The extent and nature of the risk management tools that should be offered to EU farmers is one of the main issues which will be debated in the context of the future CAP after 2020. Already, in the COMAGRI amendments to the Omnibus Regulation, we see the interest of parliamentarians to extend the risk management toolkit and to make it more attractive for farmers to use.

The COMAGRI amendments seek to allow Member States to use CAP funds to contribute to insurance premiums for market-related hazards (that is, price variability) and revenue variations as well as just production variations due to adverse climatic events, diseases, pest or an environmental incident as at present; to provide for sector-specific income stabilisation tools so that farmers could enrol in schemes for a specific production and not necessarily for whole farm income; and would allow indemnification payments to farmers whenever the production loss (or income loss in the case of mutual funds operating an income stabilisation tool) exceeds 20% rather than the 30% in the existing legislation.

A counter-argument to these proposals is that the CAP budget is limited, so any funding to extend the risk management toolkit would mean a reduction in funding for other farm programmes, either in the rural development Pillar 2 (where funding for the risk management toolkit is currently placed) or possibly for Pillar 1 supports if funding were shifted from direct payments to risk management tools as was recommended in the report of the Agricultural Markets Task Force at the end of 2016.

There is no doubt that farmers would favour increased public support for risk management instruments if this was in addition to the support they currently receive under the CAP. The more interesting question is whether it is in the interest of (a) farmers and (b) taxpayers to encourage a shift of resources in this way within the CAP budget, if overall support were held constant. Specifically, direct payments are often justified as a risk management instrument within the CAP, but are they the most efficient instrument for this purpose?

Erik Mathjis has written a very useful background note for this debate in his chapter for the recent RISE Foundation report The CAP: Thinking out of the Box. He discusses the different kinds of risk that farmers face and the appropriate role for public support for risk management. He emphasises that public support is not the only way to assist farmers to manage risk, and that there is also a role for private actors in the food chain to work together to better manage risk. Readers interested in this issue are encouraged to read his chapter to better understand the issues at stake.

Another useful resource is the rapporteurs’ report by Luka Juvancic and Carmel Cahill on the risk management workshop to the recent CAP: Have Your Say public conference. They summarise six findings in thinking about the role of risk management instruments in the CAP after 2020:

• Strengthen farmers’ own capacities to deal with risks

• Improve the potential for market-based risk management instruments

• Encourage risk-sharing along supply chains

• Take a holistic view and ensure coherence between different risk management policies

• Design a common but flexible risk management toolkit for the CAP post 2020

• The best approach to income risks needs further consideration

In this post, I review some relevant results from a recent paper by Alba Castañeda-Vera and Alberto Garrido which evaluates the effectiveness of different risk management tools to stabilise farm income in the current CAP.

They compare four policy instruments: direct payments, crop diversification, crop insurance, and the Income Stabilisation Tool (IST) with respect to their impact on farm income and farm income stability, the interest of farmers to adopt these tools, and the efficiency of public expenditure invested in supporting them. In this post, I consider crop diversification as a farm management strategy rather than a policy option, and focus attention on the relative impacts of direct payments, crop insurance and the IST in helping to stabilise farm income. I am grateful to the authors for further elucidation of some points in their paper when writing this post.

Methodological approach

To understand their results, it is first necessary to explain their experimental setup. They focus on a representative arable farm in a province of the Castilla y León region (northern central Spain), which is the only Spanish region which has proposed to support the IST within its 2014-2020 Rural Development Programme. Two farm strategies are examined: a wheat monoculture, and a crop rotation meeting the CAP requirements for the Pillar 1 greening payment (40% wheat, 40% barley and 20% dry beans). Farm income is defined as the difference between revenue and variable costs (gross margin). The average costs for each production are based on FADN-type data collected for farms in the Valladolid province in this region and are assumed fixed in the simulations.

However, farm income can vary because of variations in both crop yields and crop prices. The authors use the observed variability in crop yields and prices in the period 1993-2015 to generate probability distributions for yields and prices which they use to generate 2000 different possible combinations of yields, prices and thus farm incomes for this arable farm. They then examine how the resulting distribution of farm incomes could be affected by the different risk management tools that they investigate. Because of the sharp increase in price volatility after 2007, the authors calculate crop price volatility for two scenarios: a low and stable prices scenario (based on the price variability experienced from 1993 to 2006) and a high and volatile prices scenario (based on crop price data from 2007 to 2015).

