On 17 July last week the EU and Brazil, supported by Columbia, Peru and Uruguay, put forward a proposal at the WTO in Geneva in an effort to build momentum to reach agreement on revisions to agricultural domestic support disciplines and on a resolution of the public stockholding issue at the upcoming WTO Ministerial Council meeting in Buenos Aires in December (I will refer to this as the EU-Brazil proposal in what follows). This follows a similar joint initiative by these two WTO members to eliminate export subsidies in the run-up to the last WTO Ministerial Council meeting in Nairobi in December 2015, which resulted in the Nairobi Ministerial Decision on Export Competition. What is the prospect that last week’s proposal might meet with similar success?

The negotiating context

At the end of last year in November 2016 Ambassador Vangelis Vitalis provided an overview of the state of play of the agriculture negotiations at a meeting of the Committee on Agriculture in Special Session (CoA-SS) . Since then, there have been further proposals made for a negotiating outcome in Buenos Aires. At the most recent CoA-SS meeting in June 2017, the new Chair of the Agriculture Committee Kenyan Ambassador Stephen Ndung’u Karau noted that there was “near universal support among the membership for an outcome on domestic support”.

The EU-Brazil proposal follows on earlier proposals on domestic support disciplines from the Least Developed Countries, the ACP Group, and the Cairns Group of agricultural exporting countries. A further proposal from New Zealand, Australia, Canada and Paraguay on domestic support was published on the same day as the EU-Brazil one. This Bridges article provides a good summary of the state of play of these discussions at the present time.

There is an unfortunate tradition in WTO to keep negotiating documents restricted, which means that we have to rely on journalistic reports for details of some of these proposals. The screenshot below shows just a proportion of the negotiating proposals made in recent months. In most cases the links to the proposals are greyed out, meaning that access is restricted. In this screenshot, only the New Zealand proposal, shown in blue, is publicly available. Other WTO members, including the EU, make their proposals publicly available on their own websites. WTO members should realise that many stakeholders will be affected by their proposals and that the public has a legitimate right to know what exactly is under discussion. Hopefully, transparency will improve as we approach closer to the Buenos Aires Ministerial Conference.

While disciplines on domestic support have attracted the greatest attention, proposals have also been made in other areas of the agricultural negotiations, including market access, a special safeguard mechanism for developing countries, export competition, cotton, export restrictions, and public stock-holding. In particular, there is a commitment arising from the Nairobi ministerial decision to make all concerted efforts to agree and adopt a permanent solution to the public stockholding issue by the Buenos Aires Ministerial Conference in December 2017. The EU-Brazil proposal links the domestic support and public stock-holding issues, while also making a brief reference to the cotton issue.

The EU Brazil proposal on domestic support

The EU Brazil proposal for new domestic support disciplines provides for two alternatives:

A) Developed Members shall not provide trade distorting domestic support in excess of [X%] of the total value of agricultural production as of [2018], while developing Members shall not provide trade distorting domestic support in excess of [X+2%] of the total value of agricultural production as of [2022]. This paragraph shall not apply to least developed Members. Members whose average notified trade-distorting domestic support during the 2013-2015 was above [X%] of the total value of domestic production would have up to an additional [five] years to implement the commitment.

OR

B) Developed Members shall not provide trade distorting domestic support in excess of [X%] of the total value of agricultural production as of [2018], while Developing Members shall not provide trade-distorting domestic support in excess of [X%] as of [XXXX]. From [2022] until [XXXX], developing Members shall not provide trade-distorting domestic support in excess of [X+Y%] of the total value of agricultural production. This paragraph shall not apply to least developed Members. Members whose average notified trade-distorting domestic support during the 2013-2015 was above [X%] of the total value of domestic production would have up to an additional [five] years to implement the commitment.

The two alternatives differ with respect to how special and differential treatment of developing countries would be recognised. Under proposal A, developing countries would have a permanent right to a higher limit on trade-distorting domestic support of 2 percentage points. Under proposal B, developing countries would only be allowed a higher limit for a transitional period, following which they would be expected to adhere to the same limit as developed countries. Under both alternatives, least developed countries would not be subject to any limit.

