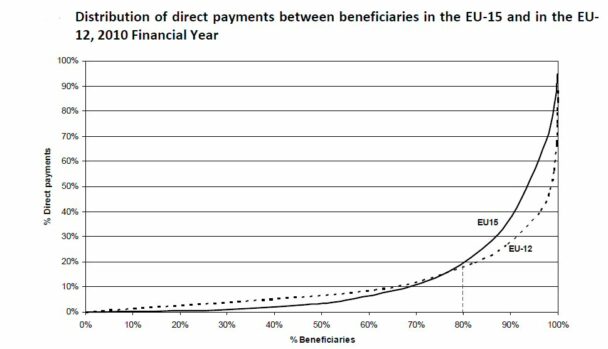

Ever since direct payments were introduced into the CAP, their unequal distribution has attracted unfavourable attention. The Commission’s 1991 paper The Development and Future of the CAP criticised the distribution of price support, noting that “80% of the support provided by FEOGA is devoted to 20% of farms which account also for the greater part of the land used in agriculture”. Yet the proportions remain exactly the same in both the EU-15 and EU-12 today, according to the Commission’s latest figures for the claim year 2009 (financial year 2010) (see diagram).

Even for those who argue that the specific nature of farming justifies a permanent system of direct payments support, the unequal distribution of support is hard to justify. The Commission has regularly made proposals to reduce payments to larger farms through either progressive modulation and/or capping. But these proposals equally regularly were either watered down or rejected by the member states.

Neither was the European Parliament a supporter of greater progressivity in direct payments in the past (for example, it did not support the Commission’s progressive modulation proposals in the CAP Health Check 2008). So, the introduction of co-decision in agricultural policy for the first time for the CAP2020 reform was not expected to add to real efforts to cap payments to larger farms.

Nonetheless, it was hardly expected that the initial Ciolos reform proposal could actually worsen the distribution of CAP payments. This aspect was overlooked in the more general debate on the different layers of direct payments proposed by the Commission. The widening of payment disparities would result from the elimination of the very limited progressive modulation introduced by the Health Check without providing any replacement instrument (the very limited form of capping proposed is without teeth and cannot be seen as an adequate replacement).

Whether or not inequality would increase in practice, of course, depends on how the regionalisation of direct payments, as implemented in each member state, will affect the relative value of entitlements on farms receiving large total payments compared to those with small payments. If, for example, the largest farms in a region are arable farms and the flattening of payments due to regionalisation favours smaller livestock farms, then the overall impact would be to reduce inequality in the distribution of payments.

But this outcome is a result of the structure of production and the way regions are defined by the member state, and is not inherent in the Commission proposal. The accompanying impact assessment to that proposal looked at the implications for the distribution across farm types but not across farm size.

The redistributive payment

At a late stage in the negotiations, however, a French proposal to allow higher payments on the first hectares of a farm, apparently intended to address a specific French problem to avoid too high a redistribution of payments from (relatively lower-income) livestock farms to (relatively higher-income) cereal farms in moving to the regional flat rate system, has the potential to introduce significant progressivity into the direct payments system in those member states that adopt it.

The proposal was first included in the COMAGRI amendments to the Commission’s proposal. COMAGRI called for ‘a complementary annual payment in respect of the first hectares to farmers in order to better take into consideration the diversity of farms with regard to their economic size, to their choice of production and to employment.’ The COMAGRI scheme would be voluntary for member states, the complementary payment would be limited to a maximum of 50 hectares on each farm, a maximum of 30% of a member state’s national ceiling could be used for this payment, and member states would have one opportunity (by 1 August 2013) to notify the Commission of their decision to make use of this payment.

This proposal (now called the ‘redistributive payment’) was taken up as part of the package of amendments to internal convergence rules for direct payments introduced by the Irish Presidency at the last Farm Council meeting in February, where it also received broad support among the Ministers. So a redistributive payment on the first hectares of a farm now looks likely to be part of the new CAP.

While the proposed payment will be voluntary for member states, the possibility to shift payments from larger to smaller farms will ignite passionate political debate in most EU countries. There are generally more farmers who would benefit from this payment than would lose from its introduction. This has already happened in Ireland where redistribution has been championed by farm groups in the more disadvantaged small farm regions and by the main opposition party, much to the discomfort of the main farmers’ union. But just how much scope for redistribution will the French proposal give?

The Presidency amendment to introduce a voluntary ‘redistributive payment’ would allow member states to grant a top-up on the basic payment for the first hectares of each farm to ‘take account of the greater labour intensity on smaller farms and the economies of scale of larger farms.’ This would be a new layer in the complex layered structure of direct payments proposed by the Commission. The Presidency proposal closely follows the COMAGRI amendment but with some differences. It would have five main characteristics (set out in a proposed new Article 28 in the direct payments regulation):

• It would be voluntary for member states which could each year decide whether to make use of the option in the following year.

• To finance the payment, member states may use up to [30 %] of their annual national ceiling set out in the regulation (the square brackets around the 30% figure indicate that this is a provisional figure proposed by the Presidency which could change in the later negotiations).

