We are pleased to welcome this post which has been written by Jabier Ruiz, who is Senior Policy Officer, Agriculture and Sustainable Food Systems at the European Policy Office of WWF in Brussels.

Internal convergence: a multi-faceted obligation

In recent reforms of the Common Agricultural Policy, and of the Multiannual Financial Framework, the (external) convergence of decoupled direct payments across EU member states is always a very sensitive political topic. This issue has been covered extensively in this blog (for example, here and here). There is much less awareness and discussion on the topic of internal convergence, another obligation existing in the current (and future) CAP and which aims to progressively equalise the value of decoupled direct payment entitlements (€ per hectare) within each Member State or region.

The debate on external convergence is largely motivated by the concerns of the newer Member States. Internal convergence is an issue for the older Member States (plus Slovenia and Malta) that apply the Basic Payment Scheme (BPS) with entitlements rather than the Single Area Payment Scheme (SAPS) under which all payments are anyway on a flat-rate basis per eligible hectare.

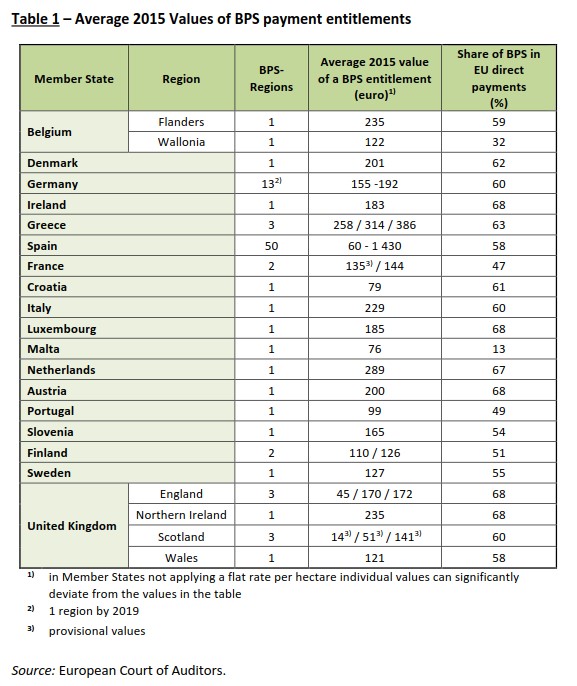

Article 25 of the Direct Payments regulation 1307/2013 establishes that, in principle, by 2019 “all payment entitlements in a Member State or in a region shall have a uniform unit value”, but it also details numerous derogations and technicalities in the process that in practice undermine achieving such uniform values. The modalities by which Member States choose to distribute decoupled payments and apply internal convergence (which was analysed by the Court of Auditors in their 2018 special report on the Basic Payment Scheme for farmers, see table extracted from this report below) have been very different.

Some EU countries applying the BPS have completed their internal convergence and now have flat-rate entitlements for the entire country in the 2019 claim year. Austria, Germany, Malta and the Netherlands are examples of this, as well as some regions within countries such as UK-Wales and Fr-Corsica. Others have used all the flexibility offered in the internal convergence mechanism to limit changes in the value of entitlements to the largest extent possible.

This post focuses on the case of Spain, a country which receives one of the largest “CAP envelopes” in the EU and spends 81% of it (almost €5 billion annually) through the first pillar. Spain is a peculiar case as regards the distribution and convergence of direct payments. It is possibly the Member State in which the flexibility offered by the regulation has been stretched to its maximum, thus perpetuating “historical references” as the main factor determining the value of entitlements. As we discuss below, the choices Spain made in the application of internal convergence may continue to be possible under the CAP post-2020. This could result in decoupled direct payments that will be made in 2027 still being based on entitlements whose value is mostly determined by the historical support levels registered 25 years earlier, in the 2000-2002 reference period.