The proposal has a number of other elements:

1. Trade-distorting domestic support is defined as domestic support referred to in Article 6.3 (a country’s Current Total Aggregate Measurement of Support, or support included in the Amber Box), Article 6.4 (product and non-product-specific support exempted under de minimis limits or thresholds) and Article 6.5 (Blue Box support). However, the intention is that Blue Box support would be accounted differently than Amber Box support on the grounds that it does not have the same trade-distorting effect. It is left to further negotiations to define precisely how this might be done, taking into account the need for adequate transitional periods and the efforts already made by countries using the Blue Box to move away from the more trade-distorting Amber Box support. This is thus a variant of the Overall Trade Distorting Support (OTDS) concept first introduced in the 2008 Doha Development Round draft modalities circulated by Ambassador Crawford Falconer at the time.

2. Existing disciplines on domestic support in the Agreement on Agriculture (AoA) would be maintained. Specifically, there is no change proposed to Article 6.2 which allows developing countries to exempt investment subsidies generally available as well as input subsidies generally available to low-income or resource-poor producers from inclusion in their Aggregate Measurement of Support. Nor is any change proposed to Annex 2 which sets out the Green Box measures which are not subject to reduction. Nor is there any proposal to limit the ability of Members with a Bound Total Aggregate Measurement of Support (BTAMS) to direct this support disproportionately to a limited number of sensitive products.

3. The limits on trade-distorting support are set as a percent of the value of a Member’s agricultural production. These limits would thus vary as the underlying value of agricultural production changed, and most likely increased, over time. The value of agricultural production would be calculated for the three most recent years for which domestic support notifications have been submitted and examined by the Committee on Agriculture, although Members would be invited to submit updated values of production on an annual basis to the WTO Secretariat. On the assumption that the value of agricultural production will tend to increase over time, this can be seen as an incentive to countries to maintain their notifications up to date, as otherwise their limit on trade-distorting support might be lower than it otherwise could be.

Evaluation of the EU-Brazil proposal on domestic support

The EU-Brazil proposal differs in some significant ways from the OTDS discipline proposal included in Rev 4 of the 2008 modalities. Highlighting these differences provides one way to assess the significance of the latest proposal.

The Rev 4 approach. In the Rev 4 proposal, the OTDS concept is defined as comprising Amber Box, de minimis and a measure of Blue Box support. Each Member’s OTDS limit would be established taking as a base the sum of its Bound Total Aggregate Measurement of Support (BTAMS), de minimis limits based on a percentage of the average total value of production in a base period, and an allowed Blue Box amount (where the latter could be either the higher of average Blue Box payments notified in a base period or 5% of the average total value of production). This base level would then be reduced by a tiered formula, according to which those Members with the highest (absolute) amounts of Base OTDS would be asked to make the largest percentage reductions.

There are four things to note about this Rev 4 approach. First, Blue Box support (or an allowance for it) is treated symmetrically with the two other forms of trade-distorting support, Amber Box and de minimis. Second, the Base OTDS and the maximum limit following the application of the tiered reduction coefficient would be a fixed amount; it would not vary over time with changes in the average total value of production, for example. Third, the tiered reduction coefficient approach would lead to a convergence in the amounts of trade-distorting support that different Members could use, but it would not alter the ranking. That is, countries that had made most use of trade-distorting support in the past would still be ‘rewarded’ for sinning because they could continue to make more use of trade-distorting support in the future. For developing countries, most of whom are limited to de minimis limits of trade-distorting support, this has always (and understandably) been a sore point. But fourth, under Rev 4, countries without a BTAMS (the great majority of developing countries) would not be asked to make any cuts in their Base OTDS. Reductions in the Base OTDS in Rev 4 applied only to developed countries and those few developing countries which had a BTAMS limit.

The EU-Brazil proposal in comparison. The EU-Brazil proposal differs from this in a number of ways. First, Blue Box support would be ‘discounted’ and presumably included at less than a ‘one-for-one’ conversion when added to the other two types of trade-distorting support. As the Blue Box is predominantly used by developed countries, this might be seen as a concession to these countries. Because the Blue Box comprises payments made under production-limiting programmes, it is often assumed it has limited interest for developing countries. However, some developed countries have notified programmes in the Blue Box where payments are limited (e.g. to a fixed area or a fixed number of animals) but not necessarily production (meaning that farmers can increase the number of hectares planted or the number of animals kept but do not receive support for numbers beyond the fixed payment limits). It is possible that this interpretation of Blue Box payments, if not challenged, could well be of interest to developing countries too in the future.

