This is a second, long-delayed, post on the issues at stake in the trilogue negotiations between the Council, Parliament and Commission on the CAP reform dossier. The first was on relevant definitions, this time on the rules for public intervention.

I have previously discussed the history and described the rules for public intervention in the run-up to the 2013 CAP reform in this post. Anyone who wants a quick refresher might find it useful to re-read that post. The Commission also has a website explaining the market management measures under the current CAP.

The issues at stake in the current trilogues are like the debates in 2013. The Parliament’s desire to maintain and strengthen public intervention (which in this post I will take to also include private storage aids (PSA)), given the likelihood of greater future market volatility, is reflected in its amendments to the Commission proposal, while the Council reiterates its concern to avoid tampering with the market orientation of the CAP.

The rules relating to public intervention and PSA are set out in Articles 11 through 22 in the Common Market Organisation Regulation (EU) No 1308/2018. The Commission did not propose any amendments to these Articles in its amendments to this Regulation in June 2018 (the ‘Amending Regulation’). Nor did the Council propose amendments to the 2018 legislation in its general position. The German Presidency in its final progress report in December 2020 noted that “It could be concluded that there is no major appetite for review of the CMO and that the Commission had managed to use currently available instruments in a flexible and timely manner in the recent years.” However, as in 2013, the Parliament has proposed amendments which we review in this post, together with the Council’s mandate for negotiations on these amendments agreed by the Council in the middle of January.

We also add a comment on the efficacy of public intervention and discuss concerns that it could provide indirect price support with detrimental impacts on third countries.

Background on public intervention

Intervention is used to stabilise the market by purchasing surplus supplies, which are stored. Intervention stocks are then sold through public tenders when market prices increase. Intervention buying and PSA support the market price when they remove stock from the market and store it. But large overhanging stocks can depress market prices and when stock is sold again market prices are reduced below what they would otherwise have been. Public intervention and PSA can help to stabilise prices but are not intended to raise prices over the market cycle. However, if products bought into public intervention are disposed of through non-commercial channels (e.g. used for free distribution) or otherwise sold below cost, this provides de facto support to the market price.

Public intervention applies in respect of common wheat, durum wheat, barley, maize, paddy rice, fresh or chilled meat of the beef and veal sector, butter and skimmed milk powder. Public intervention for common wheat, butter and skimmed milk powder consists of a fixed price for certain quantities and in other cases depends on tendering (which can also be used for the fixed price commodities when the specified quantities are exceeded).

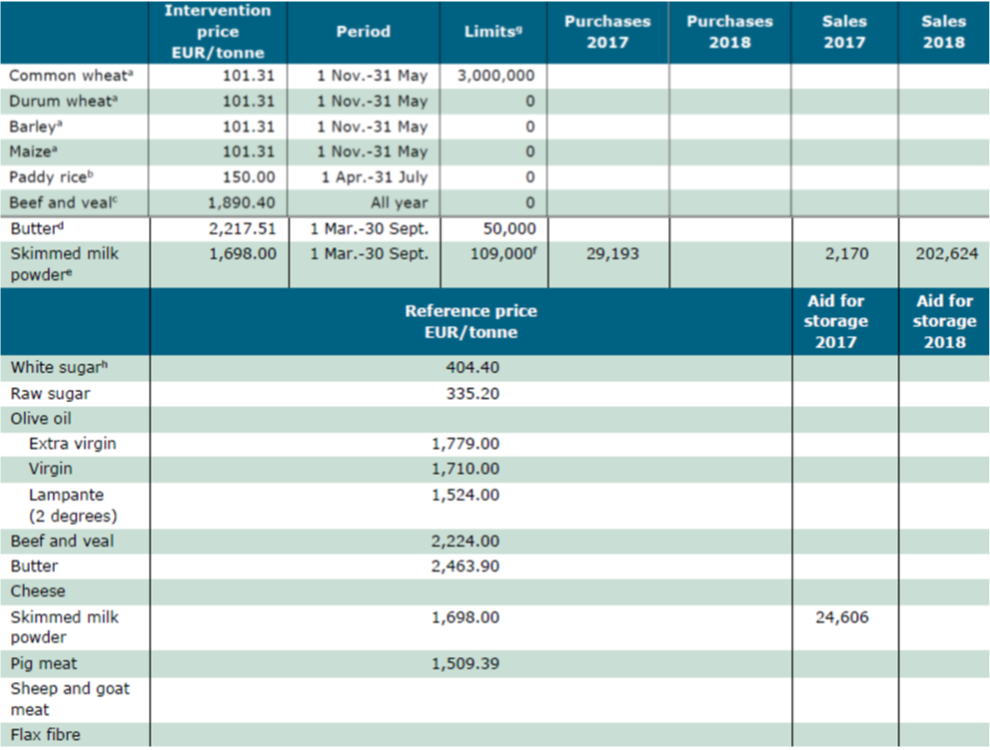

Public intervention is open for common wheat, butter and skimmed milk powder during specified periods and can be opened for the other commodities by the Commission during specified periods when circumstances dictate. The public intervention price refers either to the fixed price for the three products that are acquired at a fixed price or is a maximum price for products that are acquired for intervention using a tender procedure. The table below gives details of intervention prices, buying-in periods and eligible quantities for buying-in at fixed prices. The list of products eligible for PSA is also shown, where the reference price is used in conjunction with market prices and production costs to determine when the Commission might introduce this market support instrument.

