Efforts to reduce greenhouse gas emissions in a single country will usually lead to increased emissions in other countries – a phenomenon called carbon leakage (for simplicity, I will use the term carbon leakage although the same outcome also applies to other greenhouse gases). Various mechanisms contribute to this effect:

- If climate policy increases production costs, this will reduce the competitiveness of domestic production relative to countries without or with a laxer climate policy. Consumers will shift their purchasing to the cheaper imported alternatives. The effect will be that some emissions-producing production will shift to third countries with the laxer climate policy – the competitiveness channel.

- If climate policy in a single country reduces consumption of fossil fuels (for example, through a carbon levy), this will lower the world market price of fossil fuels a little, which will encourage increased consumption in third countries – the fossil fuel channel.

- The institutional design of carbon policy can also influence carbon leakage. For example, the operation of the EU Emissions Trading System (ETS) has meant that if one EU country through effective climate policy reduces its demand for allowances, the price of allowances will fall sufficiently to ensure that these allowances are used in other EU countries, contributing to high leakage. The recent reform of Phase 4 of the ETS will help to reduce this leakage rate. Conversely, the fact that all EU countries have national reduction targets in the non-ETS sector will help to reduce carbon leakage. To the extent that signatories to the Paris Climate Agreement in their nationally-determined contributions (NDCs) have set a ceiling on future emissions, this will also help to reduce carbon leakage – the policy design channel.

- Climate policy can have an incentive effect on the willingness of third countries to also increase their mitigation efforts, which may be either negative or positive. There could be a negative incentive effect if more ambitious reduction targets in the EU lead other countries to sit back and take it easier. Or the incentive effect could be positive if other countries are inspired or obliged (for example, by inserting climate clauses in trade agreements) to also increase their level of ambition – the incentive channel.

- Finally, carbon leakage can be influenced by technology spillovers. If the EU adopts an ambitious climate target this will incentivise and speed up the development of low- or zero-emissions technologies. Once developed, these technologies can then be used by other countries to reduce their emissions in turn – the technology spillover channel.

The importance of these leakage effects can be measured using an indicator called the leakage rate. The leakage rate expresses how much of a reduction in domestic emissions is replaced by emissions in third countries. If climate policy reduces domestic emissions by 10 tonnes of carbon dioxide equivalent (CO2eq) and emissions increase by 3 tonnes CO2eq in third countries, the leakage rate is 30%. How big the leakage rate is will depend on factors such as the openness of the economy, the policy instrument used to reduce emissions, and the extent of the reduction ambition.

Leakage rates will differ across sectors. High leakage rates will be associated with sectors:

- with a higher emissions intensity per euro of output or gross value added because these sectors will experience a greater increase in production costs, other things equal;

- which are more exposed to international competition making it easier to substitute domestic production by imports, thus making it more difficult to pass through a higher carbon cost to consumers;

- which have fewer technological options to switch to lower-emissions technologies;

- and where the emissions intensity of production in third countries is higher than for domestic production.

In this post I examine the phenomenon of carbon leakage in the agricultural sector as a result of climate policy, review some estimates of its size and discuss its significance for agriculture’s role in climate mitigation policy.

Danish Environmental Economics Council study 2019

A recent study by the Danish Environmental Economic Council attempts to calculate the size of leakage effects by sector for the Danish economy, taking into account the specific design of EU climate policy.

For the technically minded, the calculations were done with a modified version of the GTAP-E model. One important extension was to include emissions of methane and nitrous oxide as well as carbon dioxide in order to be able to include agriculture in the calculations. The model was also adjusted to take account of EU climate policy instruments including the ETS and national non-ETS sector targets as well as emissions ceilings in other countries arising from the Paris Agreement.

Scenarios. The study first calculates an economy-wide leakage rate by applying a uniform levy of DKK 100 on each tonne of COeq emitted by households, the public sector and economic sectors. For agricultural emissions, the levy is calculated on the basis of average emissions from crop and animal production. In the case of animal production it is assumed that emissions reductions can only take place through a reduction in activity. To the extent that this proves too extreme and emissions can be reduced through a change in inputs, the fall in production and thus the leakage rate in this simulation will be overstated.