Second, the OTDS ceiling would be based on a tiered formula linked to the average total value of agricultural production. This is a very welcome break from previous approaches to setting disciplines in the AoA based on historic levels of support. Invariably, taking historic levels of support as the baseline benefits those Members which have had the most trade-distorting levels of support in the past. It rewards the sinners while penalising the virtuous. In their proposal for this new OTDS limit, the EU and Brazil get away from historic baselines. The limits are based solely on a Member’s total value of agricultural production and a percentage figure which, in alternative A, is higher for developing countries (and infinite for the least developed countries).

Admittedly, under alternative B, the higher percentage figure would only be available for a transitional period. However, under both alternatives, developing countries would still have the right to exempt investment supports and input subsidies under specified conditions from inclusion in their OTDS so arguably, the preference in using trade-distorting domestic support in favour of developing countries is maintained even under alternative B. Of course, whether this notional entitlement to OTDS can be used or not depends both on the value of X% in the formula above as well as on the binding nature of the existing disciplines developing countries have accepted under the AoA. We return to this issue in the second half of the post.

There may also be an argument over whether the average total value of agricultural production is the best indicator of a country’s ‘need’ for trade-distorting support. One could envisage arguments being made that this indicator should be weighted differently depending on whether a Member is a food importer or a food exporter, or depending on the number of farmers engaged in producing that value of output, or whether a country is land-locked or not, and not solely based on its development status. If the EU-Brazil proposal gains traction in the negotiations, we should expect to hear an increasing number of arguments along these lines.

Third, the limit on future OTDS support would be a moveable feast, as it is based on the total value of agricultural production which would be expected to change (most likely, increase) over time. This change from the Rev 4 proposal has been sharply criticised by New Zealand and its allies in its domestic support proposal published at the same time as the EU-Brazil one. They estimate that the total value of agricultural production is currently increasing by 10% per annum on average for major Members. They argue that a fixed monetary cap rather than a floating one would provide a more meaningful incentive for countries to move away from trade-distorting support, as well as providing greater certainty for traders than a ceiling whose value would essentially be unknown from year to year.

Fourth, in Rev 4, we noted that most developing countries would not be asked to make additional reductions in trade-distorting support because the Base OTDS limit was already higher than their existing entitlements under the AoA (because of the inclusion of the additional 5% Blue Box allowance) and because developing countries without a BTAMS limit were not asked to reduce their Base OTDS limit. Whether some developing countries might find the EU-Brazil an additional constraint on their entitlement to use trade-distorting supports as compared to their existing rights under the AoA would depend entirely on the value chosen for X% in the EU-Brazil proposal and on whether there was agreement to use a fixed rather than a floating value for the total value of agricultural production.

For example, using a value of 20% (or even 18% in alternative A) for X% in the EU-Brazil proposal plus a floating value for the total value of agricultural production would not constrain those developing countries without a BTAMS from making full use of their de minimis limits under the AoA. In this context, I find the choice of 2% as the special and differential treatment coefficient in alternative A an unusual number and hard to understand in terms of balancing the severity of the obligation for different groups of WTO Members. It would be good to learn more from the proponents what they had in mind when choosing this number.

The EU-Brazil proposal on public stockholding

I have noted that one of the positive features of the EU-Brazil proposal for a new discipline on OTDS is that it starts from a principle that countries should have equal limits on trade-distorting domestic support differentiated only by development status, rather than have entitlements earned by historic use of policies that are damaging to other WTO Members. However, the proposal insists that Members should also continue to respect the existing limits on the provision of domestic support set out in the AoA, which implies respecting limits that many developing countries find discriminatory and objectionable. However, it is necessary to read the EU-Brazil proposal on domestic support along with, and in the light of, its proposal on public stockholding.

The debate around public stockholding rules in the WTO is often (and sometimes, wilfully) misinterpreted. To be clear, there is nothing in the WTO AoA rules which prevents developing countries from building and managing public stocks for food security purposes. Where, however, governments purchase supplies for public stocks at administered prices, then the difference between the acquisition price and the external reference price must be accounted for in the AMS. It is the use of public stockholding policies to provide price support to producers, rather than to provide subsidised food to consumers, which is the issue.

Because of the way world market prices have evolved (and thus, domestic market prices which have followed them) since 1986-88 when the fixed external reference prices were established, developing countries can find themselves reporting positive market price support when notifying their AMS figures to the WTO even though, in practice, their policies may not provide any economic price support to their farmers. Some developing countries, not surprisingly, believe this approach to calculating their WTO obligations is unfair and unreasonable. Concessions on exempting price support provided through public stock-holding programmes have been put forward, principally by India but supported by the G-33 group of developing countries, as a way to escape from this perceived unfair constraint (I have previously examined this issue and possible solutions to it in this ICTSD paper. Also, anyone interested in the way WTO rules work in practice should read Lars Brink’s surgical dissection of policy space in agriculture under the WTO’s rules on domestic support.)