The use made of public intervention has become more sporadic as buying-in prices have been reduced to safety-net levels. However, significant use was made of public intervention in the milk market in 2016 particularly through purchases of skimmed milk powder (SMP). PSA was provided in 2020 following the initial market reaction to the coronavirus pandemic. The table below shows the use made of these instruments in 2017 and 2018. These years do not capture the dramatic increase in SMP purchases in 2016 but do capture the significant disposals initiated in 2018 and which continued into 2019. In the early months of the coronavirus pandemic in 2020 private storage aid was opened for dairy products as well as beef and sheepmeat. The use of public intervention and private storage aid for dairy products during these years is discussed with some excellent graphics in this blog post by eDairyNews.

Intervention and private storage aid, 2017 and 2018

The European Parliament’s amendments

The Parliament’s amendments with respect to public intervention cover the following issues:

- Extend the list of products eligible for public intervention to include sheepmeat, pigmeat, poultrymeat and white sugar. This was a recommendation in the original COMAGRI rapporteur’s report where it was justified on the grounds of the risks from Brexit as well as health concerns (swine fever). The Council is willing to consider this amendment.

- Open public intervention for all eligible products all the year round and not just for specified periods. This was also a recommendation in the original COMAGRI rapporteur’s report where it was justified on the grounds that, because intervention prices are now lowered to safety net levels, there is no longer a danger that intervention becomes an automatic market outlet. There is therefore no longer any reason to limit intervention to certain periods. Allowing public intervention to be open all year round would allow improved responsiveness from the Commission in times of crisis. The Council is willing to consider this amendment.

- Grant the Commission power to open public intervention by tendering also for the additional products added to the public intervention list. The Council opposes this amendment although it would seem to follow logically if the list of eligible products for intervention were extended.

- Remove the ability of the Council to set quantitative limits on intervention purchases when buying-in takes place at a fixed price. The Council opposes this amendment.

- Limit the definition of ‘public intervention price’ to the maximum price at which purchases can be made by tendering, thus eliminating the reference to the buying-in price where products are purchased at a fixed price as a ‘public intervention price’. The Council interprets this as deleting the possibility to have public intervention using a fixed price (where setting its level is a Council competence) so that buying-in is always done under a tender procedure. Taken in conjunction with the Parliament’s amendment that public intervention should be open all year round, it concludes that this would require the Commission to open a tender for every month of the year. The Parliament’s amendment may not be intended for this purpose, but then it is hard to see what purpose it does serve. The Council opposes this amendment.

- The Parliament further proposes that, when fixing the level of the public intervention price, “the Council shall use objective and transparent criteria, which shall be in line with the objective of ensuring a fair standard of living for the agricultural community, in accordance with Article 39 TFEU.” The Council argues that, if the public intervention price is defined only as prices established by tender, there is no role for a fixed intervention price and therefore no point in having criteria to fix these prices. However, the public intervention price also sets the maximum price when purchases are made by tender so it would have a role in that context. The Council also highlights difficulties around defining what is ‘a fair standard of living’. It is not surprising, given that fixing public intervention prices is a Council prerogative, that it opposes this amendment.

- The Parliament would require Member States to notify to the Commission the identity of companies that have used public intervention as well as buyers of public intervention stocks. Each year the Commission would publish a report on the identity of the companies, the relevant volumes, and the buying and selling prices. The justification for this is the need to ensure compliance with international agreements, specifically, to avoid implicit export subsidies. This is an important issue and is considered in greater detail below. The Council opposes this amendment.

- Finally, the Parliament wants to add table olives and rice to the list of products eligible for PSA. The Council opposes these amendments on the grounds that they are against the market orientation of the CAP.

The economic effects of public intervention

Public intervention got a bad name in the EU when intervention prices were set at levels such that producing for intervention became an objective in itself for many processors. The cost to the EU budget of operating this system became enormous. To avoid disrupting the domestic market, intervention stocks could only be sold outside the EU with the aid of export subsidies, thus distorting world markets and creating unfair competition for third countries.

