As long as I have been commenting on the CAP, its most criticized feature has been its use of export subsidies, also called export refunds. In the late 1980s and early 1990s, the EU was spending €10 billion a year on export subsidies, almost one-third of the CAP budget, in order to allow traders to get rid of the EU’s growing export surpluses by paying the difference between the EU’s high internal prices and lower world market prices.

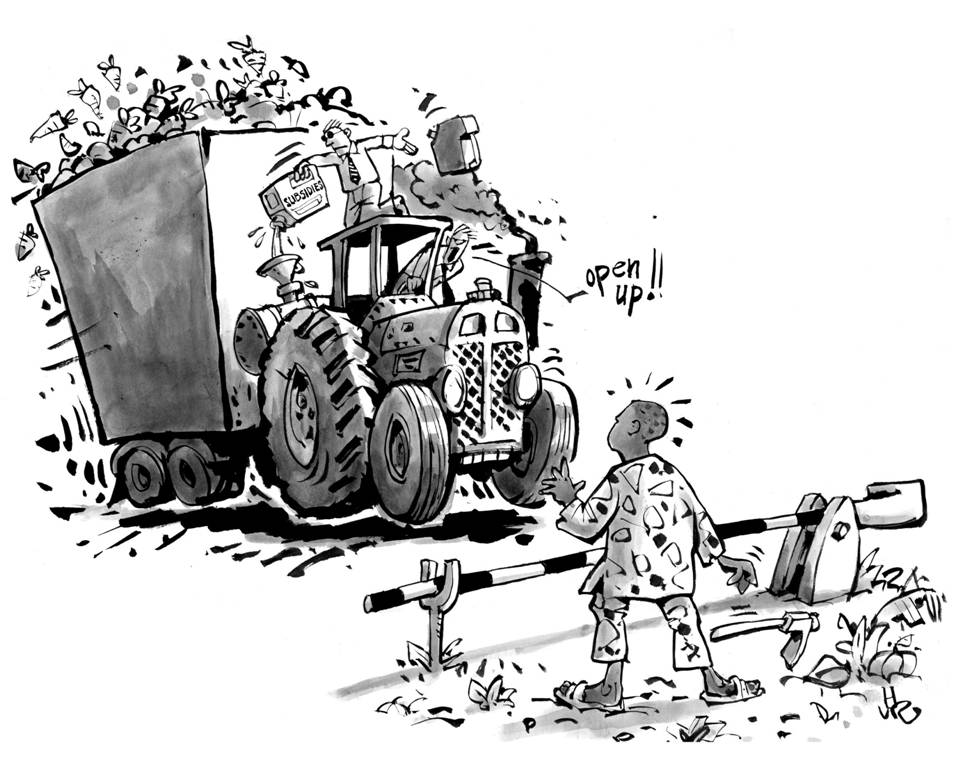

Export subsidies allowed EU exporters to grab market share in import markets from competing exporters, put downward pressure on the level of world market prices, and competed unfairly with local producers in many developing countries. The damages caused were brilliantly highlighted and analyzed in a series of powerful reports and pamphlets by development NGOs such as Oxfam (Stop the Dumping! How EU Agricultural Subsidies are Damaging Livelihoods in the Developing World, 2002; Dumping on the World: How EU Sugar Policies Hurt Poor Countries, 2004); Aprodev (No More Chicken, Please, 2007; Preventing Unfair ‘Dumping’ of EU Subsidized Food, 2011); ActionAid (Milking the Poor; How EU Subsidies Hurt Dairy Producers in Bangladesh, 2011) and Brot für die Welt (Milk Dumping in Cameroon: Milk powder from the EU is affecting sales and endangering the livelihoods of dairy farmers in Cameroon, 2009).

In the end, it was pressure from the United States which forced the EU to the negotiating table. Fed up with losing market share to subsidized EU exports (for example, in the market for wheat flour in Egypt), the US started in turn to subsidize its exports and to offer increasingly preferential export credit terms. This ‘war of the treasuries’ was such an obvious zero-sum game that the two parties agreed for the first time to negotiate disciplines on agricultural supports. The Blair House Agreement between the two sides in November 1992 eventually became the basis for the WTO Agreement on Agriculture (AoA).