Results. The simulation shows that for the economy as a whole a reduction of 4.5 million tonnes CO2eq would be offset by an increase in emissions in other EU countries equal to 2.3 million tonnes CO2eq with roughly unchanged emissions in third countries, resulting in an overall leakage rate of 52%. The leakage rate is due to the substitution of production in countries outside Denmark for Danish production as well as the fact that the emissions intensity of non-Danish production is on average higher.

The story for Danish agriculture is somewhat different. Here the leakage rate is calculated to be 75% as against 52% for the economy as a whole. This higher leakage rate is due to three factors.

First, consumption of food products both in Denmark and elsewhere is relatively insensitive to changes in prices and income, so a reduction in Danish production results in a similar corresponding increase in imports.

Second, there is a relatively larger fall in Danish agricultural production because of the limited ability to reduce emissions by altering input use through technological substitution.

Third, because further increases in agricultural production in other EU countries is assumed to be limited by each country’s national non-ETS sector targets, most of this increase in production will come from third countries outside the EU. Crop production in Denmark is estimated to be a little more emissions-intensive than in the rest of the EU, while animal production is a little less emissions-intensive. The emissions intensity of crop production in third countries outside the EU is estimated to be roughly similar to Denmark, while the emissions intensity of animal production is calculated to be twice as high. Because much of the reduction in Danish agriculture takes place in animal production, the leakage due to the substitution of production in Denmark by imports from third countries outside the EU is further exacerbated by the higher emissions intensity of imported products. 31 percentage points of the leakage rate of 75% is due to the lower carbon efficiency of imported agricultural products.

An annex in an accompanying document note (p. 74, only in Danish) provides a decomposition of this leakage rate, distinguishing between direct and indirect effects. The direct effect represents the change in agricultural emissions in other countries compared to the change in emissions from the agricultural sector in Denmark. This is calculated to be 122 kg CO2eq increase in agricultural emissions in other countries for every reduction of 100 kg CO2eq agricultural emissions in Denmark.

This leakage rate of 112% is reduced to 75% because of indirect or general equilibrium effects. The release of production factors from Danish agriculture, by altering the relative prices of land, labour and capital, will lead to further changes in the production structure of the Danish non-agricultural sector which will, in this case, lead to a further reduction in emissions in Denmark. A similar restructuring of non-agricultural production will also take place in other countries as resources are pulled into their agricultural sectors. By reducing non-agricultural emissions this general equilibrium effect offsets some of the increased emissions from agriculture in other countries.

A sensitivity analysis shows that the leakage rate for the agricultural sector would be greatly reduced (more than halved) if the Paris Agreement were to result in binding national ceilings in many third countries outside the EU (the simulation assumes binding targets for all countries except the large economies of China, India, Russia and US). However, there will be scepticism around the binding nature of the Paris Agreement NDCs until they have begun to show their worth.

There is one important qualification to these results. The study assumes that Denmark is the only country that implements a climate policy, by implementing a levy on CO2eq emissions of DKK 100 per tonne. Other EU countries are assumed to have binding non-ETS sector targets such that their emissions cannot increase. This limits their ability to increase production in response to lower production in Denmark, but there is no attempt made to model similar climate policies in other EU countries as in Denmark. Coordinated action by a group of countries to limit GHG emissions would reduce the leakage rate for any one of them, unless the supply response in third countries is perfectly elastic which will not be the case.

We cannot be sure how the non-ETS climate targets in other EU countries will specifically affect agricultural production, as there are no national targets for reductions in agricultural emissions in EU climate policy. However, to the extent that EU climate policy leads to adjustments in agricultural production across the EU and not just in an individual Member State, the leakage rate for that Member State will be reduced.

