On 2 May 2024, the European Commission adopted an amendment to the State aid Temporary Crisis and Transition Framework (TCTF) to allow Member States to continue to provide aid to farmers affected by persistent market disturbances up to €250,000 to end-December 2024. This followed the European Council’s endorsement in its conclusions following its meeting 17-18 April 2024 of “the proposed extension of the temporary framework on State aid and the possibility to increase the ceiling on de minimis aid for agriculture.”

Following on the European Council’s conclusions, Germany on behalf of 16 Member States informed the last AGRIFISH Council meeting in April 2024 that it was seeking an increase in the de minimis aid amounts for farmers from a total of €20,000 over three years (€25,000 in certain circumstances) to an amount of €50,000. This would become the relevant ceiling once the TCTF derogation expires at the end of the year. The Commission announced in parallel with its adoption of the TCTF amendment that it will launch a revision of the agricultural de minimis regulation “in light of the inflationary pressure in recent years and the current context with, amongst others, high commodity prices affecting the agricultural sector.”

These decisions put the focus on how much additional aid farmers receive from Member States in addition to the funds transferred through the CAP. This is an extremely murky area as, despite the obligations on Member States to report State aid and other aid to farmers, there is no central registry which keeps track of these amounts. But that the amounts have been significant is beyond doubt. Back in May 2023, Commissioner Wojciechowski tweeted that more than €7.6 billion in State aid under the TCTF had been approved between March 2022 and May 2023 (though I have been unable to track down the document copied in the tweet).

Please find below the state aid update dedicated to agriculture in the EU? pic.twitter.com/CU73yMUEZG

— Janusz Wojciechowski (@jwojc) May 24, 2023

A little earlier, in November 2022, Farm Europe estimated that Member States received approval for around €4.6 billion in aid to farmers in 2022 both under the Temporary Crisis Framework (TCF, which preceded the TCTF) and the Covid-19 Temporary Framework (TF). Its analysis included a table which compared the crisis support approved with the direct payment transfers to each Member State. Its estimates showed that in Italy, Poland and Bulgaria the crisis aid approved amounted to between 27% and 33% of the direct payments envelope in 2022.

A more recent analysis by Euractiv journalists Maria Simon Arboleas and Sofia Sanchez Manzanaro examined aid to agriculture and the food sector under both the TCF and the TCTF between March 2022 and March 2024. They estimated that Member States had approved over €11 billion in State aid over those two years, with Poland (€3.9 billion) and Italy (€2.3 billion) the clear leaders.

These estimates underline that Member State transfers to farmers outside the CAP have been very significant in recent years, but there is still huge uncertainty about the figures. For one thing, the amounts approved for State aid are not necessarily disbursed in full, so the figures above exaggerate the actual transfers that farmers received. On the other hand, these figures only cover crisis State aid, while Member States also transfer significant amounts to farmers through regular non-crisis State aid and de minimis amounts (the latter are not considered State aid under EU law) in addition to the funding allocated in the CAP Strategic Plans.

In this post, I first discuss the different ways Member States can transfer national funds to farmers. I then examine available information on the amounts transferred in recent years, highlighting the lack of consistent robust data. Because there is a risk that national aids can distort the level playing field within the single EU market, I conclude by calling for a single central repository of data (building on but extending the State Aid Scoreboard maintained by DG Competition) to allow full transparency around this largely invisible flow of funds to EU farmers.

The EU State aid architecture for agriculture

EU State aid rules play a critical role in ensuring fair competition and the efficient allocation of resources within the internal market. The basic principles are set out in Articles 107-109 of the Treaty on the Functioning of the European Union (TFEU). Article 107 begins by prohibiting aid by a Member State that distorts or threatens to distort competition insofar as it affects trade between Member States in the single market. It then goes on to identify certain categories of aid that are deemed to be compatible with the internal market, and further categories of aid that can be deemed to be compatible. The Commission has developed a set of horizontal rules to clarify its position on particular categories of aid, including general guidelines, block exemptions, and de minimis provisions.