The Agriculture Committee of the European Parliament seems to be (only) partly aware of this challenge. In the hearing of the Commissioner-designate Mr. Wojciechowski, the coordinator of the EPP group in this Committee, MEP Herbert Dorfmann, challenged the continued use of historical references for CAP direct payments. And earlier this year, in its report approved back in April, the Agriculture Committee amended Article 20 of the draft Strategic Plans Regulation to require a full internal convergence of payments entitlements. Despite these intentions, further amendments would be necessary to close the existing loopholes and derogations, at least if they believe that progressing towards flat rate entitlements in a Member State is a positive step for the fairness of decoupled direct payments.

The Spanish model of internal convergence

Spain made use of the option offered under Article 23 and 25 (Regulation 1307/2013) to apply the Basic Payment Scheme (and therefore, internal convergence) at regional level. This option was strongly advocated until the end of the negotiations by the Spanish Agriculture Minister at the time, the outgoing Climate Commissioner Miguel Arias Cañete, who argued that the high diversity of agronomic systems and productive potential of Spanish farmland required such flexibility.

While the term regional level could seem to refer to the administrative Comunidades Autónomas, that hold most of the governmental responsibilities for agriculture in Spain, including the design and implementation of the (regional) Rural Development Programmes, this is not the case. “Basic payment regions” could be defined much more flexibly “using objective and non-discriminatory criteria such as their agronomic and socio-economic characteristics, their regional agricultural potential, or their institutional or administrative structure” (Art. 23), which led to the creation of 50 “artificial” regions in Spain (link here to the Spanish legislation). A similar level of flexibility is found in the draft CAP Strategic Plans Regulation, Art. 18(2): “Member States may decide to differentiate the amount of the basic income support per hectare amongst different groups of territories faced with similar socio-economic or agronomic conditions”.

The creation of these basic payment regions in Spain took place at the end of 2014, before the first year of application of the 2013 CAP reform, and was mainly based on two clear criteria:

- An administrative one: the more than 300 “farming counties” (comarcas agrarias), which are aggregations of municipalities.

- An agronomic one: the use of farmland in 2013 (rain-fed arable, irrigated arable, permanent crops and permanent pastures).

As a parsimonious regionalisation was preferred, the hundreds of combinations of the two criteria above were brought down to the final 50 regions, mostly by grouping many counties together, Rain-fed and irrigated arable land uses were sometimes grouped together in a single region, while permanent crops and permanent pastures were always kept separate from each other and from arable land regions. This final grouping was based on two further (and much more arbitrary) criteria:

- The productive potential (based on 2013 data, but with no details given in the legislation)

- The socio-economic impact of certain crops in the farming counties.

This regionalisation had very deep implications, not initially but in the medium term, when internal convergence started to accumulate. The initial value of entitlements held by a farmer was calculated taking into account the surface area they claimed and the support levels they were receiving in 2013, irrespective of the basic payment region where they were located. After the first claim year (2015), when farmers had to “activate their entitlements” on eligible agricultural land, the agricultural authorities could complete the “regionalisation process”. .

