Here is a suggestion for the Commissioner’s simplification agenda: scrap the crop diversification requirement, which is one of the three ‘simple, generalised, non-contractual and annual actions that go beyond cross-compliance’ that make up the requirements for eligibility for the greening payment in the CAP’s Pillar 1. And use the money saved (up to half of the greening budget, or €6.1 billion in 2015) to promote improvements in soil organic matter (the main environmental objective of crop diversification) in a more cost-effective way.

The crop diversification greening measure is a scandalous waste of resources. Not only does the EU notionally spend €6 billion annually on this measure for virtually no environmental or other impact (as we will see). It is also a very complex measure to administer, requiring significant changes in the computer systems of the paying agencies to track individual cropping patterns and thus adding to the administrative costs of making payments to farmers. Prior to the recent reform, national paying agencies were spending €5 billion annually on control costs alone adding a further 8.5% to the cost of the CAP. They estimate this could double as a result of the Ciolos 2013 CAP reform.

JRC study on crop diversification

The most recent information on the (lack of) effectiveness of the crop diversification measure comes from a Joint Research Centre report on the development of An EU-wide Individual Farm Model for Common Agricultural Policy Analysis (IFM-CAP). This is an exciting new microsimulation tool which builds on the FADN farm database (around 60,000 individual farms representing around 5 million commercial holdings in the EU) to permit the analysis and simulation of agricultural policy measures that target groups of farms or have different impacts on heterogeneous farms. The first empirical application of this model has been to analyse the likely impacts of the crop diversification measure.

The JRC results are striking, even though they do not differ greatly from the results in the Commission’s own impact assessment of the crop diversification measure also based on the FADN database which accompanied the publication of the CAP reform legislative proposals in October 2011.

First, some background statistics to set the results in context. Out of the five million commercial farms represented in the IFM-CAP model for the EU-27, the JRC estimates that 31% are subject to the crop diversification measure. They refer to these as ‘concerned farms’, and the arable area on these farms as the ‘concerned area’. The remaining 69% of commercial holdings are exempted from the measure. The latter include non-arable farms, farms with a small arable area (less than 10 ha) or farms with a large proportion of land planted with fodder crops.

This 31% figure is an average with the share of concerned farms in individual member states varying from 10% in Slovenia to 90% in Denmark. Those member states with a high proportion of concerned farms (> 60%) have a farm structure dominated by large farms and/or by specialised farms and/or have a large arable sector. Member states with a low share often have a high proportion of small commercial farms in the total FADN sample, which are exempted from the diversification measure.

The JRC analysis is based on a hypothetical baseline scenario for the year 2020 assuming the continuation of the CAP measures in place before the CAP 2013 reform. In the baseline scenario, the proportion of farms in 2020 not complying with the diversification measure is around 15% of concerned farms in the EU-27. This is the proportion of farms that need to adjust their land allocation in order to comply with the diversification measure. Otherwise, these non-compliant farms would face a reduction in subsidy (i.e. lower greening payments) under the CAP 2013 reform.

The impact of the crop diversification greening measure

The JRC analysis then considers the impact of introducing the crop diversification requirement as agreed by the Council and Parliament in the CAP reform package in 2013. The cropping adjustments made by individual farms are modelled taking into account the financial costs they will face if they remain non-compliant. These financial costs (discussed further below) can include the loss of some or all of their greening payment plus an administrative penalty. Farmers with a high proportion of high-margin crops may decide that non-compliance remains the most profitable option for their farms.

Under the 2013 diversification scenario, the JRC estimates that the proportion of non-compliant concerned farms in the EU-27 falls from 15% to 10%. However, it notes that these farms may have partially adjusted their cropping pattern to the requirements, even though a proportion of their area remains non-compliant. In fact, they conclude that approximately 80% of non-compliant farms reduce their non-compliance level in response to the introduction of diversification measures relative to the baseline, while the remaining 20% (or 2% of the concerned farms) do not change their non-compliance level at all.

