 50%, respectively. While assuming zero slippage is simply not realistic, we might interpret this option as taking into account any possible supply reduction effects from the additional conditional aid schemes implemented by Member States using the national envelopes financed by the remaining €350 million in the EU package.

The opportunity cost of the milk foregone. We also need to make an assumption about the opportunity cost of the foregone milk that participating farmers would otherwise have supplied to their processors. Although the farm organisations claim that many dairy farmers are losing money at current milk prices, this does not mean that the opportunity cost of not delivering milk is zero or negative.

We need to distinguish between fixed (overhead) costs and the gross margin earned on the marginal milk supplied. Assuming a fixed cow herd, the farmer attempting to maximise his or her gross margin (and thus the contribution to overhead costs including family-owned factors of production) will choose the level of feed at which the marginal contribution to the gross margin (the milk price) is just equal to the feed cost of producing that kg of milk.(assuming for simplicity that feed is the only variable cost). At this point, the milk sent to the processor is earning a positive gross margin, even if the farmer is operating at a loss when overhead costs including the need to remunerate the family labour are taken into account.

Unfortunately, a precise estimate of what the opportunity cost of not supplying milk for those farmers who will participate in the scheme is not available. For the purpose of the calculations here, I work with two estimates. One estimate is to assume an opportunity cost of zero, which is obviously highly favourable to the scheme. The other is to assume an arbitrary figure of 7c/kg, or half the incentive bonus proposed.

Administration of the scheme. I assume that the scheme is implemented for three months beginning in October 2016 and that the available budget is exhausted by the end of this period. The time profile of applications does not make any difference to the analysis. We can either assume that the full budget allocation is spent in the first month. Or more realistically, one can assume that the scheme attracts applicants over the three months or even longer. While the impact on monthly prices will obviously be smaller if applications are spread out over a longer period, the total additional revenue gained by dairy farmers would remain the same.

I assume that there will be no additional knock-on effect resulting in lower production in later months, apart from the reduction which is paid for by the scheme. Essentially, I assume that ‘new’ farmers attracted into the scheme would dry off their cows earlier over the winter period but would return to full production again in the spring.

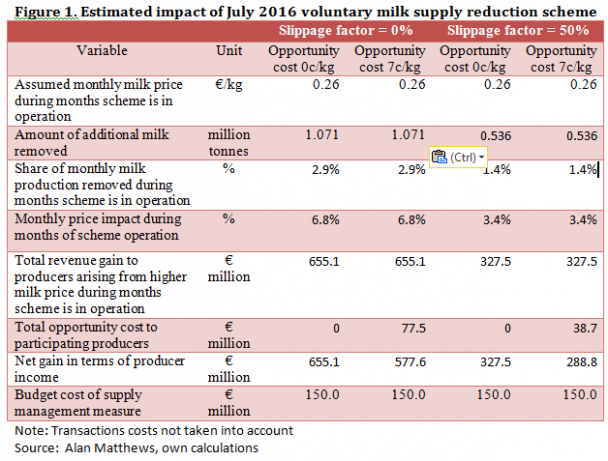

Under these assumptions, the impact of the voluntary supply reduction scheme is shown in Figure 1. There are four options in all, taking the two slippage scenarios and the two assumptions about the level of opportunity costs. The most favourable option is the first one which assumes no slippage and no opportunity cost to participating farmers of not supplying milk. On this basis, the scheme could raise dairy farm incomes in the latter quarter of the year by up to €655 million.

However, for the reasons mentioned above, I regard this as highly optimistic. Assuming slippage of 50% and an average opportunity cost of 7 cents/kg for milk not delivered by participating farmers would reduce the net gain from the scheme to €289 million. I would regard this estimate as much closer to the likely outcome, although the ultimate figure could be a little higher if Member States use their conditional assistance to further incentivise additional supply reductions.

The incentive per kg of milk not delivered. The EMB in its response argues that 14 cents/kg is not a sufficient incentive. Whether or not it will attract sufficient participants will only be seen once the scheme is put into operation. Given that many of those applying would have intended to reduce production in any case, so that the payment is only an additional bonus, we can expect considerable demand. If my assumption that the average opportunity cost per kg of milk foregone is only 7 cents/ kg is reasonable, then a payment of 14c/kg should be sufficient to also attract considerable interest from ‘other’ producers.

A voluntary versus a mandatory scheme. The EMB argues that there should be a compulsory capping of production for all producers. For reasons spelled out in the CoR report, this would have a dramatic effect on EU milk supplies and milk producers. At any one time, a large proportion of EU milk producers are expanding production. Even where overall national production is relatively stable, around one-third or more of dairy farms are increasing production, simply to make up the production lost by those exiting the industry.