Developing countries have had a more ambiguous attitude to export subsidies. Export subsidies lowered the cost of food imports for food importing countries and, although it depressed prices for local producers, many importing developing countries gave little priority to agricultural development in those years. For example, the only reference to food security (Article 54) in the Cotonou Partnership Agreement signed with the African, Caribbean and Pacific (ACP) states in 2000 obliged the EU to ensure that export refunds for all ACP states would be fixed further in advance “in respect of a range of products drawn up in the light of the food requirements expressed by those States” (my italics).

The WTO Agreement on Agriculture introduced limits on the volume and expenditure on subsidized exports for those countries with export subsidy programmes in place at the time. All other countries, including most developing countries, undertook never to make use of export subsidies in the future.

Export subsidies in the Doha Round

This imbalance was clearly unsatisfactory. Export subsidies were thus a main focus when negotiations resumed in the WTO on further agricultural trade liberalization in 2000. These negotiations were subsequently folded into the WTO Doha Round of trade negotiations when it was launched in late 2001. Many countries wanted a commitment in the Doha Round mandate that the negotiations would lead to the elimination of export subsidies but the EU resisted; in 2001 export subsidies were still too central to the CAP policy of market price support. The eventual wording in the Doha Ministerial Declaration was a compromise that the negotiations would aim at “reductions of, with a view to phasing out, all forms of export subsidies”.

A breakthrough of sorts came at the Hong Kong WTO Ministerial Council meeting in December 2005 when the EU eventually conceded that export subsidies (where it was the biggest user) might be eliminated provided equivalent disciplines were introduced on export credits and food aid (widely used by the US) and state monopoly marketing boards (used by Canada and Australia). Members agreed “to ensure the parallel elimination of all forms of export subsidies and disciplines on all export measures with equivalent effect to be completed by the end of 2013”. The end of one of the most distorting forms of agricultural support seemed in sight.

However, it was not to be. A comprehensive draft of an agricultural agreement was prepared by the Chair of the agricultural negotiations at the end of 2008 (called Revision 4 or Rev.4 in WTO jargon), but differences persisted. There were differences within the agricultural negotiations (over the developing countries’ demand for a special safeguard clause) as well as over the balance of ambition in the agricultural pillar versus the non-agricultural one. Negotiations broke down and all subsequent efforts to revive them have proved unsuccessful.

When the EU came to reform the CAP during the period 2011-2013, export subsidies no longer played a crucial role. Higher world market prices together with successive reductions in market intervention prices as a result of CAP reforms had largely narrowed the gap between EU and world market prices. Nonetheless, the EU did not want to take the final, logical step of renouncing the use of export subsidies. Its argument was that this was one of the few bargaining chips it could use when trying to negotiate additional market access in the Doha Round negotiations. Instead, the EU made a commitment in the 2013 reform that it would only revert to using export subsidies in the event of a severe market crisis (read this earlier post and this post for a fuller discussion). All export refund rates were set to zero in the reform.

Thus, it came as a surprise to many that last week the EU made a proposal for the Nairobi Ministerial Council meeting in December which would, inter alia, set an end date for export subsidies at the end of 2018. Even more surprising was that this proposal was made jointly with Brazil (the first time the EU and Brazil have jointly submitted an agricultural proposal) along with Argentina, New Zealand, Paraguay, Peru and Uruguay.

Brazil had emerged as the leader of the G-20 group of developing countries after the unsuccessful WTO Cancun Ministerial Council in 2003. However, far from being welcomed with open arms, this joint proposal has been criticised by India and other developing countries amid a sense that they have been betrayed by Brazil. One trade envoy is quoted: “With what face can Brazil convene a G-20 ministerial meeting on December 14 in Nairobi after have buried the goals for which it was established and now having collaborated with the EU on export competition” (quoted in SUNS #8136).