ECAMPA 2 2016 study

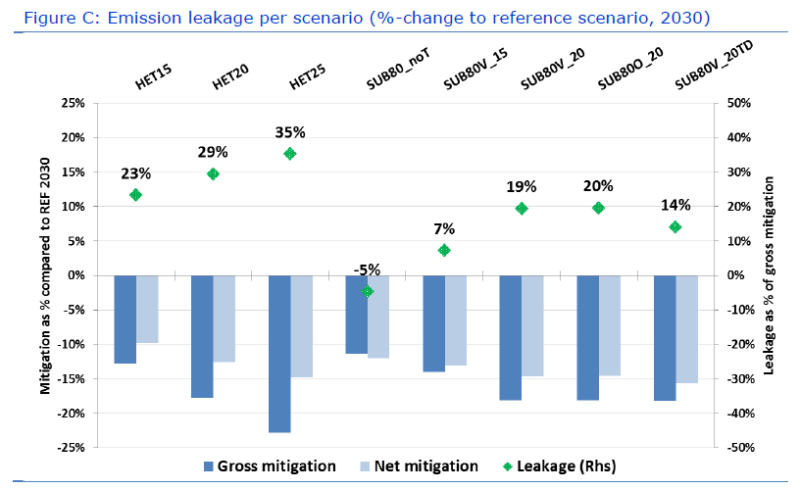

These Danish results can be compared to the leakage rates estimated in the ECAMPA 2 study conducted by the Joint Research Centre (JRC) for the European Commission shown in the figure below. Some important differences between the two studies should be noted. The Danish study is based on a computable general equilibrium model, GTAP, while the JRC study is based on a partial equilibrium model, CAPRI. The JRC study adopts specific mitigation targets for agriculture and models the appropriate levy rate endogenously. The Danish study chooses a levy rate which leads to a relatively low reduction in agricultural emissions (-5% compared to the 15-25% reductions assessed in the JRC study). The JRC study includes some mitigation technologies for animal agriculture, in contrast to the Danish study which links emissions to the level of output solely. Finally, the JRC study simulates mitigation reductions in all EU countries simultaneously, while the Danish study only considers national reductions in Denmark. It is probable that the emissions intensities assumed for crop and animal production both in EU and non-EU countries also differ as different databases are used.

Several scenarios were evaluated in the ECAMPA 2 study.

- Three scenarios (HET15, HET20 and HET25) which have a compulsory mitigation target for EU agriculture of 15%, 20% and 25%, respectively, distributed across Member States according to cost effectiveness and assuming restricted potential of mitigation technologies.

- Two scenarios (SUB80V_15, SUB80V_20) which have a compulsory mitigation target for EU agriculture of 15% and 20%, respectively, distributed across Member States according to cost effectiveness, assuming restricted potential of mitigation technologies and with an 80% subsidy for the voluntary adoption of mitigation technologies.

- One scenario (SUB80V_20TD) with a 20% mitigation target, an 80% subsidy for the voluntary adoption of mitigation technologies and ‘unrestricted’ potential of the mitigation technologies (i.e. more rapid technological development).

- One scenario (SUB80O_20) with a 20% mitigation target and an 80% subsidy for the mandatory adoption of selected mitigation technologies and for the voluntary adoption of the remaining technologies.

- One scenario (SUB80V_noT) with no specific mitigation target for EU agriculture but with an 80% subsidy for the voluntary adoption of mitigation technologies.

The leakage rate for the various scenarios as calculated for the year 2030 is shown in the figure above. For the scenarios without subsidies, the leakage rate increases with the ambition of the mitigation target. With higher mitigation targets, more of the emissions reduction takes place by reducing production.

Using subsidies to offset most of the cost of adopting mitigation technologies reduces the leakage rate considerably because now EU farmers mitigate more emissions via the use of technologies rather than by reducing production. Indeed, subsidising the adoption of mitigation technologies alone could even lead to a negative leakage rate (scenario SUB80V_noT, shown as SUB80_noT in the figure) because some assumed mitigation technologies (e.g. breeding programmes) have a positive effect on production efficiency, leading to production increases and the replacement of non-EU production with a higher emissions intensity by EU production exported.