To summarise, the JRC study concludes that the crop diversification measure will induce 5% of concerned farms which were non-compliant to fully comply with the crop diversification requirements, and a further 8% of concerned farms to partially comply. In terms of all commercial farms (given that concerned farms are 31% of the total), the total proportion of commercial farms affected either wholly or partially is (13% x 31%) or 4% of the total. As the commercial farms in the FADN database represent less than half of all EU farms covered by the Integrated Administrative and Control System (IACS) to which farm payments are made, we can conclude that less than 2% of all EU holdings are affected by this measure.

Comparison with Commission impact assessment

The Commission’s impact assessment came to very similar results also using the FADN database. It concluded that 92% of commercial farms would not be affected by the measure while 8% would be (compared to just 4% in the JRC study). This discrepancy is primarily explained by the Commission’s assumption that all non-compliant farms would move to compliance, while the JRC study shows that less than half of them would. When other differences between the two studies are taken into account (e.g. the Commission impact assessment was based on hypothetical crop diversification rules, whereas the JRC study was based on the actual legislative outcome, and the JRC results are based on a simulated baseline in 2020 while the Commission impact assessment is based on 2005-2007 data), the results are strikingly similar.

But the absurdity of the crop diversification measure eventually agreed is best captured by the proportion of land that will be affected. The JRC study shows that the proportion of non-compliant area is reduced by more than 50% in the EU-27 (whether measured relative to the concerned arable area or the total arable area) under the diversification scenario. This apparently significant change in behaviour is explained by the relatively high subsidy reduction that would be imposed on farms if they do not comply. But the arable area affected by this change of behaviour is tiny, given that the non-compliant area is tiny to start with.

According to the JRC study, the proportion of non-compliant area in the total concerned arable area (i.e. the arable area on those farms concerned by the requirement) is 1% in the baseline in the EU-27 (varying between 0% and 6.5% for individual member states). When expressed relative to the total arable area (including the arable area on farms exempted from the requirement), the non-compliant area in the baseline is 0.6% of the total in the EU-27.

So even though the non-compliant area in both cases is reduced by 50%, the area of arable land affected is tiny – around 0.3% of all arable land will be diversified as a result of spending €6 billion !

Again, this result was foreseen in the Commission’s impact assessment which concluded that 2% of arable land would require to be diversified. Given the Commission’s assumption that all non-compliant land would be brought into compliance as well as other differences in the methodologies, there is a good correspondence between the results from the two studies.

(For technical boffins, the JRC study is calibrated to a three-year average cropping pattern in the FADN sample farms. Over a three-year period, with crop rotation, the average share of individual crops is likely to be lower than if a snapshot of a single year were taken. Thus the JRC study probably underestimates somewhat the number of farms and the area of land that will be affected by the crop diversification requirement.

On the other hand, other study limitations move the results in the other direction. For example, the JRC study does not take into account that organic farms or farms in the small farmer scheme are also exempted from the crop diversification requirement, the fact that member states can opt to define alternative practices that yield an equivalent or higher benefits for climate or the environment, nor does it allow for the possibility that we will see arrangements between farmers to allow them to overcome the constraints on their desired cropping practices.)

Greening penalties

Although it is a footnote to the main argument, the proportion of non-compliant farms in the diversification scenario makes a small difference to the overall area of land that will be affected by the measure. When Commissioner Ciolos announced the greening measures, he intended these to be compulsory for all farms receiving the basic payment/single payment. This language is carried over into the guidelines produced by paying agencies which explicitly refer to the greening measures as mandatory.

In practice, however, the mandatory nature of the greening measures depends on the sanctions that apply to farmers that decide not to comply. These sanctions are of two types. First, a farmer can lose some or all of the relevant greening payment (for the crop diversification measure, the relevant withdrawal can be up to half of the total greening payment). Second, a non-compliant farmer will also face an administrative penalty. According to the recital of the delegated regulation specifying the way that administrative penalties are calculated, ‘administrative penalties under this Regulation should be considered dissuasive enough to discourage intentional non-compliance’.

In my view, it is a basic requirement for a just society that those affected by laws should be able to understand the consequences and sanctions if the law is not observed. But the legislation setting out the sanctions to be applied in the case of non-compliance with the CAP Pillar 1 greening requirements is among the most complex that I have ever read. The relevant provisions are set out in Articles 24 through 28 of the Commission’s Delegated Regulation 640/2014.