The EU-Brazil public stockholding proposal would exempt price support for traditional staple food crops provided in pursuance of public stockholding programmes for food security purposes from being counted in a Member’s AMS (a) if they are a least developed country or (b) for other developing countries, if the value of the stocks procured does not exceed [10%] of the average value of production in that Member. Furthermore, (c) support provided under programmes which existed at the date of the Bali Decision on public stockholding could also be exempted provided that the Member concerned respects the requirements of that Decision.

The proposal suggests that an amount up to [10%] of the value of production for staple food crops could be exempted, with the 10% figure in square brackets indicating that the specific figure is open to further negotiation. This figure bears a superficial similarity to the 10% of the value of production that developing countries can already exempt as de minimis product-specific support. However, these two 10% figures are very different.

The 10% de minimis figure allows a developing country to exclude an absolute amount of product-specific support up to 10% of the value of production from its AMS calculation. Assuming all production is eligible production, this limits support to administered prices which are just 10% higher than the fixed external reference price.

The proposed concession is to exclude support if the value of the stocks procured does not exceed [10%] of the total value of production regardless of the amount of unit support provided. That is, the administered price could be double the fixed external reference price and this would still be exempt from the country’s AMS, provided that the government purchases less than [10%] of the value of the crop at this price for the public food security stocks.

This distinction focuses attention on the concept of eligible production for the purpose of calculating market price support for AMS purposes. The Appellate Body in the US Korea Beef case noted that “In establishing its program for future market price support, a government is able to define and to limit “eligible” production”. In other words, it accepted that if the government pre-announced a limit on the amount which would be eligible for support, then that amount could be used in the calculation of market price support rather than total production. In the EU-Brazil proposal, the government must notify in advance the value of acquired stocks prior to implementation of the programme (Para 7a) and this amount must be less than [10%] of the value of production. Thus, the proposal is in line with the principle set out in US-Korea Beef.

As I did for the domestic support disciplines, this EU-Brazil proposal on public stockholding can be compared with the one included in Rev 4 in 2008. Here, Ambassador Falconer suggested exempting from a developing countries’ AMS the acquisition of stocks of foodstuffs at administered prices with the objective of supporting low-income or resource-poor producers (which was the formulation put forward in the original G-33 proposal on this issue). In the EU-Brazil proposal, this restriction is removed (experience in the context of Article 6.2 input subsidy measures suggests it is anyway virtually impossible to police) but in its place there is a quantitative limitation of [10%] of the value of production of the staple food.

The ability to purchase this amount of the crop at an administered price in a developing country might often be expected to lead the market price to be close to the administered price, at least for an imported commodity and where sufficiently high import tariff barriers are in place, and depending on the state of infrastructure to allow spatial arbitrage to take place. In practice, the extent to which the procurement of 10% of a crop can be expected to stabilise the price around the administered price will depend on the size of harvest fluctuations from year to year.

Potential impact on India

As India has been the main demandeur in this area, it is interesting to look at India’s experience. In India, farmers are guaranteed a Minimum Support Price (MSP) for 25 major agricultural commodities, and government-designated agencies intervene in the market to purchase at the MSP when prices of the relevant commodities fall below the MSP.

In their analysis of Indian food policy, Hoda and Gulati point out that meaningful purchase operations only take place for three crops – wheat, rice and cotton – and although purchases are made by designated agencies for other crops, they are not on a sufficient scale to make a difference to the market price (p. 29). They also note that a feature of the procurement operations for wheat and rice in support of the MSP is that they are carried out virtually indistinguishably from the purchases for maintaining buffer stocks and the procured stocks are fungible. In other words, the Food Corporation of India purchase operations for wheat and rice in support of the MSP and public stockholding operations for food security purposes are carried out in a seamless manner, and these authorities conclude that “it is difficult to tell where one function ends and the other begins” (p. 32).