The ECAMPA 2 study also reviews how the leakage rate is affected by assumptions regarding the rate of improvement of emissions intensities in non-EU countries. The assumption behind the leakage rates reported above is that emissions intensities in non-EU countries would continue to grow at their trend rate. This is facilitated by the technology spillover mechanism identified at the outset of this post. If there were no further improvement in emissions intensities in non-EU countries, then not surprisingly the leakage rate would increase by between 9 and 15 percentage points depending on the ambition level of the mitigation target. Most of the emission leakage happens because of trade in meat products (this aspect is further elaborated in this 2016 paper by Barreiro-Hurle and others from the JRC team).

These studies come to very different conclusions regarding the size of the leakage rate (I am not aware of other studies that specifically calculate leakage rates for agriculture but please email me if I have overlooked one). The lower rates in the ECAMPA 2 study may reflect different assumptions regarding the relative emissions intensity of EU and non-EU production, the fact that it includes some emissions-reducing technology options for animal agriculture, or the fact that it assumes a coordinated effort by all EU countries together rather than by one country alone. Generally, leakage rates calculated for specific sectors are in the range 5%-30% in the economic literature, so these studies support the view that leakage rates are likely to be higher in agriculture than in other sectors.

These studies assume that efforts are made to reduce emissions from agricultural production. Some argue instead that the focus should be on reducing consumption of emissions-intensive foods and particularly red meat. Consumers are urged to adopt vegetarian or vegan diets or at least to eat less meat in order to reduce their climate footprint, and some suggest a tax on meat consumption to accelerate this trend.

Reduced meat consumption from its current high levels in the EU would help to lower emissions from the food system (and would also contribute to improved health outcomes). But also here there will be a carbon leakage effect so that reduced emissions in the EU will be partially offset by increased emissions outside the EU. This will be due to the fossil fuel channel identified at the outset although now initiated by a reduction in meat consumption rather than fossil fuel use.

Reduced meat consumption in the EU will lead either to lower imports or increased meat exports, and in either case will tend to lower world market prices. These lower world market prices will give an incentive to increase meat consumption in non-EU countries, thus partially offsetting the reduction in emissions within the EU.

A recent paper (Zech and Schneider 2019) quantifies this effect and calculates that 43% of the reduction in greenhouse gas emissions inside the EU would be offset by emissions leakage. They calculate that increased EU net exports would in fact offset 70% of the demand reduction. But because these increased EU net exports would in part offset some non-EU production which has a higher emissions intensity, the overall leakage rate is reduced to 43%.

Conclusions

If we are only interested in reducing emissions on the national territory, then the phenomenon of carbon leakage is irrelevant as we are not interested in what happens to emissions in the rest of the world. If, however, we want to lower global emissions as well as national emissions, then it makes sense to take leakage rates into account when designing national climate policy. All other things equal, sectors with a relatively higher leakage rate should be treated more leniently either when setting domestic emission reduction targets by sector or when implementing national climate policy instruments such as a carbon levy or in setting regulatory standards.

A more lenient approach for agriculture but not exemption. As we have seen, the limited evidence suggests that EU agriculture has a higher leakage rate than other sectors, which would support a more lenient approach to agricultural emissions when determining national climate policies in the EU. However, a more lenient approach is not the same as exempting the agricultural sector from making a contribution to emissions reduction.

First, although the leakage rate may be high, there is no empirical evidence that it is greater than 100% so there is still a reduction in global emissions as well as in national emissions when agricultural emissions are reduced. This is an important finding, as it is sometimes argued that reducing agricultural emissions in Europe will lead to an increase in global emissions because of the higher emissions intensity of production outside Europe. At least in the studies reviewed in this post, this is not the case (although the Danish study found a leakage rate of 112% if only the direct effects comparing the change in agricultural emissions alone inside and outside Denmark are considered).