The elements of the EU-Brazil joint proposal

Clearly, there is more at stake here than meets the eye. To understand the issues, it is necessary to deconstruct the EU-Brazilian joint proposal against the background of what had been included (though never agreed) in the Chair’s Rev. 4 draft modalities back in late 2008. Essentially, the proposal covers five points (this summary is based on reports by Reuters here, the Third World Network SUNS here and here and the ICTSD Bridges here as the proposal itself is not publicly available on the WTO website).

1. An end to export subsidies. Developed country Members would eliminate their remaining scheduled export subsidy entitlements by the end of 2018 i.e., in three years from the date of implementation which begins on January 1, 2016. The Rev 4 had suggested a longer five year transition period ending in 2013. Those few developing countries with export subsidy commitments would eliminate their subsidies three years after the complete elimination by the developed countries, as also proposed in Rev.4.

2. Exempted export subsidies for developing countries. Article 9.4 of the AoA allows developing countries, under certain conditions, to provide subsidies to reduce the costs of marketing exports of agricultural products and internal transport and freight charges to export shipments. This article has been available to any developing country, whether it has export subsidy commitments or not. Article 9.4 treatment applies only in the “implementation period”, which the AoA defines as “the six-year period commencing in the year 1995”, i.e. ending in 2000. In the Ministerial Declaration following the Hong Kong Ministerial Council in 2005, it was agreed that developing countries would continue to benefit from the provisions of Article 9.4 for five years after the end-date for elimination of all forms of export subsidies. A Ministerial Declaration, while constituting ‘guidance’ to the WTO, does not formally add to or diminish the legal obligations of WTO members. The EU-Brazilian proposal would allow developing countries to continue to benefit from these Article 9.4 provisions until the end of 2026, i.e. five years after the end-date for elimination of all forms of export subsidies.

3. Disciplines on export credits. Export credits and guarantees can be a way of providing an implicit subsidy to an importer if the interest rates and terms involve concessions relative to the market rate of interest. In Rev. 4, two types of disciplines were foreseen. First, the maximum repayment term could not be longer than six months (180 days). Second, export credit programmes should be self-financing over a 4-year rolling average. This would ensure that there was no hidden government subsidy implicit in the lending conditions.

The EU-Brazilian proposal introduces some additional flexibility to meet US concerns. Although the proposal maintains the 6-month maximum repayment limit, they have added a footnote which allows for longer repayment terms, up to a maximum of 9 months or 270 days, subject to additional conditions. The minimum rates to be charged for private operators must be at least 90% of the OECD benchmark credit risk associated with that country. This formulation is taken from the deal agreed between the US and Brazil which settled their cotton dispute some years ago

4. Limits on monetization of in-kind food aid. Food aid is a potential instrument of surplus disposal and can disrupt commercial export markets. Yet food aid can also be helpful particularly in emergency situations, so there is a balance to be struck. In Rev.4, members would commit “to making their best efforts to move increasingly towards more untied cash-based food aid” which is seen as the least-distorting kind. However, a share of US food aid in particular continues to be delivered in-kind. In-kind food aid in emergency situations would be protected under a Safe Box arrangement. Outside emergency situations, in-kind food aid would be subject to further disciplines such as the requirement to be based on a targeted assessment of need, targeted to meet the nutritional requirements of identified food insecure groups, and be required to avoid, or at least minimize, commercial displacement. Rev. 4 contained additional disciplines on monetization of non-emergency food aid. In principle, this would be prohibited except in the case of least-developed or net food-importing countries where monetization would be allowed in order to fund the internal transportation and delivery of the food aid, or the procurement of agricultural inputs to low-income or resource-poor producers, in those countries.

The EU-Brazilian proposal would relax these conditions by allowing some monetization of non-emergency food aid, on condition that this did not exceed a to-be-determined share of total in-kind food aid donations.

5. State-trading enterprises. As regards state-trading enterprises, the joint EU-Brazilian proposal contains no changes as compared to Rev.4.

