We are pleased to welcome this guest post by Lars Brink, who is an independent advisor working from Canada.

This post examines the concepts and calculations of the two different agricultural policy indicators called Market Price Support (MPS): the one is used by the Organization for Economic Cooperation and Development (OECD) in its measurement of producer support in its Producer Support Estimate (PSE) indicator, and the other is identified in the Agreement on Agriculture (AA) of the World Trade Organization (WTO) as part of the measurement of the Aggregate Measurement of Support (AMS) indicator.

Once the United Kingdom (UK) has withdrawn from the European Union, the UK by itself will be the entity for which support to agriculture is measured under the practices or rules of international organizations such as the OECD and the WTO.

As a non-EU member of the OECD, the UK is assumed to participate in the measurement of the OECD’s PSE. Likewise, as a non-EU member of the WTO, the UK will be expected to calculate AMSs, as appropriate. This note discusses the differences between one component referred to as MPS in the two indicators, with an eye to the policy data the UK might wish to maintain to support the respective MPS calculations.

OECD MPS and WTO MPS are conceptually different

Measurement by the OECD serves to support its longstanding flagship activity, the monitoring and evaluation of agricultural policies for many countries. Measurement under the WTO rules supports the review by the Committee on Agriculture of each member’s implementation of its commitments, which include a commitment not to exceed the member’s ceiling on its Current Total Aggregate Measurement of Support (Current TAMS). The Current TAMS is the sum of a number of individual AMSs, summed in a particular way, and represents certain applied support. The member’s Bound TAMS is the ceiling on its Current TAMS. In July 2018 the United Kingdom proposed a Bound TAMS of EUR 5,914.1 million. Some of the context for the UK’s Bound TAMS was outlined in this post.

A measurement called MPS can be a component of both the PSE and an AMS. The fact that two very different indicators have the same name is confusing. For example, the amounts of OECD MPS and WTO MPS for the European Union differ greatly. Likewise, the OECD and ICRIER reported large negative OECD MPS amounts for many products for India, while the United States calculated very large positive WTO MPS amounts for wheat and rice in India, and India itself reported small or slightly negative WTO MPS amounts for wheat, rice and other crops in the same years (see G/AG/N/IND/10, G/AG/N/IND/11 and G/AG/W/174 here). This also indicates that WTO members have different views on how to calculate WTO MPS.

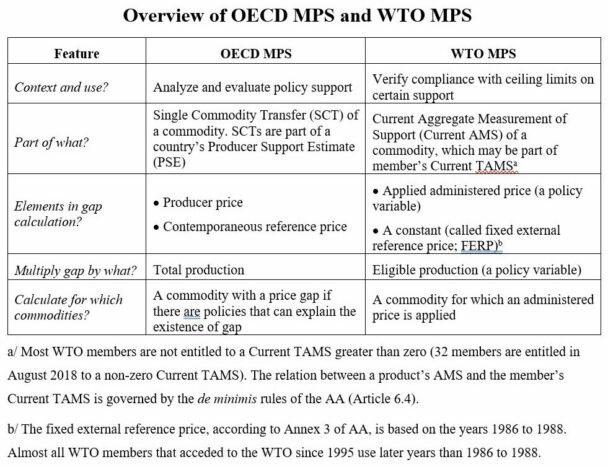

In essence the OECD MPS and the WTO MPS have only one thing in common: a gap or a difference is multiplied by a quantity of production. The gap for the OECD MPS is the difference between two observed prices. The gap for the WTO MPS is the difference between a policy setting (also called a price) and a constant. The applicable quantities for the two indicators are also defined differently. Table 1 summarizes the main differences between the OECD MPS and the WTO MPS.

Market price support as a component of policy transfers

Governments in many countries implement agricultural policies that lead to transfers to (or from) individual producers. They take the form of (1) budgetary payments and (2) policies affecting farm prices. Some countries operate no such policies, some operate only one kind and some operate both kinds. In order to better understand the size and nature (level and composition) of the total agricultural policy effort in a given country, a method is needed to add together the transfer through budgetary payments and the transfer through price policy. This need was articulated already in 1958 by Haberler in the context of trade negotiations.

Measuring the budgetary payment transfer can be straightforward, using various forms of government accounts. Measuring the actual transfer through price policy requires a method based on economic reasoning. While the OECD measures the price policy transfer using the opportunity cost idea, the WTO AA is designed to measure something else, not based on opportunity cost. The WTO indicators are nevertheless labelled “support”, which harks back to the origin of what eventually became the negotiated WTO indicators and methods.