Intervention prices have since been lowered to safety-net levels, and export subsidies have been eliminated. In principle, public intervention could operate like speculative private storage, buying when prices are low and selling when prices rise again, and thus contribute to stabilising prices over time. Indeed, because of the EU’s position on world dairy markets and the linkage between EU and world market prices, stabilising EU dairy product prices in this way should also help to stabilise world market prices. One might expect this price stabilisation would also be welcomed by third country producers and exporters.

But this is not the case. A report by Kenneth Bailey and Megan Mao for the US dairy industry published last year concluded that SMP intervention in 2016 and 2017 adversely affected global trade in SMP and reduced US dairy export earnings over the full price cycle 2016-2019.

The report draws two conclusions. The first conclusion is that the EU disposed of intervention stocks at below cost in 2018-19, effectively creating a subsidy for EU traders. It further claims that the EU knowingly sold intervention stocks, with no restrictions on end use, to trading houses that exported the product abroad.

The SMP buying-in price was €1,698/mt. During the 18-month period January 2018 to June 2019 the EU sold, via a tendering process, 379,453 mt of intervention product at a weighted average price of €1,337/mt. Furthermore, the report estimates that the average spread or discount between the tender price and the prevailing world price over the period January 2018 – June 2019 was about $374/mt. Including the cost of operating intervention (storage charges and interest costs), the report concludes that the EU operated a dairy price support programme that cost about €190 million.

However, this is misleading if it is intended to imply that the EU dairy industry (traders and farmers) benefited by a price support programme to the extent of €190 million. As the report acknowledges, the problem was that much of the SMP was over two years old when sold. Thus, some part at least of the price discounting was due to product deterioration which should be counted as an additional cost of the programme rather than a benefit to producers. Of course, even if not a benefit to producers, these costs are borne by EU taxpayers through the EU budget.

The second conclusion is that major SMP exporters were disadvantaged by the EU’s intervention programme. The gain in prices in 2016 and 2017 when SMP product was diverted from export markets to EU storage was offset by the reduction in prices in 2018 and 2019 when this product was disposed of and much of it ended up on export markets. This conclusion is based on an econometric model of the global SMP market. The result is not based on assuming that the intervention programme provided additional taxpayer support to EU dairy farmers. Instead, it seems to follow mechanically from the fact that average world market prices were higher when stocks were released. Assuming similar percentage (but offsetting) price effects in the accumulation and disposal phases, the absolute reduction in prices in the disposal phase when average prices are higher is greater than the absolute increase in prices in the accumulation phase. Although this conclusion in not drawn in the report, it would also imply that EU dairy farmers are also worse off over the cycle because of the intervention programme for the same reasons as US producers.

The study’s policy conclusion is that the EU’s dairy intervention programme should either be reformed by internalising all SMP stock disposals or by ending it altogether. The EU could internalise all SMP surpluses and avoid exporting that surplus onto the world market by developing domestic feeding programs for the poor, use in animal feed, or other programmes.

This is not a new suggestion. The Dutch government commissioned a report from Roel Jongeneel and colleagues at Wageningen University Research in 2018 to examine the budgetary and market impacts of different strategies of selling EU SMP intervention stocks. They concluded that selling intervention stocks for non-human consumption had the highest budget cost but the lowest impact on market prices.

The potential distortionary impact of selling intervention stocks at less than the purchase price is the motivation for the European Parliament amendment noted earlier that would require Member States to notify to the Commission the identity of companies that have used public intervention as well as buyers of public intervention stocks. This amendment was included in the COMAGRI rapporteur’s report and justified as follows: Information on the identity of buyers of public intervention stock is not systematically communicated to the Commission; the latter is therefore not able to characterise market disturbance effects or to ensure compliance with international agreements. This is all the more important considering that tender procedures allow stock to be sold at a much lower level than the purchase price, where the differential is considered as a form of support

The motivation behind this amendment should be applauded, but whether this is an appropriate or effective way of achieving the objective of avoiding indirect price support is open to question. Knowing the identity of those companies purchasing intervention stocks when stocks are sold by tender does not, a priori, seem to avoid the danger of providing indirect price support.

We earlier noted that sales of SMP out of intervention were made at below the purchase price but this might be largely accounted for by product deterioration. A more important comparison (at least in the case of SMP where there is a close relationship between world market and EU prices) would seem to be between the purchase price and the world market price at the time of disposal. If the world market price (adjusted for transport costs) is above the intervention buying-in price, sales out of intervention should not be at risk of providing indirect price support. This assumes that EU traders can sell at the higher world market price, and that any discount relative to this price reflects differences in the quality of the product.

If distress disposals out of intervention must be made when the effective world market price is less than the buying-in price (e.g. to avoid further product deterioration), this would indeed provide indirect price support. In this case, there is a case to require disposal of the surpluses through non-commercial channels to avoid adversely impacting other exporters and distorting global markets and trade.

This post was written by Alan Matthews.

Update 2 February 2021: The discussion on the amendment including criteria when setting the public intervention price has been clarified compared to the original post.