The CAP in recent decades has been largely an income support policy, particularly since the decoupling of direct payments after 2005. These CAP budget transfers together with national budget support either in the form of co-financing or as stand-alone payments account for over half of net farm income (for family farms, this is equivalent to family farm income). For specific enterprises and in individual countries, the contribution to farm income can be even higher.

In the first part of this post, I present the most recent data on the dependence of EU farm income on public transfers (see this post for data up to 2018 and a description of the various indicators that can be used to measure the dependence of farm income on public support). Despite the criticisms that using the CAP as a mechanism of farm income support is ineffective, inefficient and inequitable (see this analysis and this previous post), there has been little progress in developing a less subsidy-dependent agricultural sector. In the second part of the post, I discuss the implications of this for the political economy of the green transition in agriculture.

The dependence of EU farm income on budgetary support

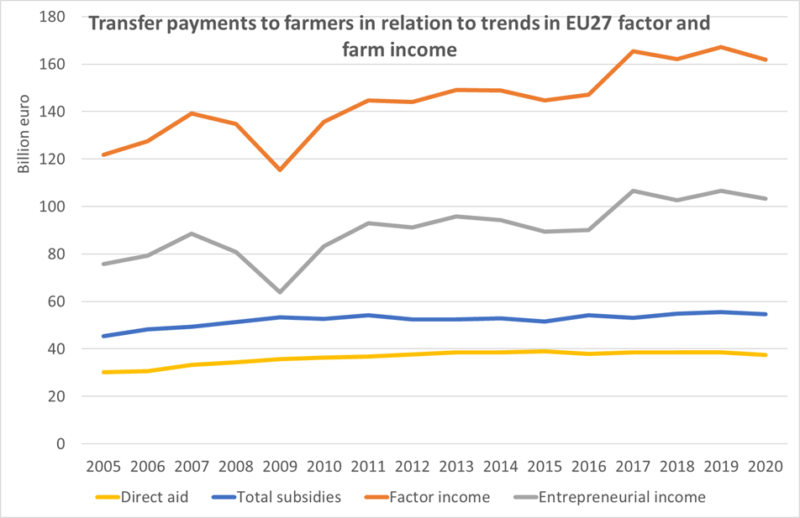

The first chart below presents two measures of budgetary support (direct aids and total subsidies) and two measures of farm income (factor income and entrepreneurial income, also called net farm income). Direct aids are the amounts paid from the CAP Pillar 1 budget for direct income support (ideally, one would also include the payments for farmers in areas of natural constraints in Pillar 2 as these are also essentially income support payments). Total subsidies also include CAP rural development payments apart from investment supports (some of which are intended to remunerate the provision of public goods which one could argue should be excluded from a measure of budgetary ‘support’) as well as budgetary payments from Member States.

Agricultural factor income represents the income generated by farming which is used to remunerate borrowed/rented factors of production (capital, wages and land rents) as well as own production factors (own labour, capital and land). This latter element represents entrepreneurial income and represents the amount available to remunerate the own factors of production used in agricultural production.

Both income indicators show a slow increase over time, apart from the severe drop in 2009 following the global financial crisis. There is also some evidence that incomes jumped to a new plateau after 2016 but have since stabilised around that higher level.

Both indicators of budgetary support show small increases in the early years but have remained broadly stable over the past decade. Note that all these amounts are in current prices. In the case of direct aids, the small increase between 2005 and 2013 represents the phasing in of direct payments following the accession of the countries of Central and Eastern Europe in 2014. This increase is less pronounced when total subsidies including national payments are considered, as many of these countries opted to top up their CAP direct aids with Complementary National Direct Payments.