However, these general rules derived from the Treaty Article 107 are not automatically applicable to agriculture. The EU legislator has decided, on the basis of TFEU Article 42, that State aid rules do not apply to support financed under the CAP in relation to production and trade in agricultural products listed in Annex 1 of the TFEU (Articles 145-146 of the CAP Strategic Plans Regulation and Articles 211-212 of the Single CMO Regulation). Thus, national co-financing of rural development spending relevant to Annex 1 products in CAP Strategic Plans, including additional national co-financing, is not considered State aid. However, for the following expenditures normal State aid rules apply:

- National spending related to producers of Annex 1 agricultural products financed solely by national resources (i.e. without any EU element). This includes all subsidies, tax advantages, and grants that exceed specified thresholds or do not fall within exempted categories.

- Measures in CAP Strategic Plans that fall outside the scope of Article 42, for example, forestry measures and support for tourism or small businesses in rural areas.

Normal State aid rules mean that Member States must first notify their intention to provide assistance and then wait until the Commission has given the go-ahead after checking its impact on competition in the internal market before they can implement the measure.

The Commission has developed a set of horizontal rules to clarify its position on State aids to agriculture and forestry:

- The Agricultural Block Exemption Regulation (ABER) allows Member States to implement certain types of aid to SMEs in the agricultural sector without prior notification to the Commission, provided the aid meets specific criteria and conditions outlined in the regulation. This includes support for investments in physical assets, environmental and climate action, research and development, and risk management in agriculture. A revised ABER entered into force on 1 January 2023 which included a significant extension of the scope of block-exempted measures. The Commission anticipates that the new rules will block-exempt up to 50% of cases which before were subject to notification.

- The Agricultural Guidelines on State Aid provide the framework for assessing the compatibility of State aid with the internal market and stipulate various conditions under which aid may be considered permissible. These guidelines emphasise the need for aid to support genuine public policy objectives such as environmental protection, animal welfare, and the promotion of rural development, without unduly distorting competition.

- The agricultural de minimis Regulation sets a ceiling below which aid measures are not seen as State aid and do not have to be notified to the Commission. After the last revision to this Regulation in 2019, the de minimis ceiling was raised to €20,000 for a single undertaking over a period of three years subject to a national cap of 1.25% of national output (these amounts can be raised to €25,000 per undertaking and 1.5% of national output provided certain conditions limiting the amount of aid to a specific sector and establishing a central register for such aid are observed). Member States are obliged to report such aid to ensure transparency and adherence to cumulative limits.

These non-crisis State aid rules have been supplemented in recent years by several crisis measures. In March 2020 the EU introduced the Covid-19 Temporary Framework (TF) which permitted additional aid to farmers up to €100,000 in 2020, provided that the aid was not fixed on the basis of the price or quantity of the products put on the market. Successive amendments extended the period of validity to June 2022 and in November 2021 the maximum ceiling on aid to farmers was increased to €290,000. This aid could be paid in addition to de minimis aid.

Following the Russian invasion of Ukraine in February 2022, the EU introduced the Temporary Crisis Framework (TCF) in response to market disturbances. For farmers, Member States were allowed to provide up to €35,000 per undertaking in the form of direct grants, tax advantages, or guarantees and loans up to end December 2022. In July 2022 the maximum ceiling on aid to farmers was increased to €62,000. In October 2022 all measures were extended until end December 2023 and the maximum ceiling for aid to farmers was increased to €250,000 per farm. The TCF was replaced by the Temporary Crisis and Transition Framework (TCTF) in March 2023 which also set the permitted maximum level of aid to an individual farm at €250,000 to be paid before the end of December 2023. The period of validity was later extended to June 2024 and, as noted in the introduction to this post, has now been extended to December 2024 for farmers alone.