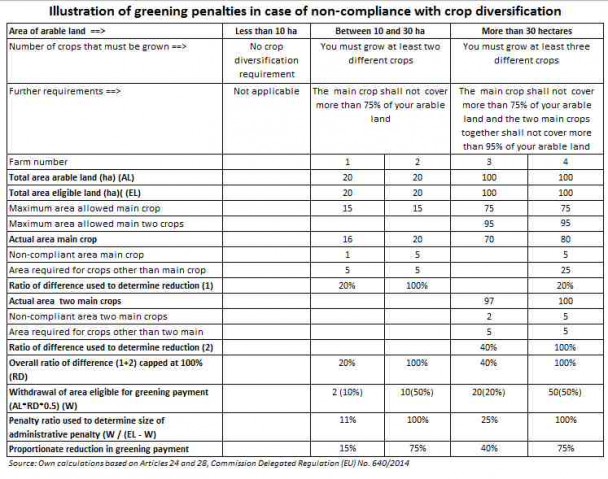

The crop diversification obligation differs according to the size of the arable area, as shown in the table below. The crop diversification requirement applies only to farms with an arable area greater than 10 hectares. Farms with between 10 and 30 arable hectares must grow at least two crops, and the main crop cannot exceed 75% of the arable land. Farms with more than 30 ha arable crops must grow at least three different crops; the main crop cannot exceed 75% of the arable area and the two main crops cannot exceed 95% of the arable area. As noted previously, the sanctions for non-compliance are made up of two elements: a reduction in the greening payment related to the extent of non-compliance, and an administrative penalty.

The reduction in the greening payment due to non-compliance with the crop diversification requirement is set out in Article 24 of the Delegated Regulation. It is defined as a reduction in the area eligible for the greening payment compared to the eligible area if the farm was otherwise compliant. The area of land withdrawn (W) is the product of three elements (which we will call the Article 24 formula):

• The total arable area (AL)

• The ratio of difference (RD)

• A fixed coefficient of 50%

The ratio of difference is defined as the excess arable area planted to the non-compliant main crops (i.e. the area beyond 75% of the total arable area for the first main crop, and where relevant, the area beyond 95% for the first two main crops) divided by the area required for the remaining crops. Some examples of the way the greening payment reduction is calculated are shown in the table (double click on the table to enlarge).

For each of the four concerned farms, we assume that the eligible area to be used for the calculation of the greening payment is the same as the total arable area (i.e. the farmer has sufficient entitlements to be able to claim the basic payment on all of his or her arable area and complications due to weighting coefficients for ecological focus areas are ignored). Farm number 1 has an excess non-compliant area of 1 hectare. This is compared to the requirement for other crops on that farm which is 25% of the arable area or 5 hectares. Thus the ratio of difference (RD) for this farm is 20%. For the larger arable farms, two ratios of difference are calculated and the total ratio of difference is the sum of the two. However, there is a constraint that the total ratio of difference cannot exceed 100%.

Thus, applying the Article 24 reduction formula (before taking administrative penalties into account) would mean a reduction in the eligible area for the greening payment for farm Number 1 of 10% or 2 hectares. For farm Number 4, the reduction in the eligible area is the maximum of 50% or 50 hectares. This assumes that the farms are compliant with their other greening obligations (with respect to the maintenance of permanent grassland and ecological focus areas, EFAs) and that non-compliance is only with respect to the crop diversification requirement.

Administrative penalties

The administrative penalties depend on the severity of the non-compliance with all three of the greening requirements and are set out in Article 28 of the Delegated Regulation. We assume that non-compliance is only due to the crop diversification requirement. The severity of non-compliance is determined by the difference between the eligible area for the greening payment assuming full compliance (EL) and the eligible area for the greening payment as reduced using the Article 24 formula (EL – W), expressed as the following proportion (W / (EL – W)). The administrative penalty applied depends on the size of this ratio (let us call it the penalty ratio).

However, the Council and Parliament agreed that no administrative penalties would apply in 2015 or 2016. In 2017, the administrative penalty as determined by the appropriate formula is divided by 5 but limited to 20% of the amount of the farmer’s greening payment. For 2018 and onwards, the administrative penalty as determined by the appropriate formula is divided by 4, but limited to a maximum of 25% of the amount of the farmer’s greening payment.