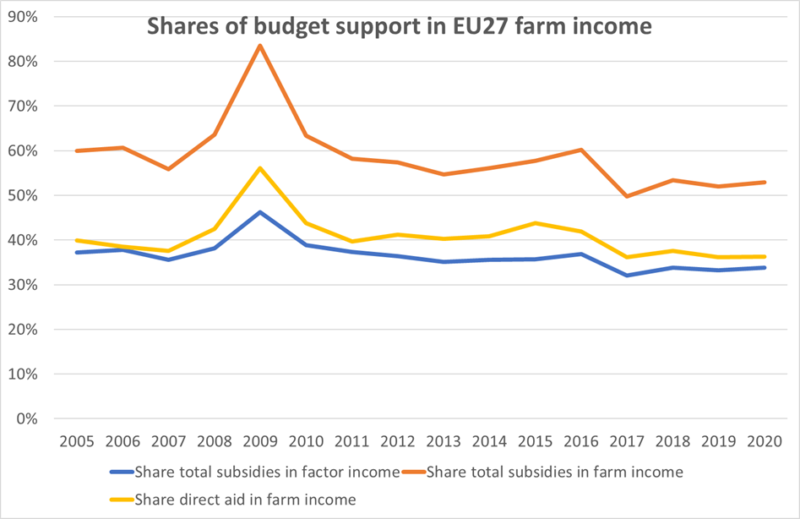

The next chart shows the same data but this time the budgetary supports are expressed as a share of farm income. The peak in 2009 stands out, but otherwise there is little change between 2005 and 2016 but in more recent years the dependence on public support has fallen slightly, particularly relative to factor income, reflecting the increase in income levels in these years. Nonetheless, the key takeaway numbers are that total subsidies contribute 34% to agricultural factor income and 53% to net farm income in 2020. Direct aids alone contribute 36% to net farm income.

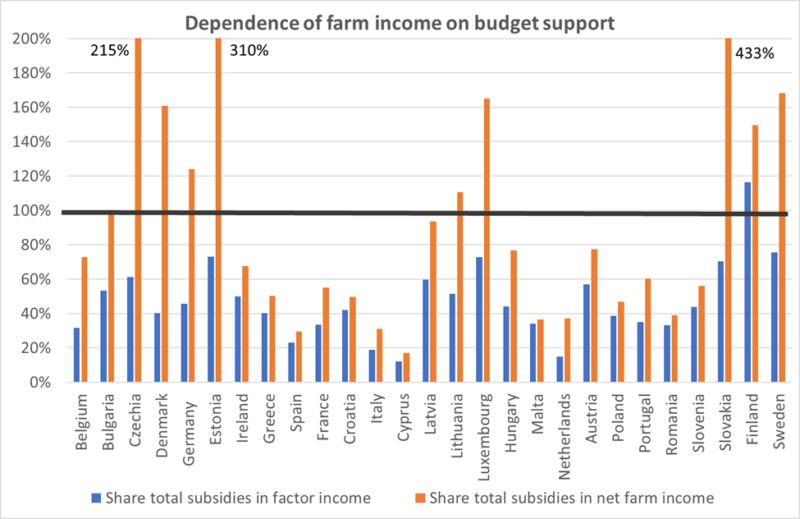

These averages hide a lot of heterogeneity across countries, farm sizes and production systems. Using the Eurostat agricultural accounts data, it is only possible to explore the heterogeneity across countries, which is shown in the third chart. This shows the contribution of total subsidies to both factor income and net farm income in each Member State. It can be seen that for many Member States these percentages exceed 100%. To improve the legibility of the chart, the vertical axis has been truncated at 200%, but there are three countries where total subsidies as a percentage of net farm income exceed this level.

Only in the case of Finland are total subsidies greater than agricultural factor income. Finland is the world’s northernmost agricultural country and production costs are above the prices paid to the producer. Finland operates a national aid system on top of CAP supports (for farmers in southern Finland and Nordic aid). This aid supports farm income but also domestic food production.

However, there are many more countries where budget support is greater than the net farm income. This underlines the general criticism of direct payments that much of their value leaks out of the farm sector in terms of higher land rents, higher borrowing and thus higher interest costs, as well as payments to farm employees. For these reasons, it is not the case that reducing support will translate into an equivalent reduction in farm income.

We cannot draw the conclusion that, if these income support payments were removed, then production would no longer take place in these countries. Not all farms have a negative value added after subtracting budget payments, market prices would be higher, and prices of factors of production (particularly land) but also farm inputs would be lower. Model simulations (e.g. the SCENAR 2030 study by the EU Joint Research Centre) suggest there would be a relatively low production impact of removing all CAP support but there would undoubtedly be a significant structural adjustment accompanied by farm closures and amalgamations. Even in those countries where budget support is less than net farm income and there is a positive contribution from market activity, the loss of payments would induce similar pressures for structural adjustment. The SCENAR 2030 simulations suggest that production would become more intensive in the more favoured farming areas (in response to the improved price incentives) while production would reduce and even cease entirely in more marginal farming areas.

Discussion

The previous analysis shows that, for many family farms, CAP direct payments as well as the additional payments from participating in various rural development programmes make a significant contribution to their income. This explains why farmers are nervous about the outcome of the legislative process around the CAP post 2022 and the implications it will have for the value of their payments.

The overall size of the CAP budget in the coming period in nominal terms, after taking into account the boost to rural development spending in 2021 and 2022 from the Next Generation EU recovery instrument, is broadly maintained (see the figures in this post). It is essential that we make better use of this funding to incentivise and support farmers in making the green transition to a more sustainable agriculture. Hence the importance of securing well-funded and well-designed eco-schemes and agri-environmental-climate measures (AECMs) in the coming CAP.