Finally, we should note that farmers have also benefitted from the call up of the agricultural reserve in both 2022 and 2023. In 2022 this was worth €500 million and Member States were permitted to add double this amount (200%) from their own resources (in practice, national top-ups amounted to €575 million giving a total budget of £1.1 billion). The total amount was allocated between Member States according to their net ceilings for direct payments, and farmers were eligible provided that they engaged in activities pursuing one or more of these goals: circular economy, nutrient management, efficient use of resources, and environmental and climate friendly production methods.

Expenditure of the 2023 agricultural reserve was more piecemeal and not without controversy. The EU 2023 budget included an amount of €450 million for the agricultural reserve and five measures, totalling €530.5 million, were adopted. These included two tranches of support for front-line states bordering Ukraine worth €56.3 million and €100 million respectively. This led several other Member States, annoyed by the unilateral restrictions on imports from Ukraine imposed by several of the beneficiaries, to question the criteria used to allocate this funding, a criticism repeated by MEPs in November 2023. Subsequently, the Commission proposed a general support package of €330 million for all Member States, again with the possibility for Member States to add double this support from their own resources, with Member States again criticising the lack of transparency. Smaller amounts were also made available for the eggs and poultry sectors in Poland and Italy. According to the EAGF Early Warning System, some of this expenditure (€134.5 million) was paid from the 2023 EAGF budget and the remainder (€315.5 million) was carried forward to the 2024 budget.

The agricultural crisis reserve itself is part of the CAP budget and does not represent additional resources transferred to farmers. However, the possibility for Member States to add double these amounts from national resources does represent additional State aid which would represent an increase in transfers over and above the channels considered so far. The Commission is obliged to report every three years on the use of crisis measures adopted on the basis of Articles 219 to 222 of the Single CMO Regulation including the use of the agricultural reserve, its first such report was published in January 2024. But this report only covers expenditure from the EU budget and does not cover complementary national aid.

How much national aid have farmers received?

State aid approvals under crisis measures

In this section, we want to estimate how much additional funds have been transferred to farmers under national aid measures in recent years. One way to get a handle on this amount is to examine the Commission decisions on Member State notifications under the various emergency aid packages (COVID TF, TCF and TCTF). This is the approach taken by Farm Europe and Euractiv in the analyses previously summarised. It aggregates the maximum ceilings for State aid approved by the Commission. Although there has been a specific interest in aid approved under the various crisis measures, the approach can be extended to all State aid notifications. One (major) drawback is that actual State aid provided under these approvals may turn out to be much less than the amounts approved (discussed further below). Other issues are that the schemes identified in this approach are those that specifically target agricultural producers. In practice, other beneficiaries such as aquaculture producers and forestry may also be included in these schemes. More important, several countries introduced umbrella schemes which, for example, reduced energy costs across the economy under which agricultural producers can also benefit but are not identified as a distinct group.

To illustrate this approach, I have estimated the total State aid approved primarily for the agriculture sector under the Temporary Crisis Framework introduced in March 2022 and approved during 2022. The main source used was the Commission Staff Working Paper accompanying the 2022 Annual Competition Report. Relevant schemes were identifying using keywords such as ‘agriculture’, ‘livestock’ or other specific commodities. Schemes specifically targeting the food processing sector were excluded. The list of schemes derived from this source was compared with the list of Member State measures adopted under the TCF and TCTF published by the Commission in May 2024 and some additional schemes not in the original list were added. The final list of schemes is available in this spreadsheet. Total approvals in 2022 under the TCF amounted to €4.93 billion, with Italy accounting for €2.23 billion of this total, Poland for €836 million, and France for a further €559 million (note that these figures are considerably higher than the €3.8 billion estimated by Farm Europe for the same scheme in the same year). These figures are compared with actual expenditure under the TCF in 2022 on agriculture, forestry and rural areas later in this post.