The EU-Brazilian proposal goes further than Rev.4 in eliminating export subsidies of developed countries more quickly, extends the special treatment for developing countries for a further ten years (although Australia, for one, has questioned whether this exemption is justified on development grounds), and moved to address US concerns on monetizing food aid and the use of export credits by providing some slightly increased flexibility. Taken together, this is a valuable effort to achieve a worthwhile outcome from the Nairobi Ministerial meeting.

Why has the proposal met opposition?

Yet India has criticized the proposal, raising a series of ‘technical questions’ around the proposed additional flexibilities compared to Rev.4 for monetized food aid and export credits (see SUNS #8139). It also queries more generally this recalibration of the export competition pillar which it sees as implying additional concessions from developing countries (ignoring the balancing greater disciplines on developed countries).

The broader political and economic context for the Doha Round negotiations provides some of the explanations for India’s position. First, the G-33 group of developing countries (of which India is a leading member) had at the same time presented proposals for decisions on a special safeguard mechanism and for greater flexibilities to provide price support to farmers under the guise of public stock-holding programmes for food security. Both proposals had received a frosty reception not only from developed countries but also from Brazil. India may be trying to gain some negotiating leverage by linking the two sets of processes.

More significantly, the landscape of agricultural support has changed dramatically since the Doha Round negotiations were launched and the Rev.4 draft modalities were circulated. When the Doha Round started, although 25 countries had export subsidy commitments (meaning that they had used export subsidies in the base period for the Agreement on Agriculture), the EU was by far and away the greatest user. Today, the EU does not use export subsidies but an increasing number of developing countries do – China for cotton, Thailand for rice, India for sugar, for example, even if these are not notified to the WTO because these countries have zero entitlement to use export subsidies under their WTO schedules.

Development NGOs have been regrettably silent on this growing use of trade-distorting export subsidies by developing countries. If you are a cotton farmer in Chad and the price you get for your cotton is depressed because other countries provide export subsidies to support their producers, you do not care whether that other country is China or the United States. The key task is to develop a set of binding trade rules for all which provide appropriate policy space to developing countries to pursue their food security goals while limiting the damaging effects on the food security of other developing countries.

The EU might be accused of cynically trying to strengthen WTO disciplines on export subsidies at precisely the moment when it is developing countries that start to use them. But the EU-Brazilian proposal does not alter the legal position for most developing countries that have no entitlement to use export subsidies; indeed, it proposes to extend the developing country exemption to allow subsidies to cover marketing and internal transport costs for exports for a further ten years. The EU-Brazilian proposal is aimed at tightening the disciplines on countries that have used export subsidies in the past, which are mainly developed countries. And for this reason, it should be welcomed.

The concessions which have been made (relative to the Rev.4 draft modalities) and which have drawn the ire of India are designed to make it easier for the US to sign up and take account of provisions in the latest US Farm Bill. The US has not played a constructive role in recent Doha Round negotiations and it remains to be seen if, even with these concessions, it will support this proposal.

There is one caveat to the above account. For reasons unknown, the EU proposal is not publicly available on the WTO website (unlike the G-33 proposals on a special safeguard mechanism and public stockholding which can be downloaded). Thus I have relied on journalistic accounts of the contents, which may or may not be accurate, and it may be that there are other issues in the proposal which I have not seen that are more problematic.

It seems there are still officials in DG Trade who have not been alerted to the supposed new era of transparency for EU trade negotiations. It took an own initiative report from the EU Ombudsman as well as a lot of pushing from MEPs, national parliamentarians and civil society groups before the EU Commission saw the sense of keeping its public informed of its main negotiating positions in the ongoing US-EU TTIP negotiations. This secrecy is not only counter-productive, but it is foolish because it allows conspiracy theories as well as speculation and rumour to flourish. So, Mrs Malmström, please follow through on your promises and publish the EU’s negotiating positions at the WTO as well.

Yet, despite this caveat, we should recognise the fact that, after more than 50 years of the CAP, the EU has finally indicated that it is willing to give up the use of export subsidies within a few years. At a time when the EU faces a lot of criticism for its handling of various crises, this is a milestone to be celebrated by EU citizens.