But, from a farmer’s perspective, payments received as a basic income support and payments received under eco-schemes/AECMs do not have the same value. Unless the eco-scheme/AECM payment is simply paying farmers for what they were doing already (in which case their contribution to the green transition is at best limited to preventing undesirable change, such as intensifying production on natural grasslands), there will be an additional cost involved to meet the conditions for the payment. As a result, the value of that CAP payment will be reduced, and that farmer would expect, ceteris paribus, to face a lower standard of living. There is a short-run trade-off between farm income and the transition to more sustainable practices.

The question is whether this trade-off can be alleviated and in what ways.

The ceteris paribus qualification is important. First, we cannot assume that EU farm production and income can continue at current levels without taking action to protect biodiversity, to reduce emissions and to safeguard water quantity and quality. Another JRC study published this month examined the likely economic impact of more frequent droughts on European agriculture. It concluded that an extreme climate scenario with 4? warming could reduce agricultural output in western and southern parts of Europe by 10%. In the longer-term, good ecological health is a prerequisite also for profitable farming. This argument is particularly important with respect to environmental pressures where agricultural intensification is the main contributor.

Second, the green transition will be easier, the more buoyant are agricultural markets (even though there is the paradox that more favourable market conditions could also incentivise greater production and therefore greater environmental stress in the absence of changes in agricultural practices). Currently, agricultural markets are tightening. Grains and oilseed prices are now 42% higher than a year ago, according to the May 2021 AMIS Monitor. The broader FAO Food Price Index which includes in addition dairy, meat and sugar prices, was 31% higher in April 2021 than the same month last year. Whether prices will continue at elevated levels in the medium-term remains to be seen. There is a well-known saying that ‘the cure for high prices is high prices’, meaning that high prices will induce a supply response that will push prices down. Given the increasing constraints on the availability of inputs (land, water), the future price outlook will depend on the pace of productivity growth in the years ahead.

Third, in those Member States where there are significant differences in the size of payments received by individual holdings, the redistributive payment should be used to maintain the basic payments of the more numerous smaller producers. From my perspective, this should be a transitional measure intended to manage the pace of adjustment to a model of payments for public goods in line with the just transition principle for the green transition, rather than a permanent feature of the future CAP.

Fourth, it will be important to identify market opportunities for farmers in the green transition that can attract additional income to the sector from outside the CAP. Meeting some of the growing demand for renewable energy is one potential market. There are justified concerns around the potential for food-fuel conflict as we have seen with first-generation biofuels but there may still be relevant opportunities in specific national circumstances. There may also be opportunities to produce crops for the bioeconomy, for use in making bioplastics, biochemicals, and other industrial raw materials. The Commission has promoted carbon farming to sequester carbon in soils as a new business opportunity for farmers but this only creates a new stream of revenue if it attracts funding from the private sector or is remunerated from the proceeds of carbon tax revenue. Although I support exploring this option, there are major uncertainties about the likely scale of this market and many technical issues to be resolved before it can be implemented (the Commission last month published a technical report on the potential for carbon farming, while for a sceptical view see this blog post from David Pannell). There may be greater scope to pay farmers to reduce methane below long-term levels given that this is equivalent to negative carbon emissions and has a cooling effect on global temperatures.

Fifth, there is a great need to scale up research efforts and innovation to expand the toolbox of options available to farmers looking to participate in the green transition and to meet the objectives set out in the Farm to Fork Strategy. These objectives include reduced chemical pesticide use, reduced chemical fertiliser use, reduced use of antimicrobials, reduced gaseous emissions, and greater space for nature. Farmers need alternatives to combat pests and diseases, better ways to recycle nutrients, better housing and animal husbandry practices to reduce the risk of infections, more tools to reduce emissions, and better information on how to integrate nature and nature-based solutions into their farming activity. Soil health and food is one of the missions chosen for the EU Horizon Europe research programme, but we should look again at whether this resourcing is adequate in view of the challenges facing the sector to make the green transition. Member State funding is equally important in this respect.

Conclusions

Agricultural practices have many negative environmental impacts. Agriculture is a major contributor, even if not the only one, to outcomes such as nutrient overload in waterways and coastal areas, chemical contamination of groundwater, the loss of biodiversity due to habitat disappearance and the use of pesticides, and air pollution due to ammonia. It also contributes to climate change through emitting greenhouse gases, to water quantity issues in some regions due to excessive levels of extraction, and to the loss of soil and soil carbon through soil erosion and degradation. These negative impacts are fully documented in reports such as the European Environment Agency’s The European Environment – State and Outlook 2020.