EEA support amounts

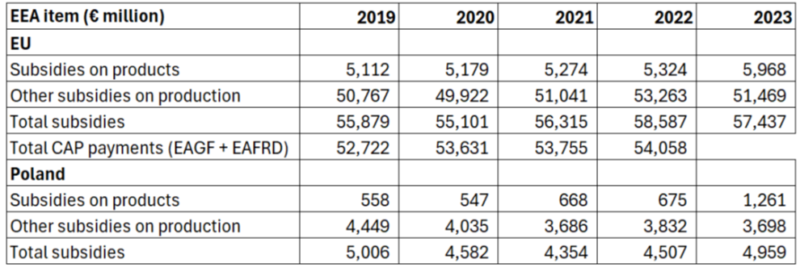

To assess the actual level of disbursements a first place to start is to examine the Economic Accounts for Agriculture (EEA) compiled by Eurostat. The EEA captures budget transfers to farmers under two headings: subsidies on products (e.g. coupled payments) and other subsidies on production (e.g. direct payments, agri-environment payments). Table 1 shows the trend in these subsidies in recent years. As well as giving the data for the EU as a whole, I also include Poland which is identified as a country that has made great use of the crisis emergency measures.

Source: Eurostat, Economic Accounts for Agriculture domain [aact_eea_01]. Total CAP payments to Member States (excluding the UK for 2019 and 2020) from DG BUDGET, EU spending and revenue – Data 2000-2022. CAP spending by the Commission is excluded. Note that not all EAGF and EAFRD payments are made to individual farmers.

The most striking message from Table 1 is how little the crisis State aids in 2020-2023 show up in the table, either for the EU or for Poland. For the EU, we control for changes in CAP payments by looking at the total receipts of Member States from the two CAP funds EAGF and EAFRD. Not all of these payments are received by individual farmers and therefore would show up in the EEA figures, but it is the overall trend that is significant. In 2020, the year of the Covid-19 TCF, total subsidies actually fell compared to 2019 despite an increase in CAP payments. In 2021 there was a small increase in total subsidies compared to 2019 but still much less than what can be explained by a greater increase in CAP payments. Only in 2022 do we see evidence of an increase in total subsidies greater than the increase in CAP payments compared to 2019 but still only amounting to €1.4 billion. While we do not yet have data on CAP payments to Member States for 2023, assuming that they are similar to 2022 payments suggests that they would account for all of the increase in total subsidies relative to 2019. The situation for Poland is even starker as there has been no increase in the reported amounts of subsidies in recent years, despite the significant use Poland has made of the temporary crisis measures. In other words, it seems that the crisis payments to farmers have gone missing in action.

In the EEA, agricultural output is valued at both producer prices and at basic prices (the difference here is what allows us to calculate subsidies on products). However, inputs are always valued only at basic prices, i.e. the prices that farmers actually pay (excluding VAT). A feature of much of the crisis aid to farmers is that it was used to lower input prices, i.e. subsidies on energy costs, on fertiliser, on fodder and on interest rates, or to provide tax exemptions or reductions in social security contributions. By definition, these subsidies would not be picked up in the EEA. However, the input cost subsidies would still be captured in the income arising in agriculture because the value of inputs would be reduced by the amount of these subsidies. This is a major limitation of using the Economic Accounts for Agriculture to track the impact of national State aids.

State aid Scoreboard

Another source to use in tracking State aids is the State aid Scoreboard repository maintained by DG Competition. It is a requirement for the EU Commission to publish annually a State aid synopsis based on expenditure reports provided by Member States covering all aid expenditure that falls under the scope of TFEU Article 107(1). In principle, this covers notified State aid to agriculture and forestry, aid exempted from notification under the block exemption regulation, and State aid expenditure on the crisis measures. Importantly, the Scoreboard data do not include de minimis aid because it is not subject to the Commission’s investigative powers under the State aid rules nor deemed to be State aid. The Scoreboard covers all Member State expenditure for which the Commission has either adopted a formal decision following notification or received a summary information sheet from Member States for measures qualifying under the agricultural block exemption ABER.