Update 27 Nov 2015: Today the EU published its proposal after getting the agreement of its co-sponsors, see this notice on the DG TRADE website which also gives the link to the proposal itself. This is a welcome development which we hope will become the norm in future. Having the full document instead of just relying on press accounts allows a more accurate assessment of its contents.

The proposal takes the form of Track Changes annotations to the Rev.4 draft modalities. A few additional wrinkles to the account given above can be highlighted.

First, with respect to the maximum length of repayment period for export credits. while the 180 day limit in Rev.4 is maintained in the text, it is put in brackets indicating that the proposers are open to negotiation on this issue. Then, in addition, there is a footnote indicating the a country could make use of an even longer repayment period (but not exceeding 270 days, and continuing to be subject to the requirement to be self-financing over a long-term period) if it met the additional conditions set out above regarding charging risk based fees related to the OECD benchmark rate for a country. Importantly (and which I had not highlighted in the earlier discussion), credits to least-developed and net-food-importing developing countries could be allowed longer repayment periods of between 360 and 540 days as in Rev.4, but with these time limits again in square brackets allowing scope for negotiation.

The other changes which I had not identified above relate to additional monitoring and reporting requirements under each heading (export credits and guarantees, agricultural exporting state trading enterprises, and food aid) while the reporting arrangements for export subsidies agreed at the Bali Ministerial in 2013 are confirmed.

This post was written by Alan Matthews.

Picture credit: Wageningen UR Frontis Series

3 Replies to “The EU has finally agreed to eliminate export subsidies…three cheers!”

Comments are closed.

When the author writes: “Today, the EU does not use export subsidies but an increasing number of developing countries do… Development NGOs have been regrettably silent on this growing use of trade-distorting export subsidies by developing countries”, he seems to ignore that development NGOs and developing countries (DCs) themselves are not fooled that the reduction or even elimination of explicit export subsidies (“export refunds”) have been replaced by domestic subsidies which benefit as well to the exported products.

It was the pressure from agribusiness – anxious to reduce the prices at which they bought agricultural commodities so as to improve their competitiveness and profits through increased exports – and the definition of dumping in the GATT and the Anti-Dumping Agreement (ADA) that prompted the US and the EU to change the rules of agricultural trade in the mid-1980s. Having reached the top of the ladder of agricultural competitiveness thanks to decades of high import protection and high export subsidies, the US and the EU created a double trap for DCs to prevent them from climbing the same ladder: in 1986 they launched the Uruguay Round of trade negotiations, where they wrote together the Agreement on Agriculture (AoA) rules while changing radically their agricultural policies, the Common Agricultural Policy (CAP) and the Farm Bill. Those radical changes included the EU and the US reduction of their minimum guaranteed agricultural prices in the early 1990s – and the EU continued their reductions in the CAP reforms of 2003 and 2004 – while compensating their farmers for the income loss with subsidies that they defined in the AoA as not trade distorting, so as to improve the competitiveness of their agricultural products by importing less and exporting more.

But it is the scandalous definition of dumping in the GATT and the ADA that was the most decisive reason for the radical change in the CAP and Farm Bill price policies. For economists and the average citizen, there is a dumping when exports are sold at prices lower than their production costs. However, for the GATT and ADA, there is no dumping as long as exports are sold at the domestic “market prices”, even if those prices are lower than national production costs. This explains why the US and the EU have taken advantage of this definition to lower their agricultural prices. Yet the WTO Appellate Body has held four times – in the “Dairy products of Canada” case of December 2001 and December 2002, in the “US Cotton” case of March 2005 and in the “EU sugar” case of April 2005 – that domestic subsidies should be taken into account in assessing dumping. But the WTO Members refuse to recognize a legal value of precedent in the rulings of the WTO panels and Appellate Body. During the plenary session of the WTO Public Forum on September 30, 2015, J. Berthelot questioned the representative of the Appellate Body, Ms Yuejiao Zang, one of the panelists, asking her to confirm these Appellate Body’s rulings. She confirmed them implicitly stating that the WTO Members are not obliged to recognize a legal precedent in the panels’ and Appellate Body’s rulings but she stated that these rulings do have the legal weight of precedent for the members of the panels and Appellate Body when they adjudicate on similar cases.