MPS in the OECD family of support indicators

The standard method for measuring the transfer through price policy is to subtract a reference price from the actual farm price of a commodity and multiply the difference (a price gap) by the country’s total production of the commodity.

The reference price is usually derived from the price at the country’s border, which an importer or exporter would face in the absence of a border policy. The border price is adjusted to represent what it would be if observed at the farm gate: prices are compared for the same kind of product at the same level in the value chain. This approach was developed by Josling for the FAO in 1973, inspired by the work of Corden. The method was subsequently adapted for use by the OECD, under whose aegis it has been further developed over time. Other organizations have undertaken calculations using similar methods, such as the U.S. Department of Agriculture, Inter-American Development Bank, World Bank, International Food Policy Research Institute, and Asian Productivity Organization. Individual researchers have also contributed.

The OECD MPS is one of the transfers accounted for in a commodity’s Single Commodity Transfer (SCT), along with budgetary payments to producers. Summing all the OECD MPS amounts and all the budgetary transfers (payments to producers, whether attributable to particular commodities or not) generates the OECD PSE for a country. Knowing the size of the various components of OECD PSE and several related indicators of transfers has made it possible to analyze the evolution of transfers over time in different countries, to compare them across countries and to evaluate the effects of a country’s policy efforts in agriculture.

MPS in the WTO Agreement on Agriculture

International trade negotiations that started in 1986 and concluded in 1994 resulted in an international body of law administered by the WTO. It includes the AA, which lays down rules for calculating the AMS for a “basic agricultural product” (the OECD usually refers to a “commodity” – not too much should be made of this difference outside of interpreting the AA in legal proceedings).

While the idea for calculating a product’s AMS evolved from the same underlying idea as the OECD PSE, the negotiations took the rules for calculating an AMS in a different direction from the practice of calculating OECD MPS, SCT and PSE. One of the reasons for the divergence between AMS and PSE is the use of AMSs in assessing a country’s compliance with its legally binding support commitments under international law, which motivated negotiators to choose particular techniques to calculate an AMS as a measurement of applied support for a product. Over the years it has become obvious, however, that countries interpret the AMS language differently (examples here).

The WTO MPS does not use an observed farm gate price of the commodity but a policy variable called an “applied administered price” (AAP). The AA can be interpreted to say that a WTO MPS must be calculated and included in the product’s AMS when an administered price is applied. There is no jurisprudence on what constitutes an AAP, but it is often seen as a price set by government policy (support price, intervention price, guaranteed price, etc.). It is possible that WTO MPS needs to be calculated only if an administered price is applied, even if the farm gate price is higher than the reference price derived from, say, a border price. The domestic price can exceed the border price if import barriers are in place, such as tariffs.

The WTO MPS does not use a reference price for the year for which the calculation is carried out – it uses a constant identified in the negotiations in the early 1990s. This constant is called the “fixed external reference price” (FERP). It is derived from border prices based on the years 1986 to 1988. Some members used border prices in their own currency, others used border prices expressed in a “stronger” currency, such as USD or EUR. The initial choice made in this respect can have large implications for the calculation of MPS in a Current AMS, since that calculation must take into account the data and methodology used in the member’s initial calculations. Sustained inflation accompanied by currency depreciation can result in a very large gap between a country’s nominal AAP for a product and the corresponding FERP expressed in its own currency. In the case of the UK calculating a WTO MPS for a product, it appears that the FERP would be the 1986-88 FERP of the European Union, which was expressed in ECU/tonne, i.e., EUR/tonne. (The draft schedule accompanying the UK’s July 2018 proposal does not seem to be publicly available, so it is not possible to verify the constituent data and methodology to which the UK may refer in Part IV, Section I, of its draft schedule).

The AA has no provision for updating the FERP. This absence of updating facility may be linked to the fact that the AA at its finalization in 1994 foresaw continued negotiations from 1999. These negotiations under Article 20 of the AA were rolled into the much broader Doha Development Agenda, where negotiations on agriculture are essentially at a standstill since several years.

The WTO MPS multiplies the difference between the AAP and the FERP by a quantity defined as the quantity of production eligible to receive the AAP. This quantity, which is set by policy decision, is not necessarily the same as the total production used in OECD MPS. Some countries use the (smaller) quantity that the government announces as being eligible for the AAP, or the (even smaller) quantity the government actually purchased at the AAP. WTO members interpret the AA provision regarding eligible production differently.