The risk management tools they investigate are based on the actual policies in place in the Castilla y León region under the current CAP. The direct payments include the basic payment and the greening payment. Crop diversification is the obligation to meet the eligibility requirements for the greening payment. Crop insurance is the scenario where the CAP pays 65% of the premium required to indemnify the farmer against losses on an actuarial basis, whereas the IST is where the CAP pays 65% of the indemnity and farmers make an annual contribution which covers the remaining losses on an actuarial basis. For both crop insurance and the IST, indemnities are only paid where the drop in yields or income exceeds 30% of the average yield or income, respectively, and the indemnities compensate for 70% of the yield or income lost in the year the farmer becomes eligible to receive this assistance.

The average basic payment is set at €90.92 per hectare while the value including the greening payment is set at €137.93 per hectare. The farm is assumed to receive both payments regardless which farming strategy it pursues (we can justify this by assuming that the arable area must be less than 30 hectares when it adopts the monoculture option). The actuarially-correct crop insurance premium was calculated at €31.4 per hectare for wheat monoculture and at €26.1 per hectare for crop rotation, of which 65% is defrayed by the CAP. Unlike the crop insurance premium, the IST premium depends both on crop prices and CAP direct payments so varies in the different scenarios. However, it is calculated so that it is able to fund the 35% of indemnities which are not met by the CAP. In both cases, the premium was increased by 20% to cover the costs of the insurer and to provide a safety reserve for the mutual fund, respectively.

How different risk management tools affect farm income

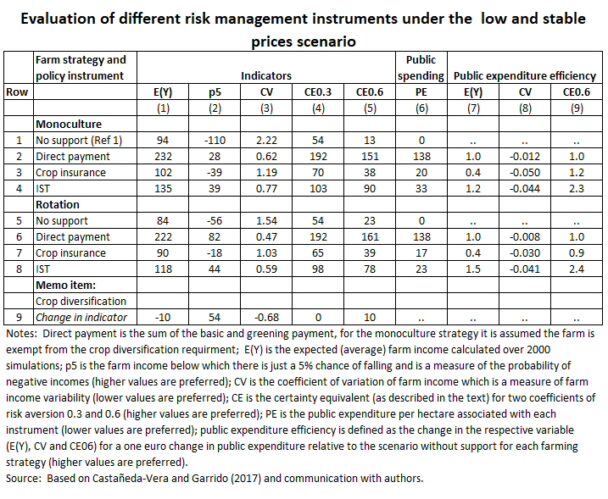

The table below shows the impacts on farm incomes, the farmers’ certainty equivalent and the efficiency of public expenditure under the two farm management strategies (monoculture and crop rotation) with and without the different risk management tools in the low and stable prices scenario. What is meant by the farmers’ certainty equivalent is explained below. For each farm management strategy, the farm income situation with the risk management tools is compared to the situation without support (this is slightly different to the presentation in the paper itself which compares all the different scenarios to the monoculture option without support).

In the case that the farm grows a wheat-only monoculture without any CAP support, its expected income would be €94 per hectare. Its expected income (that is, the income it would expect to receive averaged over the 2000 scenarios) with the existing amount of CAP direct payments (basic and greening payment) is substantially higher at €185 per hectare (this is the return assumed for farms with less than 30 ha of cereals which are not required to observe the greening obligations which include crop diversification in order to receive the greening payment). We then assume that the two risk management instruments would be substituted for direct payments. The monoculture farm would have an expected income of €102 per hectare if it could sign up to the crop insurance programme while foregoing direct payments, and an expected income of €127 per hectare if the farm was enrolled in the IST while foregoing direct payments. The paper gives much more extensive results including where risk management instruments are combined with direct payments.

Two measures of income variability are calculated. One is the probability of avoiding a negative income. The p5 indicator measures the effectiveness of the different instruments in helping this farm to avoid a particularly low income or a particularly high farm loss. Specifically, it measures the level of farm income in the lower tail of the distribution below which the income of this farm would fall at least 5% of the time – in technical terms, the 5th percentile of the income distribution. The higher the level of this threshold, the more effective is the policy instrument in enabling this farm to avoid negative incomes.