Second, exempting sensitive sectors completely can be very expensive. This is because the burden of emissions reduction is increased on the non-sensitive sectors where the cheapest reductions have already taken place, while one foregoes relatively cheap reduction possibilities in the sensitive sectors.

Third, reducing emissions from agricultural production has other positive benefits for society, notably from a reduction in ammonia emissions (leading to improved air quality) and a reduction in nitrate emissions (leading to improved water quality). The Danish Environmental Economics Council report notes that, in the Danish case, one would achieve must of the optimal reduction in agricultural GHG emissions simply by living up to the targets for reduced nitrogen leaching from agriculture. If co-benefits are considered when assessing agricultural mitigation potential, they should also be considered for all relevant alternatives.

Finally, EU Member States must weigh up the effects of carbon leakage against their economic interests. Countries that fail to meet their non-ETS targets from domestic emission reductions must purchase emission allowances from other Member States or face a Commission fine. Where the production that is lost is worth less in terms of profit than the cost of buying additional emission units Member States have an economic incentive to accept the loss of production. If emission obligations are not devolved this cost is borne by taxpayers as a fiscal cost.

Addressing leakage effects. The other approach that Member States can adopt is to attempt to reduce the leakage rate. Here there are five approaches.

Global coverage of emission reductions. Leakage can only occur if production can move off-shore in response to the introduction of national climate policy measures. Leakage can be avoided or reduced if the main competitor countries have also signed up to binding emission limits. Thus it should be a priority for EU policy to strengthen the commitment to strict implementation of pledges to limit and reduce emissions under the Paris Agreement. The access offered to the EU market when entering into free trade agreements with third countries should be used to this end.

Encourage innovation on less emission-intensive technologies. Carbon leakage arises when production is reduced in order to meet emissions reduction targets. One reason for the high leakage rate in agriculture is the lack of relatively cheap low-emission alternatives particularly but not only in animal agriculture. Innovation to develop low-cost technologies that can help to lower emissions without reducing production should be a priority.

Border carbon adjustments. Border carbon adjustments can neutralise leakage effects that occur through trade though not with 100% effectiveness. Perfectly targeted CO2eq import taxes (or some equivalent mechanism that would require importers to purchase a corresponding amount of emissions allowances) would be based on the precise CO2eq footprint of each individual imported good, including indirect emissions from relevant inputs into its production, while any CO2eq levies paid would be rebated for exports. Practical systems will of necessity be blunter, for example, by only levying or rebating the emissions directly associated with the good’s production. However, although widely proposed, no country has yet adopted them, either due to the practical difficulties involved or because of legal uncertainty whether they are compatible with WTO trade rules.

Free allocation of allowances based on benchmarks. This is the approach used in the EU Emissions Trading System to avoid carbon leakage for manufacturing industry. While normally the allowances that manufacturing firms must acquire to be able to emit greenhouse gases are auctioned, free allowances are given to industries on the Carbon Leakage List as defined under the relevant legislation.

In the past, industries (defined at the NACE 4-digit level or sometimes lower) were added to the Leakage List if they could show they fulfilled certain criteria related to openness and emissions intensity. Either the direct and indirect costs of acquiring allowances (at a price assumed to be €30 per allowance) increased production costs by at least 5% of gross value added and trade intensity (calculated as the value of imports plus exports over annual turnover plus imports) is over 10%, or direct and indirect costs increased production costs by at least 30%; or trade intensity is over 30%. The proportion of free allowances in the total is capped at 43%; if the demand for free allowances exceeds the cap, then the allocation of free allowances to individual industries on the Leakage List is proportionately reduced.