There are other methodological issues which need to be kept in mind when using the Scoreboard. First, the data represent actual State aid expenditure by Member States and not the ceilings that have been approved. There is usually a large discrepancy. For example, the State Aid Scoreboard 2023 reported that in the period between the adoption of the COVID-19 Temporary Framework in March 2020 and December 2022, out of nearly €3.05 trillion of aid approved, only around one third (34% or €1.03 trillion) of it was actually spent. For the TCF which was adopted in March 2022, only 9.6% of the aid approved in nominal terms had been spent by December 2022.

Second, the data distinguish between the nominal value of State aid granted by Member States and the aid element, which is the economic value granted to the recipient. For grants, the aid element normally corresponds to the budget expenditure but for other aid instruments there can be a difference. For example, when the State provides a loan guarantee there is an economic advantage to the recipient but not necessarily budgetary expenditure by the State unless the loan is called in. The 2023 Scoreboard notes that in nominal terms State aid expenditure under the Covid TF was €1.03 trillion, but the aid element of this expenditure amounted to only €472 billion.

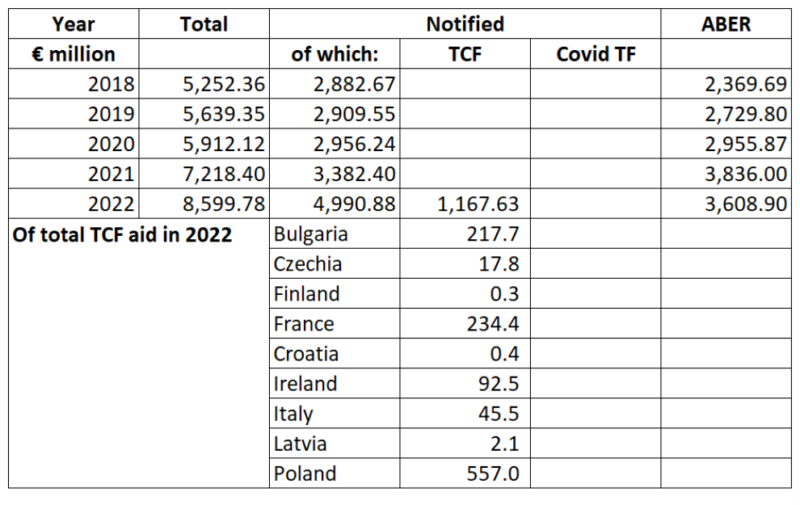

Table 2 shows the data for State aid to agriculture forestry and rural areas distinguishing between notified aid (including the crisis aid measures Covid TF and TCF in force in those years) and aid for which notification is not necessary as it is granted under the ABER block exemption regulation. Member States provide their reports by June 30 of the following year, and the latest Scoreboard data refer to 2022. The first point to note is that no COVID TF State aid measures have been reported in the Scoreboard, which seems to be a fatal omission. It is not clear whether these COVID TF measures are included under Notifications but not reported separately under the COVID TF heading, or whether they are simply omitted entirely from the Scoreboard.

Aid expenditures under the TCF have been reported by nine Member States in 2022. However, three Member States, Poland, France and Bulgaria account for the great majority of this actual expenditure (the State aid notifications to which these larger expenditures refer are listed in Annex 1 of the State Aid Scoreboard 2023). The difference between the aid expenditure reported under the TCF in 2022 and that approved (€4.9 billion, see above) is striking. The discrepancy is particularly severe for Italy, where the Commission approved national aids of €2.3 billion in 2022 but only €45.5 million was actually paid out to farmers.

Notes: Figures refer to the aid element of State aids.

Overall, the Scoreboard figures show an increase in State aid expenditure on agriculture and related areas of around €3 billion in 2022 compared to 2019. €1 billion of this is due to higher expenditure on ABER aids, just over €1 billion due to the TCF in 2022, and the remaining €1 billion due to other notified State aids (which may include measures approved under the COVID TF). The fact that expenditure under ABER has increased shows that Member States have been willing to use conventional non-crisis State aids also to make additional transfers to farmers during the crisis period.

