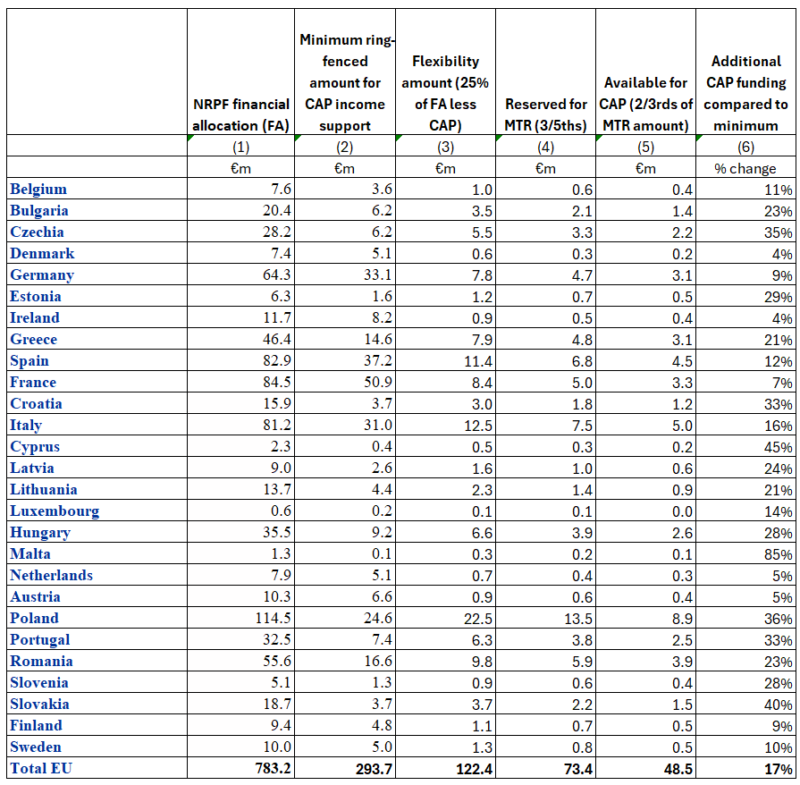

The figures in Table 1 have been slightly revised since the original post to calculate the flexibility amount as 25% of a country’s NRPF financial allocation less its minimum ring-fenced amount for CAP income support (from which the allocation for CAP investment supports for farmers and foresters should be deducted). In the original post I had based the calculation on the NRPF general allocation.

Commission President von der Leyen sent a letter to the Cypriot Presidency of the Council and to the President of the European Parliament yesterday 6 January 2026, in which she proposed to make additional resources available as of 2028 to address the needs of farmers and rural communities (with thanks to Politico Europe for the link).

This letter was sent on the same day as the Cyprus Presidency invited all Agriculture Ministers to a meeting also attended by the Commissioners for agriculture, trade and health to provide reassurances to Italy and other Member States to sign up to the contentious EU-Mercosur free trade agreement on Friday. The proposal in the letter would be a form of side-payment to bring the wavering countries on board.

The formal part of the proposal, in an annex to the letter, proposes to add a new sub-paragraph to Article 14 of the National and Regional Partnership Fund Regulation which sets out how the resources made available under the so-called General Allocation of the Fund can be used. Specifically, the following text would be added to Article 14.

“When submitting or amending its plan before the midterm review, Member States may use up to two thirds of the amount available for the midterm review for interventions referred to in Article 35(1) or for measures dedicated to rural areas.”

The flexibility amount

As this paragraph is pure legalese, I provide some context in this section. We first need to understand the notion of a flexibility amount. This is defined in Article 14(2) as money that is available to a Member State under its NRP Fund in the 2028-2034 period but which cannot be programmed immediately and which must be held in a flexibility reserve.

This flexibility amount is significant. It amounts to 25% of the financial allocation in the NRP Fund less an amount that is broadly the ring-fenced amount for CAP income support. The financial allocation is the sum of the NRPF general allocation plus the minimum ear-marked amount for migration, security and home affairs, as set out in Article 10(2)a of the NRPP Regulation.

