DG AGRI’s Milk Market Observatory (MMO) is now proving its worth as a source of up-to-date data on milk and dairy product market developments. It is also an excellent source for historical time-series statistics which allow us to see patterns in the data and to develop hypotheses about the behaviour of actors in the food chain.

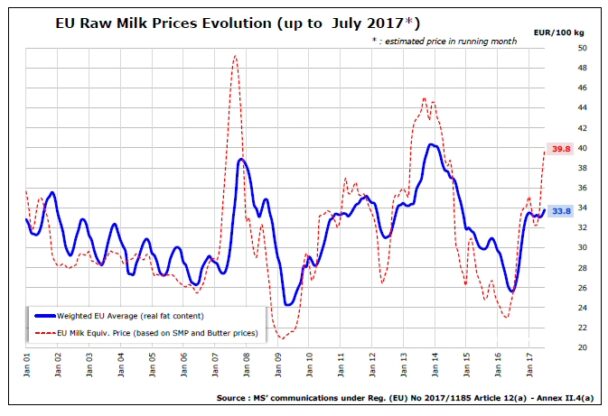

The chart below taken from the MMO shows the evolution of two indicators of producer prices for raw milk. One is the weighted average price that EU farmers received for raw milk at real fat and protein content (the ‘producer price’). The other is a hypothetical price, the farmgate milk price equivalent (FMPE), which is the price processors would be expected to pay based on the going market prices for butter and skimmed milk powder after deducting an average processing cost.

The producer price a farmer receives may be different from this hypothetical FMPE because of differences in actual fat and protein content from that assumed in the FMPE calculation, because actual processing costs may differ from those assumed in the calculation, and because much milk production is transformed into other types of dairy products which may have higher or lower value in the market place. These differences would explain differences in the level of these two price series over time. However, what I want to focus on in this post are the cyclical patterns in the two series and their significance.

First, there is the period up to around the middle of 2008 when producer prices show a pronounced seasonal pattern around a downward trend, and where the average level of producer prices seems a little higher than the FMPE level. Although the downward trend had set in since 2001, it was underpinned by the reductions in the intervention prices for dairy products (and the associated reductions in export subsidies paid on exports) which were announced in the 2003 Fischler Mid-Term Review CAP reform and introduced over the following four years.

Second, after 2008 EU dairy prices were linked to world market prices as variable export subsidies (which had acted as a buffer between the two markets) were eliminated. It is striking that prices were subject to very considerable volatility in the years after 2008 even though the quota system was in place. While the elimination of dairy quotas in April 2015 may have contributed to the prolongation of the period of low prices which began in 2014 (as I argue here, the more important reason for the collapse in prices was the production response to the record-high milk prices farmers were getting at the end of 2013), it was now clear that quotas were no longer a guarantor of milk price stability.

In fact, the peak to trough fall in milk prices by 38% between November 2007 and May 2009 (a period of 19 months) compares to a fall of 36% between December 2013 and July 2016 (a period of 31 months). Unfortunately, what should have been a wake-up call for the dairy industry went unheeded. Measures to protect farmers against this volatility were not introduced. Only much more recently do we see processors begin to introduce risk-sharing schemes and longer-term fixed price contracts and much more needs to be done in this regard.

Third, despite this criticism of processors, it is clear from the figure that processors have engaged in a considerable amount of price smoothing during this period. That is, when the FMPE (reflecting the prices processors receive on wholesale markets) begins to fall below trend, the producer price falls but with a lag and never to the full extent of the FMPE increase. On the other hand, when the FMPE begins to rise above trend, the producer price follows, again with a lag and never to the full extent of the FMPE increase. This can be interpreted as processors protecting producer prices during a downturn by cutting their margins, but siphoning off some of the gains in the good times to restore those margins. The July 2017 figures provide a good illustration of this process of restoring margins at work.

Fourth, just eyeballing the data seem to suggest that processor margins have tended to revert to a constant value over time. I do not have the raw data on the FMPE to confirm this (a suggestion here to the MMO to add this to its historical data series). But, if it is true, it has interesting implications for the debate on bargaining power and unfair practices in the food chain where the Commission is now seeking views in its public consultation on this issue.

Implications for dairy supply chain functioning

While the data cannot really be used to draw conclusions about the level of the absolute margins in the dairy industry, they do seem to support the hypothesis that, for dairy products, the fair value of the farm price is reflected back to dairy farmers based on the prices processors receive. For dairy products, these are now prices set in international markets. In this context, the focus on supermarket behaviour in setting prices seems to be exaggerated. Indeed, a criticism of the literature on EU market power and price transmission in the agrifood sector might be that there is excessive focus on the concentration of buying power within domestic EU markets, without taking into account that at least the larger processing firms may have outside options because of their ability to export.

I have long been of the view that the emphasis the farm organisations place on their poor bargaining power in the food chain as a source of low farm incomes is misplaced (some of my reasons are spelled out in this post). Conversely, I have no great expectations that any new initiative resulting from the Commission’s food supply chain initiative will make much difference to farm incomes in the long run.

This is not to say that market power does not exist in the food chain. Indeed, agribusiness input and food processing firms figure disproportionately in competition policy cases taken by the Commission for cartel and price-fixing behaviour. Consumers face search costs in local markets which may create local imperfect markets – in other words, even if prices increase in their local store, there are costs to checking comparable prices in other stores which may not be so conveniently located, giving the local store some market power.

Some of the unfair trading practices followed by supermarkets seem reprehensible and should be eliminated. And some sub-sectors within agriculture which are more reliant on domestic markets (e.g. liquid milk, some fruits and vegetables) may be more susceptible to market power exploitation than others. Dairy processing may also be exceptional because of the prominent role played by farmer-owned cooperatives in the EU.

There is also a limited academic literature suggesting the existence of asymmetric price transmission in the dairy supply chain (see this paper (working paper version here) by Tessa Serra and Barry Goodwin for the Spanish dairy market). It is clear (also from the figure) that prices are imperfectly transmitted along the supply chain. That is, a shock to prices at one level (say, the farm level) is not instantaneously passed through to wholesale and retail prices, as assuming perfect competition and zero profits would predict. There are good reasons for less than full pass-through apart from the existence of market power (for example, menu costs to changing prices, fixed-price contracts, the existence of stocks).

However, the argument about asymmetric price transmission goes further. The assertion is that, due to imperfect price transmission (especially caused by market power), a price reduction at the farm level is only slowly, and possibly not fully, transmitted through the supply chain. In contrast, price increases at the farm level are thought to be passed more quickly on to the final consumer. The implication is that the profit margins of the oligopolistic actors (those with the market power) will be higher than normal.

As I said at the outset, the data in this figure cannot really be used to say anything about the reasonableness of absolute margins in the dairy supply chain. However, they provide interesting evidence of the way processors smooth producer prices over the cycle. Eyeballing the data suggests a reasonably symmetrical response to price peaks and troughs, but formal statistical tests would be needed to confirm this. However, a reasonable hypothesis, at least for processed dairy products, on the evidence of this graph, is that farmers do seem to receive the fair market value for their milk. This does not rule out the possibility of market power further up the dairy supply chain, and particularly for more differentiated products.

Correction 14 Sept 2017: I have corrected the term Intervention Milk Price Equivalent in the original draft to the more correct Farmgate Milk Price Equivalent.

This post was written by Alan Matthews

Photo credit: Wikipedia, CC BY-SA 3.0

Europe's common agricultural policy is broken – let's fix it!