Even leaving aside the uncertainty around COVID State aid, these figures are an underestimate of total national State aids to agriculture as the Scoreboard figures do not take account of Member State co-financing of agricultural reserve crisis spending nor de minimis aid. For example, the Commission reports that Member State aid in 2022 (on top of the agricultural reserve spending of €500 million) amounted to a further €575 million.

Conclusions

The current moves to change the rules to make it easier for Member States to provide national State aid to their farmers raises the question, what do we know about the amounts of aid that EU farmers receive and which Member States make most of this channel. The question is even more relevant given the very significant sums of money transferred through the various crisis aid schemes in recent years, the Covid Temporary Framework (TF), the Brexit Adjustment Reserve, the Temporary Crisis Framework (TCF) and currently the Temporary Crisis and Transition Framework (TCTF). There is a real concern that some Member States are in a better position to provide national aid to their farmers than others, and that the flexibilities provided under these various instruments may distort the level playing field in the single internal market.

Previous attempts to address this question have relied on State aid notifications and the amounts of aid that Member States have sought approval for. These amounts are indeed eye-wateringly large. But they exaggerate the amounts of aid finally disbursed which are usually well below the total amounts of aid for which approval is sought. DG Competition does provide figures, based on returns from Member States, of actual aid disbursed in its annual Scoreboard of State aid, but this only covers formal notifications and money disbursed under the Agricultural Block Exemption Regulation (ABER). It ignores national crisis aid authorised under the Single CMO Regulation as well as de minimis aid. Furthermore, there is a question mark over the actual figures reported in the Scoreboard as aid under the Covid TF for the Agriculture, Forestry and Areas objective is not shown separately, so it is not clear to me if it is included or not. The Commission publishes a regular report on the use of crisis aid under the Single CMO Regulation, but this only covers expenditure from the EU budget and does not include complementary national aid. Although Member States are required to report on their de minimis aid to the Commission, there does not appear to be any way of finding out and tracking the sums provided under this channel.

Still, my estimate in this post is that national State aids amounted to an additional transfer of over €9 billion to farmers (€8.6 billion in notified State aids plus aid under ABER, see Table 2, plus a further €0.57 billion in complementary national support for the agricultural reserve) in 2022. This compares to total CAP receipts by Member States in 2022 under both the EAGF and EAFRD funds of €54 billion (see Table 1). These national aids are a largely invisible additional transfer to EU farmers that should become more transparent.

Farming will continue to be affected by adverse shocks arising either from natural disasters, including those due to increasingly frequent weather extremes caused by climate change, or market disruptions due to geopolitical events. In this context, the agricultural crisis reserve, in place since the introduction of the latest CAP on 1 January 2023 with a yearly allocation of at least €450 million, is established to finance exceptional measures. But a reserve of this size is not able to sufficiently address the scale of crises, and hence the Commission has resorted to permitting additional national State aids.

Various calls have been made to re-examine the budget for crisis support. Commissioner Wojciechowski in November 2023 when visiting the scenes of flooding in Slovenia called for a special EU fund as a third pillar of the CAP to be used specifically for crisis support, a call echoed by the Italian farm organisation Confagricoltura during the farm protests in February earlier this year. But it is hard to see how to introduce the possibility of sufficient flexibility in the CAP budget within the budgetary rules governing the Multi-annual Financial Framework. It is likely that relying on Member States to provide national aids will continue to be a feature of future crises.

For this reason, the Commission should commit to preparing a single centralised annual report which would allow easy tracking of all national State aids to agriculture. This could build on the DG Competition Scoreboard but should be extended to also include the other channels whereby farmers receive national aids that are not formally considered as State aid. This post makes clear that such information is not readily available at the present time.

This post was written by Alan Matthews.

Photo credit: Pattys-photos, used under a CC licence.