In calculating the size of the flexibility amount, I say that the deduction from the NRP Fund financial allocation is broadly equivalent to the ring-fenced amount for CAP income support. This is because the amount that Member States allocate to investment support for farmers and foresters will be excluded when calculating the deduction and thus the size of the flexibility amount.

The use of the flexibility amount is strictly regulated in the NRP Regulation. One-fifth of the amount can be used by Member States to provide assistance in the case of natural disasters, adverse climatic events, and animal diseases in the first three years of the programming period 2028-2030.

Another three-fifths (plus any unused amount from the first fifth) is available for programming at the Mid-term Review which should be completed by 31 March 2031. While the Mid-term Review provides an opportunity for a Member State to revise its targets and instruments, the intention of the Commission is that the flexibility amount means that Member States will also have additional resources available to address any new challenges that might have arisen between agreement on the NRP Plan and 2031. Part of this reserve can be brought forward and used for programming at the request of a Member State “in duly justified and exceptional circumstances”.

This leaves the remaining fifth of the flexibility amount which can then be requested as of 2031, again to provide assistance in the event of crises. If there is still an unused amount as of June 2033, it can be made available at that point for programming for any amendment of the Plan.

Neither the general objectives for the NRP Fund (Article 2) nor its specific objectives (Article 3) specify that the Fund can be used to provide assistance for natural disasters or climatic crises, although this is provided for in Article 34 of the NRP Regulation.

The 45 billion euro question

Against this background, we can interpret the significance of the Commission proposal presented yesterday. The reference to Article 35(1) refers to the full list of CAP interventions and all are eligible for support.

The Commission has consistently presented the ring-fenced amount for CAP income support as a minimum amount, which Member States could add to from the unearmarked amounts in their NRP Fund allocations (minimum amounts are also earmarked for fisheries, less developed regions and for migration, security and home affairs). A big constraint on Member States being able to programme additional amounts for the CAP, apart from political battles within Member States on the priority to be given between the CAP and cohesion spending, is the Commission proposal to freeze the programming of the flexibility amounts until at the earliest the Mid-term Review.

The Commission proposal is that (a) two thirds of the flexibility amount reserved for the Mid-term Review can now be programmed from the start of the programming period but (b) only if this forwarded amount is used for CAP spending or for measures dedicated to rural areas. The attraction for Agriculture Ministers is that this not only unfreezes resources and makes them available for programming from the start of the programming period, but it locks in that these unearmarked resources have to be used for the CAP or rural areas.

Critics will correctly point out that this amount is not guaranteed additional spending. It does not increase the mandatory ring-fenced amount for CAP income support. But it will give Agriculture Ministers a stronger negotiating hand within their Member States. They will now be able to point out to their Finance Ministers that if the amount is drawn down immediately from the EU budget and used for the CAP or rural areas, the money becomes available to the Member State from 2028 instead of having to wait until 2031 to unfreeze these amounts. In addition, if 20 Member States decide to make use of the option but 8 do not (counting Belgium as 2), there will be significant additional pressure within the 8 countries to follow suit.

Any funding additional to the minimum ringfenced funding for the CAP will require national contributions from Member States depending on the appropriate co-financing rates set out for the specific type of region where the expenditure takes place. There are no requirements set on the types of CAP interventions that Member States can support with this additional funding. But as using these funds for cohesion or other objectives will require a similar level of co-financing, this is not in itself a disincentive to use this opportunity.

Given the lack of minimum ringfencing within the CAP budget for agri-environment-climate actions, a case could be made that additional funds made available for the CAP in this proposal should be confined to these environmental interventions. However, given the political purpose which this side- payment is intended to achieve, expecting this kind of fine-tuning was always going to be unrealistic.

The additional text proposed by the Commission allows the unfrozen flexibility amounts to also be used for measures dedicated to rural areas. To the extent that Member States favoured rural development measures, this would reduce the additional funding that would directly benefit farmers.