• The redistributive payment will be calculated by multiplying a figure to be set by the Member State (which shall not be higher than [65] % of the national or regional average payment per hectare) by the number of payment entitlements that the farmer has activated up to a ceiling to be set by the member state. This ceiling cannot be bigger than the average size of agricultural holdings in that member state.

• The redistributive payment can be graduated provided this applies identically to all farmers.

• Member states shall ensure that they have an effective anti-circumvention clause which prevents farmers from sub-dividing their holdings simply to create eligibility for the redistributive payment.

Implications of the Presidency proposal

The implications of the Presidency proposal can be teased out with the help of a numerical simulation. For this purpose, I develop a hypothetical simulation in the table below (the numbers build roughly on the Irish situation but they are based on hypothetical figures and are explicitly intended simply to illustrate some possible outcomes of introducing the redistributive payment).

The starting point is the distribution of farms by hectares. For this illustrative simulation, farms are grouped in size classes and each size class is assumed to consist of farms of equal size. Actual hectares are used, but payment entitlements will be calculated on Potential Eligible Area. Of importance here will be the application of the reduction coefficient (recommended both by COMAGRI and the Presidency) which will reduce the PEA for more marginal and low-productive land.

The second input requires linking the value of entitlements to farms in different farm sizes. For this simulation model, I assume a pattern whereby farms in larger size classes receive higher-value entitlements (except for the very largest size class which includes a lot of hill farms).

Under the internal convergence proposals, the value of the basic entitlements is supposed to converge to a uniform regional average although it is likely this convergence will be incomplete in the next MFF budget period. In addition, farmers can receive a green payment, a natural constraint payment, a young farmer payment or a small farmer payment. The ultimate redistribution arising from this reshuffling of direct payments cannot be known a priori.

For this simulation, I am only interested in the impact of the redistributive payment, so I do not alter the initial level of payments per farm size group. However, it is important to highlight that the distributional effect of the redistributive payment will be additional to, and on top of, any distributional effects from internal convergence and the different layering of the payments.

The next step is to decide on the proportion of the national ceiling used for the redistributive payment. We initially assume that the member state makes use of the full 30% share allowed. In this numerical simulation, this is not constrained by the requirement that the payment cannot exceed 65% of the average payment per hectare. (Under the Presidency proposal, the comparison is with the notional average payment obtained by dividing the national ceiling by the total number of eligible hectares; it is not linked to the size of the basic payment). The value of the redistributive payment is calculated by dividing the value of the 30% share of the national ceiling by the total area on farms not counting area greater than the average farm size (34 hectares in this numerical example).

What we learn from the simulation

The key columns of results are the shares of payments going to each size group before and after the introduction of the redistributive payment and the changes in the average payment per farm in each size group. All farms below the threshold for the redistributive payment, which can be set at maximum at the average size of farm, obviously gain. But some farms slightly above the average will also gain, until the loss on the additional hectares outweighs the gain on the front-loaded redistributive hectares.

Numerically, the number of farms who gain is greater than the number who lose. This will be a general result, assuming that the size distribution is skewed to the left and there are relatively few farms who obtain a large share of the total payments.

The maximum reduction in payment on the larger farms, in the limit, will tend towards the percentage of the ceiling set aside for the redistributive payment. If this percentage is 30%, then in the limit the maximum loss for the very largest farms will be 30% (as the importance of the redistributive amount, which is fixed as the product of the redistributive payment and the average farm size for these larger farms, becomes vanishingly small in relation to the other payments).

In practice, farms in the largest size groups will tend to lose somewhat less – in this illustrative example, they lose 18% of their original payment. Conversely, farms in the smaller size groups gain an additional 15-20% of their original payment.

Another way to look at the outcome is to compare the ratios of average payments of farms in the different size groups. For example, before the redistributive payment, the ratio of payments on farms in the 50-100 ha range to those in the 11-20 hectare range was 5.5. After the introduction of the redistributive payment, the ratio is compressed to 4.2. If the comparison were made with the basic payment alone, the compression would be even greater.

For those member states that introduce it, the redistributive payment can introduce a much more significant degree of progressivity into CAP payments than what we have seen heretofore. The possible extent of redistribution goes well beyond what even the Commission had proposed in the 2008 Health Check, let alone what was eventually agreed.

This outcome occurs for two reasons. First, the threshold above which farms will lose from the redistributive scheme is lowered to just over the average farm size in each region/member state. It is no longer just the mega-large farms which will contribute to modulation, but a much larger swathe of middle-income farms.

Second, the modulated money is not recycled to rural development funding as in previous cases, but rather is given directly to small farms at the lower end of the distribution curve. Both of these elements contribute to the much greater redistribution effect.

It is ironic that, after years of pussy-footing with capping as a way to introduce greater progressivity into CAP direct payments, this last-minute proposal of a redistributive payment introduced for quite unrelated motives has the potential to make a much greater difference, but only in those member states that introduce it. This will now be the interesting question, and any comments on attitudes in the different member states will be very welcome in the Comments section below.

This post was written by Alan Matthews