The other measure of farm income variability is the coefficient of variation which is a standardised measure of the dispersion of the distribution.

The p5 indicator shows that, without any support, the monoculture farm has a 5% probability of making a loss greater than €110 per hectare. With direct payments, the threshold for the lowest 5% of possible income outcomes rises to an income of €28 per hectare. The p5 threshold for those enrolled in the crop insurance programme is a loss of €18 per hectare, while for those in the IST it is a gross margin of €39 per hectare. Thus, in terms of avoiding very adverse incomes, the IST performs better than either direct payments or crop insurance in this example.

The ranking of how the different instruments affect overall income variability, as measured by the coefficient of variation, is shown in Column (3). Under the assumptions the IST appears to be more effective than crop insurance at avoiding very adverse outcomes, and almost as effective as direct payments.

Turning to examine the farm which adopts the crop rotation strategy, overall expected income is lower (by €10 per hectare) because farmers must now grow a combination of less profitable crops. However, what is interesting is that, under each policy instrument, crop diversification in itself reduces farm income variability. This confirmation that diversification is an important management strategy to reduce income risk is an important finding in itself. Examining the effectiveness of different policy instruments in this scenario, it appears direct payments do most to reduce variability, followed by the IST and then crop insurance.

How different risk management instruments are perceived by farmers

The paper also presents results for the high and variable prices scenario which are not replicated here. The results are sufficient to show that some policy instruments are more effective at raising the expected (average) farm income while others are more effective at stabilising that income or preventing extraordinary losses (compare Row 4 with Row 2). Which instrument might farmers prefer? In other words, how do farmers trade off their preference for a higher farm income against their preference for a more stable farm income?

Economists have devised a method to aggregate both the level and stability of a variable taking into account the farmer’s risk aversion which is called the certainty equivalent. This is the income which the farmer would be willing to accept as a guaranteed annual income as a substitute for an overall higher but more unstable income stream. The certainty equivalent of an income stream is assumed to be directly proportional to the expected income and inversely proportional to its coefficient of variation, where the weight given to the instability term depends on the farmer’s risk aversion.

If farmers are indifferent to risk, then the weight on the coefficient of variation term is zero. However, it is reasonable to assume that most farmers are risk averse and thus are willing to trade off a lower expected income for some guarantee of greater stability. Two different risk aversion weights were assumed; a value of 0.3 representing a lower level of risk aversion and a value of 0.6 which gives a higher weight to risk aversion.

The certainty equivalents (CE) in the table show what happens when the expected income is adjusted for the expected variability of that income. Thus, with a low risk aversion coefficient of 0.3, the expected income in the no support monoculture scenario of €94 is reduced to a certainty equivalent of €54. If farmers are even more risk averse and discount unstable income streams even more, then using a risk aversion coefficient of 0.6 reduces the certainty equivalent to only £13.

The certainty equivalent of a farming strategy or a policy instrument can be interpreted as a measure of the value that a farmer would put on that strategy or policy instrument, given his or her attitude to risk. Farmers will prefer outcomes with a higher certainty equivalent. Given the assumptions behind the simulations for this farm, we can conclude that, regardless of the farming strategy pursued, this farmer would prefer to receive direct payments, and that the IST is preferred to crop insurance.

Efficiency of public expenditure

However, the analysis cannot stop at this point, because we are not comparing like with like. There are huge differences in the public expenditure per hectare on the different policy instruments, as shown by the figures in Column (6). Direct payments involve support from the taxpayer of €138 per hectare, while the cost for crop insurance and the IST, under the existing operational rules for these tools, varies from €17 to €33 per hectare. Under those circumstances, it is hardly surprising that farmers express a preference for direct payments (as shown by their certainty equivalent).

The more interesting comparison is to compare the risk management instruments on an even footing by looking at the outcomes per euro of support. These efficiency measures are shown in Columns 7 through 9.