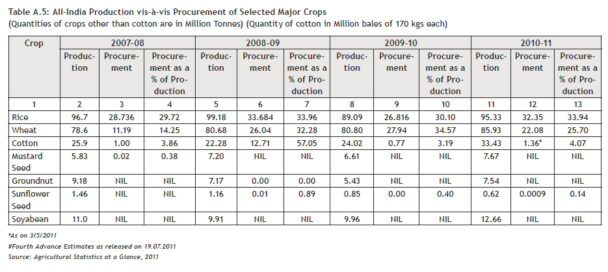

The table below, taken from the Hoda and Gulati study, shows the size of procurement as a share of total production for a selection of staple foods in India for a number of years towards the end of the last decade. For wheat and rice, the procurement shares have been well over 10% in all years. Thus, unless India wished to make use of option (c) in the EU-Brazil proposal and seek exemption under the Bali Decision, the proposal would represent a significant tightening in India’s ability to implement price support programmes for these crops compared to its current practice.

In summary, the EU-Brazil public stockholding proposal would allow a modest additional exemption when calculating a country’s AMS on top of the de minimis exemption where countries operate public stock holding programmes for food staples with minimum procurement prices. While any relaxation of the disciplines on trade-distorting support might be a cause for regret, in this case there is a manifest need for reform of the rules and the opening provided by this proposal is relatively limited. It seems to me a defensible step to take.

Conclusions

My view is that the EU-Brazil proposal represents a significant initiative in trying to chart a direction through the competing interests on domestic support. No one country is going to get everything it is looking for. The question is whether countries can be convinced that the benefits of greater disciplines on other countries’ use of trade-distorting domestic support are sufficient to outweigh the domestic political costs of accepting greater discipline on one’s own use of trade-distorting domestic support.

This question cannot be answered by the EU-Brazil proposal in its current state. The proposal sets out a framework, but important parameters remain to be negotiated – the overall percentage limit on OTDS support, whether to make this a fixed or floating limit, the treatment of Blue Box supports, how to provide special and differential treatment for developing countries, and the share of domestic production that might be exempt from inclusion in a country’s AMS when procured at administered prices for public stockholding for food security purposes. Much numerical simulation lies ahead to see whether a ‘sweet spot’ can be identified which would allow all WTO Members to be satisfied to sign up to a deal (this paper by Jonathan Hepburn and Christophe Bellman of ICTSD gives an excellent insight into the kind of work that needs to be done).

Of course, reaching a successful outcome in Buenos Aires is not only a matter of technical negotiations, but also of political will. Many observers are looking nervously at the United States to divine its attitude to seeking an agreement and here, it must be admitted, the signs are not good.

Already, under Obama’s Presidency in September 2016, the US decided to open a dispute with China based on its market price support programmes in wheat, rice and corn. A panel was established to hear this dispute in June 2017. This dispute rumbling in the background will not improve the mood music for the negotiations.

Robert Lighthizer was sworn in as the United States Trade Representative (USTR) in May 2017. He served as Deputy USTR under President Ronald Reagan and is a well-known advocate for the type of “America First” trade policies supported by President Trump. His written testimony to the US Senate Committee on Finance in June 2017 explaining the President’s trade policy agenda included the following paragraph on his WTO objectives.

“I have begun to articulate my desires to seek reforms to the WTO dispute settlement system, and have made that clear to our partners. This is now a topic of serious discussion at the WTO. We expect to see meaningful changes in order to maintain the relevance of the system. Looking ahead to December, we are pursuing successful ministerial in Buenos Aires this December that reinvigorates the WTO. We do not advocate a meeting that seeks major deliverables or significant negotiated outcomes”

Meanwhile, in Congress, significant numbers of Senators and House lawmakers have indicated their support for extending aid to US cotton farmers, in defiance of the WTO ruling against the US cotton programme.

None of this suggests that the US is preparing to make compromises to secure an agreement on domestic support in Buenos Aires.

Indeed, there were apparently indications from the AGRIFISH Council meeting which took place on 17 July, the same day as the EU launched its proposal with Brazil at Geneva, that not all EU agriculture ministers were fully happy with the proposal either (see this Agra Europe report, behind a paywall)

None of this suggests that the EU-Brazil joint proposal on domestic support will have an easy path, but we are still at an early stage in these negotiations.

This post was written by Alan Matthews

25 July 2017. This post was updated to point out that the wording of the public stockholding proposal in the 2008 Rev 4 modalities reflected the wording in the original G-33 proposal.

29 July 2017. The definition of trade-distorting support in the EU-Brazil proposal was revised to make it technically more accurate.

Very thorough and relevant analysis of a very technical issue. Enlightening and useful. Many thanks

PM