In the amendments to the ETS legislation adopted last year (Phase 4), the criteria to be added to the Leakage List are amended to showing that an industry exceeds a specific threshold resulting from the product of multiplying their intensity of trade with third countries by their emission intensity, measured in kgCO2 divided by their gross value added (in euros). Where this product exceeds 0.2, an industry will be deemed to be at risk of carbon leakage and will be eligible for up to 100% free allowances. Where this product exceeds 0.15, an industry can receive up to 30% free allowances. The free allowances allocated are based on each firm’s output based on benchmarks derived from the 10% most efficient installations. One estimate is that manufacturing sectors on the Carbon Leakage List currently account for 97% of EU industrial emissions, and this might decrease to 90% under the new criteria (EPRS 2018). Most food processing industries are included on the Carbon Leakage List. In lobbying around the post-2020 ETS (Phase 4), COPA-COGECA along with FoodDrinkEurope and the Primary Food Processors associations stressed the importance of continuing free allowances to these sectors.

Revenue recycling. This is yet another way to reduce carbon leakage rates but is only relevant if a carbon levy is an instrument used to reduce agricultural emissions. The revenue yield from a carbon levy on agriculture would be returned to the agricultural sector. This could be done in various ways, for example, as a top-up to a farmer’s basic payment, or to subsidise the adoption of emissions-reducing technologies. The impact of the latter approach in reducing leakage rates is clearly shown in the ECAMPA 2 study.

In summary, carbon leakage complicates the design of climate policy to reduce agricultural emissions. Agriculture appears to be a sector vulnerable to relatively high leakage rates. This argues in favour of a more lenient approach to reducing agricultural emissions to the extent that Member States take account of the effect of their policies on global emissions and not only emissions on their national territory.

However, given that special treatment to any one sector raises the overall cost of the transition to a net-zero emissions economy by 2050, it is important that Member States simultaneously pursue ways of reducing carbon leakage in agriculture using one or several of the instruments just discussed. To the extent that leakage rates in agriculture can be brought more into line with those in the other economic sectors in the non-ETS sector, the case for special treatment is reduced. The need for a continuous evaluation of leakage rates across a wider range of EU economies is clear.

Update 7 May 2019: The post was edited to make clear that the overall leakage rate of 75% for Danish agriculture calculated in the Danish study included general equilibrium effects. If only direct effects comparing the the change in agricultural emissions inside and outside Denmark are considered, the leakage rate is calculated to be 112% – h/t LJ.

This post was written by Alan Matthews

Dear Alan, thank you for this very informative and timely post. I agree that carbon leakage is often used as an argument to prevent emission reduction in one’s own sector. But I wonder if the problem of carbon leakage is overstated. Carbon leakage is only relevant in two cases: (1) Emissions leak to a country outside the Paris-agreement, (2) Emissions leak to a sector outside the Paris-agreement (e.g., international air traffic). In all other cases, carbon leakage is irrelevant in my view, because countries have to fulfill their committments. If one country increases its exports due to carbon leakage in another country, the former country just has to achieve additional emission cuts elsewhere.

A more lenient approach to agriculture, however, can be supported for a different reason: Many mitigation options are not fully reflected in national inventory calculation methods. Even if emissions were reduced in the ‘real world’, they don’t help countries to fulfill their commitments.

It may also be the case that mitigation options are more costly in agriculture compared to other non-ETS sectors. That is at least true for Norway. Applying a carbon tax across non-ETS sectors should be sufficient to achieve a country-specific allocation of emission reductions between those sectors that minimizes social costs.

@Klaus

In an ideal world, these arguments are absolutely correct. But many NDCs submitted to the UNFCCC are vague, they do not necessarily set absolute limits but often talk about reductions from some unspecified future level, the US may well withdraw, and there is doubt about whether peer pressure will be enough to ensure adherence to any pledges that are made. Perhaps most telling, the EU legislation for the ETS post-2020 continues to make provision for free allocation of allowances to manufacturing sectors deemed at risk from carbon leakage, suggesting the EU believes leakage will continue to be a problem after 2020 despite Paris Agreement. Unfortunately, I think this also makes it relevant when discussing reductions in agricultural emissions.