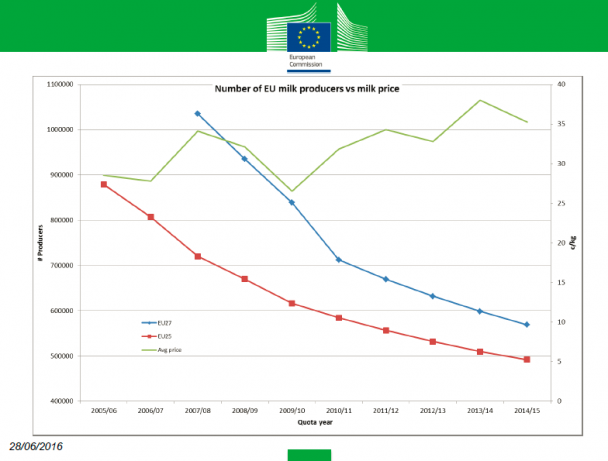

The steady decline in the number of dairy farmers across the EU is shown in the following DG AGRI graph presented to the last monthly meeting of the Milk Market Observatory. Total numbers of dairy farms have fallen from just under 900,000 in the EU-25 in 2005/06 to fewer than 500,000 in 2014/15. If Bulgaria and Romania are included, the rate of decline is if anything even steeper. The figure suggests that this decline in the number of dairy farmers is primarily structural and appears to be uncorrelated with the price and income environment.

For these reasons among others, a mandatory capping of individual producers, many of whom rely on the additional income to pay off bank debt, would be very unlikely to be accepted by the Council.

Source: DG AGRI, Milk Market Observatory Economic Board meeting 28 June 2016

Source: DG AGRI, Milk Market Observatory Economic Board meeting 28 June 2016

Production is already falling in many countries. It should be noted that, even in the absence of any formal schemes, milk production has started to fall in a few EU countries. This appears to be happening for a variety of reasons. In Portugal, the main dairy cooperative Lactogal, which has a 65% market share, put in place a private initiative to curb output (thus no need to use the Article 222 derogation introduced in the March 2016 package).

In France, production growth has been more contained than elsewhere because some manufacturers do not give their producers the opportunity to increase volumes. They require a certain tonnage of milk in their contracts, depending on the demand for finished products, and do not accept more.

In other countries, lower market prices are having their expected effect of reducing production incentives, even though the irrational belief in the ‘backward-bending supply curve’ (i.e. the idea that lower prices induce producers to increase rather than reduce production in order to maintain cash flow) still holds sway. Indeed, Commissioner Hogan justified associating conditions with the granting of the remaining €350 million aid package on the grounds that “To achieve the goal of reducing the oversupply situation, which is often a factor of attempting to maintain cash-flow, this complementary aid needs to be conditional and paid only in return for specific commitments” (italics added).

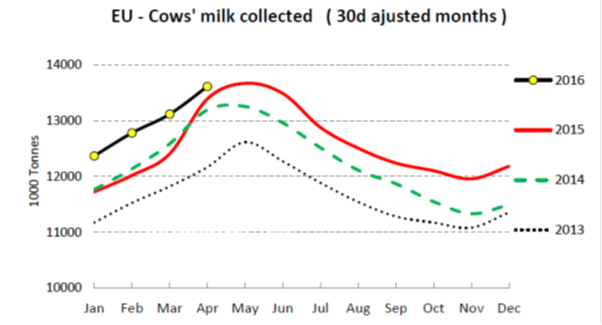

The most recent DG AGRI short-term market outlook published earlier this month suggests that, although overall milk deliveries might be up +1% in 2016, all of this increase in production has already taken place (see figure below).

In the EU, milk deliveries could grow by more than 1% in 2016 (above 2 million tonnes). This is notably due to a strong increase in the first four months of the year (+5.5%), to be followed by a slowdown, likely to lead in the second half of the year to a milk collection below last year. Data in the first quarter compares with a period of time last year when several Member States reduced milk collection to limit surplus levies because the quota system was still in place until 1 April. By contrast, some downward supply adjustments are currently taking place. In addition, as every year, weather will play a major role.

Source: Milk Market Observatory

Source: Milk Market Observatory

Conclusions

With more than 20 Member States looking for a further aid package including the introduction of a temporary milk supply management measure at the July AGRIFISH Council, Commissioner Hogan was under great political pressure to respond. Milk prices and dairy farm incomes have been falling across Europe from the record levels at the beginning of 2014, and the trough in prices has proved longer-lasting than analysts forecast at the beginning of the year.

As part of the package of measures adopted, the EU will now experiment for the first time with a temporary and voluntary incentivised milk supply reduction measure in the latter quarter of this year. In my view, such a measure is second-best compared to other ways of helping dairy farmers to manage price and income volatility. For one thing, the distributional implications are perverse, as it is likely to lead to a transfer from low-income families with children to larger dairy farmers who account for the bulk of milk production.

Nonetheless, the experiment will be an important one. If it is deemed successful, there will be demands to make this a permanent feature of the dairy CMO in the next round of CAP reform discussions.

In this post I have shown that, based on an assumed set of price elasticity of demand estimates for raw milk, it is likely that expenditure to incentivise dairy farmers to reduce supply can multiply the impact of the aid measure on dairy farm incomes by a factor of between two and four because it crowds in additional consumer transfers to farmers through higher milk prices. However, the size of this anticipated gain may be less than advocates of the programme assume because the importance of slippage and the opportunity cost of foregone milk are often ignored.

This post was written by Alan Matthews

Note: In the original version of this post the chart showing the trend in EU milk deliveries was inadvertently omitted.

Photo credit: Wikipedia, under a CC licence