Among domestic subsidies we must not forget input subsidies, particularly on animal feed, which oblige the developed countries (AoA article 6.2) to notify the feed subsidies in the amber box (AMS) of animal products (meat, eggs, dairy) that consumed the feed, but they refuse to do it. Yet until 1992, the EU regarded pig and poultry meats and eggs as processed cereals, the variable import levies and export refunds on these products being based on their content of cereals processed into meat.

Indeed the elimination of the EU export refunds did not end its dumping as its agricultural exports continue to avail of the upstream domestic subsidies. Thus the EU28 exports of cereals, meats and dairy products reached €5.9 billion in 2014, of which €3.257 billion on cereals, €1.623 billion on dairy and €1.927 billion on meats. They were of €914 million to ACPs, of which €409 million to West Africa.

The EU claims that the full decoupling of direct payments to cereals (as to other agricultural products) since 2005 and even more since 2010 (when the still coupled subsidies of France and Spain on cereals were decoupled) does not allow to know if the payments have not been transferred to other productions as the EU farmers are not required to produce the products, of which cereals, for which they received the direct payments from 2000 to 2002. The Eurostat data belie this assertion: the EU28 cereals area has increased from 57.7 million ha (M ha) in 2007 to 60.9 M ha in 2014, of which that of wheat from 25 M ha to 26.7 M ha.

And the EU28 dumping to Sub-Saharan Africa (SSA) and West Africa has increased significantly from 2004 to 2014 as its annual exports increased by respectively 10.6% and 10.5% for cereals and preparations, by 12.8% and 13.2% for all meats and preparations and by 6.2% and 5.3% for dairy products.

Excuse me: in the third paragraph before the end the sentence, “Thus the EU28 exports of cereals, meats and dairy products reached €5.9 billion in 2014…”is to be replaced by “Thus the subsidies to the EU28 exports of cereals, meats and dairy products reached €5.9 billion in 2014…”.

Apology

Jacques Berthelot.

@Jacques

Thanks for these comments. We are in agreement on the main issue, which is that the EU should move to phase out its untargeted decoupled income supports. We are also in agreement that the EU system of direct payments probably does stimulate some additional EU production although we might disagree on the size of this effect. In my view, the production effects of direct payments (coupled with cross-compliance) are relatively modest, and particularly when compared to the effects of market price support such as delivered through export subsidies. A significant share of direct payments is capitalised into higher land rents and prices, and its more important effect is probably to slow down the rate of structural change by keeping more small farms in existence than to encourage production. I don’t find it particularly helpful to link direct payments to the concept of dumping, but to take up that issue would require a longer response, and I would be interested to return to that in a separate post in the coming weeks.

I would also argue that you over-interpret the agricultural trade statistics to make your case that EU agricultural exports continue to benefit from indirect export subsidies because of direct payments. Even if EU exports have increased to a particular part of the world (and I note that your figures are in value terms which need careful interpretation because of the large jump in prices between 2004 and 2014), there could be many factors behind this including differences in demand growth in different regions, differences in productivity growth and changes in relative competitiveness which can have nothing to do with the existence or not of direct payments. To argue that direct payments are the causal factor behind the growth in exports without taking account of possible other factors is simply not convincing. I refer to an earlier post in which I show that the EU has been rapidly losing market share in Sub-Saharan African imports http://capreform.eu/eus-declining-importance-in-agrifood-trade/. Because of rapid income growth in Africa due to the recent commodity boom, the demand for food imports has shot up, but most of this growth has been met by other exporters, including from other developing countries.In this context, it would not be surprising to see that EU exports have also increased, but this tells us nothing about the possible contribution of direct payments to this increase.