The CAP through its Pillar 2 always included measures designed to support rural development, including LEADER and rural business support schemes. In its November 2025 non-paper to the Parliament, the Commission had already proposed to amend the NRP Regulation to include a dedicated target for rural areas. It had proposed that at least 10% of the NRP Fund financial allocation (again after deducting the minimum amount for CAP income support) should be dedicated to rural areas, calculated by using the code 02 in the Performance Regulation. This refers to any expenditure that takes place in a rural area and is thus a much wider definition of rural development expenditure than traditionally associated with the CAP.

In this way, expenditure traditionally funded by cohesion policy can also be funded from the unfrozen flexibility amounts. This will please advocates of cohesion policy who otherwise have been dismayed by the apparent ability of farm groups to ‘jump the queue’ in accessing unearmarked resources under the NRP Fund. However, for the same reason, this broader remit for the use of the unfrozen resources may limit the extent to which farmers will benefit.

There is also a strong possibility that at least some of this additional CAP and rural area spending will not be additional. The minimum ringfenced amount for the CAP only refers to income support interventions. This term covers more than direct payments, it refers to all those payments (including investment aids) that are received by individual farmers. There are other CAP interventions, such as LEADER, support for knowledge sharing, and territorial and local cooperation initiatives, which are not counted as CAP income support. But the proposed CAP Regulation makes it mandatory for Member States to allocate funding to these interventions in their NRP Plans (in the case of territorial and cooperation initiatives, this only refers to EIP-AGRI operational groups). Funding these interventions will in any case require allocating money from the unearmarked amount in the NRP Fund.

One assumes, if these interventions are mandatory, they will have to be programmed from day one of the NRP Plans. So at least a portion of the unfrozen flexibility amount which can be brought forward is likely to be used to finance mandatory CAP interventions which would have to have been financed in any case. As a result, the net impact of the Commission proposal will be somewhat smaller than the headline amount.

A final element in the Commission proposal confirms that farmers will still be able to access the unprogrammed amounts in the Flexibility Amount for assistance in case of natural disasters, adverse climate events and animal diseases. The sums are substantial, amounting to 10% of the NRPF Fund financial allocation to each Member State less broadly the ringfenced amount for CAP income support.

Impacts will differ across Member States

If all Member States made use of this option in designing their NRP Plans, and if expenditure on rural areas were limited to interventions, such as LEADER, traditionally funded from the CAP budget, it would add a further €45 billion to the minimum CAP ringfenced budget of €293.7 billion, or an additional 15%. By highlighting also the doubling of the agricultural crisis reserve in the new Unity Safety Net, and as well the possibility of benefiting from borrowing under the Catalyst Europe fund (an option which I highlighted in my previous post on this blog), the Commission concludes that

“the combination of these policy and budgetary tools will provide the farmers and rural communities with an unprecedented level of support, in some respects even higher than in the current budget cycle...”.

However, there will be very different impacts across Member States (Table 1). In this table, I have calculated the maximum potential impact the Commission proposal would have on the CAP budget available per Member State. There is an extraordinarily consistent pattern. All recently-acceded countries would gain more than the EU average in additional spending (for example, Slovakia 40%, Poland 36%, Hungary 28%). On the other hand, all older Member States (except for Portugal and Greece) would receive a smaller increase in their CAP budgets compared to the EU average. While the increases for Italy (16%) and Spain (12%) are significant, the increases for France (7%), Austria (5%) and Ireland (4%) are hardly so.

From a Mercosur perspective, Giorgia Meloni handsomely succeeded in her objective to gain additional support for Italian farmers, while other major opponents (France, Austria and Ireland) fared less well.

Note: The flexibility amount is calculated as 25% of the difference between a country’s NRPF financial allocation and its minimum CAP ring-fenced amount for income support. This slightly underestimates the flexibility amount as CAP investment aids to farmers and foresters should be excluded from the CAP income support amounts that are deducted, but these allocations will not be known until the approval of the CAP chapters in the National Plans. The table assumes that all of the unfrozen flexibility amount will be used for CAP interventions rather than expenditure generally dedicated to rural areas.

Source: Commission Fact Sheet, Europe’s Budget Member States allocation, 2025

This post was written by Alan Matthews.