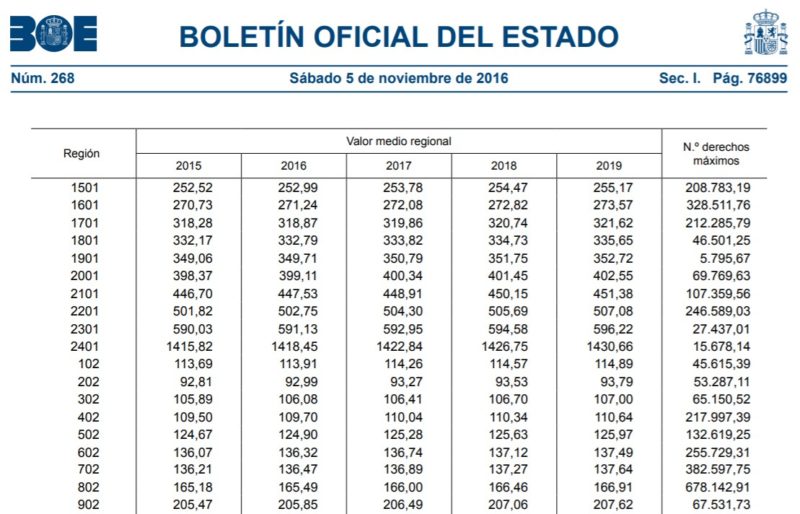

This was done by establishing the maximum amount of entitlements per region and the average value of the entitlements in each of the regions, which ranged from a minimum of €60 to a maximum of €1430 per hectare (see further details in the next section, and in the table below, extracted from this other Spanish legislation). It is important to underline that these are average values for entitlements in a region: the individual entitlements (whose range of values in each region is unknown to us) have converged since then (albeit not fully, only partial convergence applies in Spain ) towards those very different averages, irrespective of whether they were higher or lower than the country-wide average to begin with.

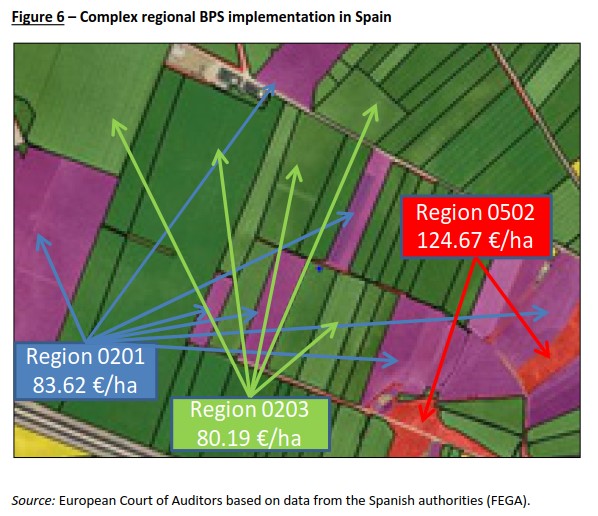

The result of this complicated process naturally led to very counter-intuitive situations. Farmers in Spain may have entitlements in multiple “basic payment regions”, particularly when they combine different farmland uses, even if their operations are very local (see the next figure). Given the differences in the value of entitlements according to the land use (see below for details), the implicit message that the system is sending to farmers is that they can get higher income support per hectare from the CAP if they irrigate than if they don’t, if they have permanent crops rather than rain-fed arable, or if they transform their pastures to any other agricultural use.

Nevertheless, changing the use of land in the course of the CAP period does not in itself increase income support, as entitlements remain in the basic payment region where they were assigned in all circumstances, and can only be traded within that region. Buying a higher value entitlement for another land use is always a possibility, but generally a very expensive one. However, farmers who change their land use can wait for the next CAP period (and the new entitlement assignation), hoping to increase their decoupled payments per hectare.

At the same time, one single basic payment region can encompass very distant lands. One example (out of many) is Region 6.1, which pulls together arable land from tens of farming counties, from Andalucía (in the South) to La Rioja or Cataluña (in the North), mixing rain-fed with irrigated arable lands. These are undoubtedly very different lands, but they were anyway put together, thus making them all internally converge towards the average value of entitlements in the region. Such eclectic mixtures can only be justified if the final grouping into regions made by the agricultural authorities in Spain was mainly driven by a wish to limit changes to the pre-existing value of entitlements. Whatever the ultimate reasons, this peculiar model has recreated de facto something very similar to the historical reference used in the previous Single Payment Scheme.

A few practical examples of what the Spanish model implies

Using the information available in the aforementioned Spanish legislation, we have done some calculations and comparisons to illustrate some striking effects of the Spanish model to distribute decoupled direct payments. Figures have been calculated based on the 2019 average value of entitlements per region. Disparities may be much higher at the farm level, due to singularly high or low value of entitlements which have not yet converged to the regional average.

Note also that the amounts mentioned below are for the Basic Payment Scheme, which is only part of the CAP direct payments. The amount received per hectare was generally topped up with greening payments (paid in proportion to the basic payment entitlements). Coupled payments give further direct support to certain farms, mainly to ruminant livestock.