Column 7 shows the change in the farm’s expected income for one euro in additional support for each instrument. In the case of direct payments, the efficiency ratio is 1, indicating that each additional euro of direct support increases farm income by one euro. The transfer efficiency of crop insurance is much poorer, at 0.4. What might not be so intuitive is that public funding of the IST has an amplifying effect on expected farm income in both farm management options. This is despite the fact that 20% of the premiums that farmers pay into the mutual fund go on administrative charges.

The IST is also the superior tool in helping to stabilise farm incomes. For a given euro of public support, the IST brings about a significantly greater reduction in the variability of farm income than either direct payments or crop insurance alone. Taking farmers with a high risk aversion (weighting of 0.6), these results imply that the certainty equivalent of one euro of public support through the IST is much higher than through direct payments or through subsidising crop insurance. With respect to the crop insurance alternative, the authors note: “The higher effectiveness in increasing farm income stability of the IST with respect to crop insurance is due to the direct protection offered by IST against low incomes. Instead, crop insurance only protects against yield losses”. We might infer that the greater efficiency of the IST tool compared to direct payments in stabilising income per unit of public expenditure is because the latter remain the same from year to year, regardless of the farm income outcome on the farm.

Finally, it is worth underlining again the contribution that crop diversification on its own makes to farm income stability. In the specific context of this farm, crop diversification imposes a penalty on the expected farm income as compared with a wheat monoculture. On the positive side, because the price and production variability of different crops are not fully synchronised, crop diversification makes a significant contribution to stabilising farm income over time, and reducing the probability of low or negative incomes. For a farmer with a low aversion to risk, the certainty equivalent of the rotation management strategy would leave the farmer feeling as well off as adopting a monoculture strategy, while there would be a clear improvement in well-being for a farmer with a higher aversion to risk.

Policy conclusions

Subsidising risk management instruments as part of the CAP gives rise to two separable impacts on farm incomes (a) the tool can help to stabilise farm incomes given the way it is designed, and (b) the tool can provide a transfer to farmers because of the role of the public subsidy. If we compare the three risk management instruments currently available under the CAP, there is no doubt that direct payments win hands-down as the preferred choice of farmers. But this is because the transfer element in direct payments is much higher than in the other two risk management tools. We are not making a fair comparison of the three alternatives.

The alternative proposed in this interesting paper by Castañeda-Vera and Garrido is to compare the public expenditure efficiencies of the different risk management instruments. With this method, it is possible that the ranking according to transfer efficiency (the increase in expected farm income per euro of public expenditure) and the ranking according to stabilisation efficiency (the reduction in income variation per euro of public expenditure) across the three instruments may differ. In order to come up with a unique ranking, therefore, some way of aggregating farmers’ preferences for a higher income level and a higher level of income stability is required. The way economists do this is to calculate a measure of the certainty equivalent of a given income stream, where an essential role is played by the coefficient of risk aversion of the farmer.

The results show that, when we take into account the stabilising effect through the certainty equivalent approach, the IST emerges as the most effective use of public resources and also the one likely to be most preferred by farmers. In the table, I have only shown the public expenditure effectiveness in increasing the certainty equivalent when the risk aversion coefficient is assumed to be quite high at 0.6. Putting a lower weight on risk aversion would reduce the relative attraction of the crop insurance and IST options, but does not alter the overall ranking.

These results refer to a single farm type in a single province in a single region of the EU. They also assume the current modalities of the crop insurance and IST instruments (we noted at the outset that COMAGRI has suggested some amendments to these modalities). While suggestive, it would not be appropriate to draw general conclusions from this single study without replicating the results for other farms in other contexts and looking at the impact of different designs of risk management tools. The results are influenced by the specific pattern of price and production variability experienced in this region in the past, including the patterns of co-movement (covariance) between the production and price cycles of the individual crops. They may also be sensitive to the level of administrative and ‘deadweight’ costs assumed in implementing the various schemes.

It would be very desirable to replicate this analysis for a wider range of farm types and regions and hopefully this is something that the authors will consider, or possibly something that might be undertaken by the Commission’s Joint Research Centre which would have easy access to the relevant data.

This post was written by Alan Matthews

Photo credit: Nick Youngson licensed under CC BY-SA 3.0 licence.