Futility of comparing WTO MPS and OECD MPS

Because the WTO MPS and the OECD MPS are designed to measure two different things, it is to be expected that their numerical values are different. Discerning the conceptual differences between the indicators can be difficult since their definitions use some overlapping terminology, where a given term, such as reference price, has different meanings. The WTO MPS uses two variables set by policy decision (eligible production and applied administered price) along with a constant. This contrasts against the OECD MPS, which uses total production, an actual average or representative producer price, and a contemporaneous reference price for each year. The conceptual and methodological differences between the OECD MPS and the WTO MPS reduce to futility any attempts to compare their levels.

Careless discussion, especially in media, often fails to distinguish between an AMS and the TAMS and refers to Bound TAMS or Current TAMS as “the AMS”. However, each AMS measures certain support for a single product (an AMS is also calculated for some non-product-specific support). In contrast, the PSE is an indicator for the whole agriculture sector. Moreover, AMS calculations leave out some of the budgetary transfers that are included in a product’s SCT and/or the country’s PSE (some examples: Single Payment Scheme, Single Area Payment Scheme, and Suckler Cow Premiums in the European Union; Cotton Transition Assistance Program and Conservation Reserve Program in the United States; Payments for conversion from rice production in Japan; Direct Payments to Grain Farmers in China; Fertilizer Subsidy in Indonesia; and input subsidies for irrigation, fertilizers and electricity in India). The eligibility of any given payment policy to be exempt from the AMS calculation has been debated in relation to the criteria of the AA, but no country’s exemption has been adjudicated under the WTO rules on dispute settlement. These differences mean that it is incorrect and misleading to consider AMS and PSE as parallel indicators.

Lack of clarity in the rules for calculating the WTO MPS

Every member of the WTO is required to submit annual or biannual notifications to the WTO Committee on Agriculture using prescribed formats and calculation procedures. The committee is a forum where a member’s calculation of WTO MPS can be questioned, but that fairly informal process falls short of being a legal challenge. A somewhat more formal process which also falls short of being a legal challenge is when Country A submits its own calculations of Country B’s WTO MPS, claiming those calculations to be the correct ones under the rules of the AA. The United States’ submission of such a claim to the WTO Committee on Agriculture in May 2018 concerning WTO MPS for wheat and rice in India (G/AG/W/174 mentioned above) was the first such counter-notification on domestic support. It moved India forcefully in the Committee to dismiss the validity of the U.S. calculations, which thus served to highlight some of the differences in interpreting the AA rules on calculating WTO MPS. These differences include the understanding of eligible production and FERP.

A legal challenge arises when a member initiates a dispute under the WTO rules on dispute settlement. Only one WTO dispute has ruled on the calculation of WTO MPS, viz. Korea-Beef. It clarified the situation where the announced quantity rather than the quantity actually purchased would constitute eligible production. The ongoing dispute China-Domestic Support for Agricultural Producers concerns eligible production and base years for FERP, among other issues.

Conclusion

The WTO MPS and the OECD MPS are conceptually different: in spite of having the same name, they measure different things. Most of the data in OECD MPS calculations is meaningless for assessing the validity of the WTO MPS that a member reports to the WTO Committee on Agriculture and which can be the subject of a WTO dispute. The OECD MPS does, however, represent the actual transfer to agricultural producers through price policies and can be used to evaluate the effects on such variables as production, consumption and trade. As a non-EU member of both the OECD and the WTO, the UK will like other members of these organizations need adequate data capacity in agriculture policy to support the calculations of both the OECD MPS and the WTO MPS. This would apply to any products and political entities where price policies or border policies would require the calculation of these indicators.

This post was written by Lars Brink

Thanks Lars.

The full Schedule is available on the UK Partliament’s website (https://www.parliament.uk/depositedpapers?max=100&page=1#toggle-770 ):

DEP2018-0770, 19 July 2018, deposited by the Department for International Trade

http://data.parliament.uk/DepositedPapers/Files/DEP2018-0770/UKs_Goods_Schedule_at_the_WTO.pdf

Best wishes,

Alan

Thanks, Alan – this is good! You give us very useful additional information. It is interesting to note that the wording of the proposed Part IV, Section I, of the United Kingdom differs in some respects from the same section of many other Members. One hopes, for example, that showing AMS commitments instead of Total AMS commitments would not confuse other Members as to contents of the UK schedule. Likewise, the absence of any reference to what Article 1(a) of the Agreement on Agriculture calls “constituent data and methodology” could make it difficult to interpret the meaning of that article in its application to the UK.

Lars