Overall, in Spain there are a maximum of 19.04 million entitlements to the Basic Payment Scheme, with an average value of €145 per hectare (each entitlement has to be activated on one hectare of eligible agricultural land). The average value of entitlements in the basic payment regions range mostly between €60 and €600 €/ha, but there is an extreme outlier of €1430/ha for one single region: Region 24.1 of Irrigated arable land in the county of Jaraíz de la Vera, in Extremadura. The singularity of the irrigated agriculture in this area is the cultivation of tobacco, which takes up approximately 8,500 ha (more than half of the 15,678 entitlements available in Region 24.1). Beyond the extremely high value of the irrigated arable land entitlements, the coherence of farming and public health could be an additional factor to consider in assessing the future of these payments.

For the sake of comparison, the average value of entitlements in other basic payment regions in the farming county of Jaraiz de la Vera are €60/ha (pastures), €106/ha (rainfed arable) and €167/ha (permanent crops). This means that two neighbouring farmers, one cultivating tobacco, and the other one raising livestock on pastures, obtain extremely different income support levels per hectare. We lack information about farm sizes, but we can presume that the average livestock farm is larger than the tobacco producing one. This would partly compensate for the extremely different value of entitlements, and the level of income support per farm may not be so dissimilar. Similar contrasts are registered in many other farming counties (e.g., Campo Níjar y Bajo Andarax), with up to 10x ratios between the average values of pastures and irrigated land entitlements. Indeed, irrigated land is generally the land use most favoured by CAP basic payments, followed by permanent crops.

There are a total of 3.4 million entitlements activated on permanent crops in Spain, with an overall average value of €223/ha. However, this grand total is divided into 18 permanent crop regions, with regional averages ranging roughly between €100 and €500 per hectare. There are five regions with averages above €300 per hectare, concentrated in the strongest olive producing areas in Andalucía (mostly farming counties in the neighbouring provinces of Málaga, Córdoba, Granada and Jaén). However, even within this geographically concentrated area, the most favoured region averages €504/ha, another one €410/ha and the other three between €300/ha and €340/ha. Considering that they share similar agronomic conditions and farming practices, these differences are very difficult to explain. And it would be even more challenging to explain why this system can result in two comparable olive growers, who possibly started the CAP period with very similar entitlement values but are located in different basic payment regions, now converging to different averages.

Overall, the three basic payment regions with the lowest averages (between €60/ha and €80/ha) are all permanent pastures and concentrate as much as 79% of the 4.25 million entitlements activated on pastures in Spain. Meanwhile, only 1.7% of permanent pasture entitlements are in regions with an average value above the country and land-use wide average of €145/ha. According to the LPIS in 2018, Spain has at least 18.8 million hectares of pastures. While part of them are now abandoned, there are certainly many more than 4.25 million hectares under use, with many mechanisms (beyond the scope of this post, see this EFNCP booklet on wood pastures for further information) put in place to limit their eligibility for direct payments. Livestock farmers who, as a result of those mechanisms or for other reasons, had relatively few eligible hectares on which they could claim their subsidies at the beginning of this CAP period ended up with fewer entitlements but artificially high entitlement values compared to their regional average. Subsequently, their income support has diminished over time, as a result of internal convergence within these basic payment regions.

Three regions of arable land also have averages that are below €100/ha, and three others are between €100/ha and €145/ha. In total, these six regions bring together 72% of the 11.37 million entitlements for arable land existing in Spain. In contrast, the maximum average for a region containing rain-fed arable land (pulled together with many other irrigated areas) is just over €400/ha.

Given the way internal convergence operates in Spain, the value of all these entitlements in below-average basic payment regions has not necessarily grown over the last few years. Their value may have increased or decreased, depending on the region they belong to, and the regional average they are converging towards. The same applies to the 29% of entitlements located in above-average regions, which are not necessarily losing value due to internal convergence.

Any solutions in sight?

This system of distribution of decoupled direct payments could continue to be possible under the CAP post-2020, unless co-legislators delve into the issue and change the draft legislation in this regard. However, this would trigger further questions: Is a full flat-rate basic payment something more desirable than a regionalised approach? What would be the limits of flexibility to Member States that could be set up at EU level? Would this make the future Basic Income Support fairer, or more effective for the objectives pursued?