Update 7 Jan 2026. Add paragraph on possible substitution between the unfrozen flexibility amounts and mandatory non-CAP income support expenditure in the NRP Plans. Corrected €45 million to €45 billion.

Update 27 Jan 2026. I have corrected Table 2 to reflect that the 25% flexibility amount will be calculated based on the full NRP Fund financial allocation to Member States and not only its general allocation, less the relevant ring-fenced amounts for the CAP.

Photo credit: stevepb and used under a Pixabay content licence.

The Commission proposal undoubtedly contains some positive elements, particularly as regards the initial programming of National and Regional Partnership Plans (NRPPs) in relation to agriculture and rural areas. Allowing part of the flexibility amount to be mobilised from the start of the programming period may indeed facilitate more coherent planning and may help ease political tensions in the agricultural sector at an early stage.

That said, the substance of the proposal appears closer to a political and communicative manoeuvre than to a genuine strengthening of the CAP.

As stated in the President’s letter, “When submitting or amending its plan before the midterm review, Member States may use up to two thirds of the amount available for the midterm review for interventions referred to in Article 35(1) or for measures dedicated to rural areas.” The wording is crucial. The additional resources are not earmarked exclusively for CAP interventions under Article 35(1), but may equally be channelled to broader measures dedicated to rural areas, which do not necessarily fall within the CAP framework.

It is also difficult to overlook that the two thirds of the midterm review flexibility correspond to roughly €45 billion at EU level, an amount almost equivalent to the proposed rural target of €48.7 billion. In practice, the Commission is enabling the early mobilisation of already foreseen but unallocated resources, rather than introducing new funding.

Consequently, the CAP budget is not increased; the two amounts are not cumulative. Member States may use the unfrozen flexibility either to support CAP interventions or to meet the rural target within the NRPF through non-CAP measures. In the latter case, this would result in little or no real reinforcement of CAP interventions as such.

If the Commission’s intention were to genuinely rebalance spending priorities in favour of the CAP, a more targeted approach could be envisaged. One option would be to restrict the early use of these resources exclusively to CAP interventions as defined in Article 35 of the proposed Regulation. Without such a safeguard, the proposal risks remaining largely a re-labelling exercise, with limited substantive impact on CAP funding.

George, This is a very astute analysis and your logical analysis of the proposal is spot on. You are painting the worst possible outcome (from the agricultural perspective) by assuming that MSs will use the new flexibility around the flexibility amount more or less entirely for investments in rural areas to ensure they meet the 10% rural target. I suspect in practice this will not be the case. Take the example of Italy, which takes credit for pushing the Commission to make this proposal, on the basis that farmers needed more support in the light of ratification of the Mercosur FTA. Italy would look totally hypocritical if it did not programme its additional resources entirely for the CAP. It is clear many other MSs will do the same. You are correct that removing the option to use the unfrozen funding for rural areas would make that more certain, but that there will be a positive effect on the overall CAP budget I have no doubt. It could be that we would see an attempt to remove the option to spend on rural areas in the trilogues. Still, I suspect many MS governments will welcome the increased room for manoeuvre this additional flexibility gives to them. The downside, of course, is that the CAP becomes less common across MSs.

Thank you, Alan – I fully agree with your reasoning and I think you are absolutely right that, in practice, many Member States (Italy being the obvious example) will feel politically compelled to programme the unfrozen amounts primarily, if not entirely, for CAP interventions. Your point about the increased room for manoeuvre at national level, and the resulting risk of a less “common” CAP, is also very well taken.

The one point on which I am still not fully certain – and where I would be very interested in your view – concerns the relationship between the two amounts. Do you read the proposal as allowing these two envelopes to be cumulative, i.e. the roughly €45 bn from the early use of the mid-term review flexibility plus the €48.7 bn rural target? Or do you see them as essentially overlapping, with the unfrozen flexibility being usable to meet (part or all of) the rural target, rather than coming on top of it?

This distinction seems crucial for assessing whether we are looking at a genuine quantitative uplift, or primarily a re-timing and re-labelling of already foreseen resources.