These environmental costs are only partially factored into farm decision-making through various regulatory instruments. Moving towards a more sustainable agriculture requires that they be fully integrated. This undoubtedly will mean higher costs, lower production and lower income for individual farmers until a new equilibrium is reached (for example, one would expect land prices and rents to fall to reflect the immediate hit to profitability, while producer prices will rise in response to the fall in production).

For this reason, we see farmer protests occurring in various countries. In Germany in January 2021 farmers protested against a draft law intended to restrict the use of pesticides to save insects. In France, farmers have started a series of rolling protests against the CAP reform. Spanish farmers were on the streets protesting low prices last year. The Netherlands experienced a series of demonstrations by livestock farmers in 2019-2020 protesting against a government proposal to limit nitrogen emissions by halving the country’s livestock.

Behind many of these protests is upset at the changing public perception of farmers who are used to being lauded as the backbone of the nation and who now find themselves increasingly vilified for environmental transgressions, and which is undoubtedly a source of mental distress. But instead of dismissing the criticisms as ‘agri-bashing’, the more productive strategy would be to embrace the need for change and to demonstrate, using metrics, that change is occurring. Farmers’ organisations at European level and in many countries bear a heavy responsibility for their lack of leadership in this context.

The next CAP will set aside additional funds to support some of the steps needed to progress the green transition. The precise details around the new green architecture are still being discussed in the trilogues between the co-legislature and the Commission, so the size of the allocation and the way this money can be spent are still unclear. But, in the short run, these funds will come from the income support payments in the CAP on which many farms depend. This is the difficult path which politicians have to navigate.

In this post, I suggest several ways in which this trade-off might be alleviated. Buoyant agricultural markets would make the transition easier. The mechanisms in the CAP to better target payments (capping, degressivity but particularly the redistributive payment) can be used to direct funding to where it is most needed. New revenue sources associated with the green transition should be supported. And there should be more investment in innovation to expand the toolbox of options available to farmers to embark on the green transition.

This post was written by Alan Matthews.

Photo credit: © N Chadwick (cc-by-sa/2.0)

Update 12 May 2021: I added a clarification on the link between changes in support and changes in income. Also, by coincidence, the Commission today published an evaluation study of the impact of the CAP on the objective of viable food production including level of farm income.

Thank You for Your post ,

but Your post is full of false facts greens assumptions and not reflect a reality for farmers everyday life.

Income support is a must to save a european future .

Certainly, this article is full of interesting information. The comparisons between countries is not what I would have expected, for eg. The difference between Germany and France or Ireland and Denmark ! But , changes in support, will lead to many conflicting outcomes. To reduce CO2 while maintaining production and maintaining farm incomes at the same time is impossible. Reducing nitrogen and other chemicals is a “lovely “ idea but will drastically reduce output; leading to imports from countries doing , away more environmental damage. Especially, give the EU reluctance to go the Genetic Engineering route which might be an alternative. Basically, for Agricultural we need to determine quickly, which soils. and practices will sequester . CO2 . Integrate farm , forest and environmental policies in a scientific manner. Not , easy when you look like areas such as land ownership. Another influence, on all this is the general move to a vegan based diet ! Put all this together and hope that the politicians can adapt the support payments to achieve good outcome.

I look after a vape store submission site and we have had a posting from a vape store in the United States that additionally markets CBD products. A Month later, PayPal has written to use to claim that our account has been restricted and have asked us to get rid of PayPal as a payment method from our vape shop web directory. We do not sell CBD product lines such as CBD oil. We simply provide promotion and marketing solutions to CBD companies. I have checked out Holland & Barrett– the UK’s Top Health and wellness Retailer and if you take a good look, you will witness that they offer a relatively comprehensive stable of CBD goods, specifically CBD oil and they also happen to accept PayPal as a payment solution. It appears that PayPal is employing double standards to many different firms. Because of this restriction, I can no longer take PayPal on my CBD-related online site. This has restricted my payment possibilities and presently, I am seriously dependent on Cryptocurrency payments and direct bank transfers. I have spoken to a barrister from a Magic Circle law practice in The city of london and they said that what PayPal is undertaking is absolutely not legal and discriminatory as it should be applying an uniform benchmark to all companies. I am still to consult another attorney from a US law office in London to see what PayPal’s legal position is in the USA. Meanwhile, I would be very appreciative if anyone here at targetdomain could offer me with substitute payment processors/merchants that work with CBD firms.

Your blog is very valuable which you have shared here about Sustainable agriculture is still an important issue. I appreciate your efforts which you have put into this article and also it is a gainful article for us. Thank you for sharing this article here.