With the limitations of the data publicly available for Spain, we have explored one option, which is limiting the spread of the value of entitlements to something more “reasonable” than the 10:1 ratio (24:1 ratio if we include the outlier region) shown by the averages for the basic payment regions. More specifically, we have tested the possibility of reducing that ratio to 5:1, which is close to the current spread of average direct decoupled support to farmers in EU countries (from the highest values in Greece, to the lowest in Latvia).

One simple way to establish a 5:1 ratio in Spain in a budget neutral way (funding increases with decreases) would be to increase the average value of the regions with lowest entitlements to a minimum of €85/ha and set the maximum at €425/ha. This change would benefit 5.1 million entitlements in regions at the lower end, mainly permanent pastures and some arable land. The “losers” would be 0.5 million hectares, mainly irrigated arable land in the south of Spain, but also some top-range olive orchards.

We will not spend time arguing whether this or another ratio is reasonable or makes basic income support fairer. Narrowing the spread to a lower ratio possibly has some merit in itself, at least in bringing Spanish farmers closer to the range of income support per hectare that fellow European farmers are receiving. We present it as an exploratory example of the implications that the adjustment of these subsidies could immediately trigger. Indeed, given the weak overall justification of direct income support payments, it is difficult to argue what the best way forward could be for a system with so many vested interests trying to preserve the status quo.

Conclusions

It does seem that situations like the one described for Spain, which largely maintains the historical value of entitlements, will have to be overhauled. Otherwise, we must expect close scrutiny from the European Commission during the revision of the CAP strategic plan, based on the objectives that the CAP post-2020 aims to pursue.

Such an overhaul will require the support of thorough analyses of the agricultural authorities, and political intelligence to bring about changes in the distribution of direct payments across sectors and territories, particularly in Member States with strong regional governments wanting to protect the money their farmers receive from the CAP.

A more robust EU framework, with stricter obligations that Member States have to respect, could certainly help in negotiating this in each country concerned. As mentioned above, co-legislators are still in time to modify the draft CAP regulations in this regard, but there have only been some timid steps to date. No straightforward solutions will resolve such a complex topic, but we dare point at three options that should be explored, at least to ensure a more level playing field for farmers within the Member State and across the EU:

- The share of the CAP budget distributed as income support per hectare must be reduced; otherwise, the regional, sectoral and individual interests in maintaining the status quo could block any significant change in the distribution of these payments and on how internal convergence operates.

- Regionalisation must be framed more tightly at the EU level, for instance by limiting the number of regions a Member State can create and/or by limiting the maximum spread of the regional (entitlement value) averages.

- Environmental payments and other CAP interventions can be used temporarily to ease the transition. By voluntarily committing to higher environmental standards (and getting some CAP support for it), or through other complementary measures (e.g., farm advice for the transition) the regions and farms weaning off high income support can partly compensate their losses.

This post was written by Jabier Ruiz.

Photo credit: Cattle grazing in Extremadura, Spain by BarbeeAnne via pixabay, licensed for reuse.

At the risk of over-repeating a point I have made many times before, a far more equitable system, and one the respects the CAP’s Treaty objective of ensuring a fair standard of living for the agricultural community, would be to distribute basic payments on the extent to which total household disposable incomes fall below a level calculated to provide that ‘fair’ level. This makes explicit the social nature of this main tool of CAP support. It would probably vary between countries but would not prevent farm operators from receiving additional incentives to supply environmental or social services.

Biggest problem I see with payments in Spain is they don’t get paid. Young farmers waiting on payments to make their next move but told they could be waiting another few months. Why won’t they pay their subventions from last year?

Thanks for your post. The Spanish basic payment uncovered. I whised a social CAP, such as pointed by Berkeley Hill in the first comment, but is not the case. Certainly the Spanish agricultural policy is focused on manteining the status quo. A big lobby of landlors watch the system.