The ‘appropriate formulas’ for the administrative penalty are as follows:

Note that this farmer only had 2 non-compliant hectares but they breached the two-crop rule, illustrating the great importance to larger arable farmers to observe the minimum 5% of their arable area for crops other than the two main crops (this point has previously been highlighted by Simon Ward of Inside Track in his 2014 post on the greening penalty for non-compliance with crop diversification).

In the case of cross-compliance, the paying authority can judge that the farmer is in a state of ‘intentional non-compliance’ and, depending on the severity of the breach, can remove up to 100% of a farmer’s payment. Intentional non-compliance is not specifically legislated for in the case of the greening measures. However, if a farmer persists in non-compliance for more than three consecutive years, then he or she will have their eligible area reduced by the total arable area multiplied by the ratio of difference, in addition to the appropriate penalty. Effectively, this means that multiplication by the 50% coefficient in the Article 24 formula is removed, and the area withdrawn for the purposes of determining the greening payment is doubled.

Thus, the mandatory nature of greening depends on the dissuasive power of the financial sanctions. Interestingly, in the JRC analysis no member state (apart from the special case of Malta) becomes 100% compliant and, as we saw, the average rate of non-compliance across the EU as a whole will be around 10% of the concerned farms.

Conclusions

Because the land area affected by crop diversification is tiny, any environmental benefits are correspondingly vanishingly small. The additional environmental benefits of the measure are even smaller because the crop diversification measure replaced a measure on crop rotation included in the standards for Good Agricultural and Environmental Condition (GAEC) which farmers must observe for eligibility for the basic payment/single payment.

Now the GAEC standard on crop rotation was extremely weak as it only required standards for crop rotation where applicable. Few member states were willing to define standards that might affect farm income and ‘freedom to farm’. Control issues also played a role. Nonetheless, the fact that previous (weak) standards that would have affected all arable land have been abolished in favour of a crop diversification measure that affects only 0.3% of arable land makes the environmental benefits of the crop diversification measure even more dubious.

It is also an unfair measure. While small arable holdings are exempt, the main costs fall on medium-size rather than large holdings. The latter are sufficiently large to be usually compliant, whereas medium-sized holdings are more likely to be specialised and thus to be non-compliant with the crop diversification requirement.

It is clear that the current crop diversification measure is not fit for purpose, and should be repealed. Environmental NGOs will argue that the problems occurred in the legislative process where legislators exempted significant amounts of arable land as well as introducing the possibility of equivalent measures and that if the rules were only tightened up all would be well.

The evidence does not support this position. Bringing more arable farms into the net would increase the area of land affected by a relatively small amount, but the additional costs would be very significant and the environmental benefits questionable. Also, the control system is complex and, from a farmer’s perspective, impenetrable as the previous discussion of the financial sanctions for non-compliance shows.

We clearly need a better approach to address soil fertility and soil health, but the first step is to recognise that the current greening measure does not work.

This post was written by Alan Matthews

Picture credit: © Copyright Jeff Buck and licensed for reuse under a Creative Commons Licence.

The greening measures under CAP are invented to decline European spending on trade-distorting farm support, so the share of support comes below a WTO ceiling on farm subsidies.

The crop diversification greening measures are used “green box” support at the WTO. Milk, cattle, and swine production indirectly benefit in total trade-distorting support, but can be classified as “de minimis” under WTO rules.

There is no way to circumvent these rules otherwise Europe looses face at WTO.

@Lucc

Thanks for this response and you raise an interesting question about the way the greening measures will be classified for the purposes of WTO domestic support. However, I think you over-state the case in your comment.

First, currently EU spending on trade-distorting domestic support is well below its WTO ceiling (its so-called Aggregate Measurement of Support or amber box). Nor would the EU have a problem in meeting a new amber box limit even under the ambitious reductions in its amber box ceiling proposed in the draft Doha Round modalities, assuming both the basic farm payment and the greening payment are considered decoupled support and therefore counted in the green box, as you believe. So there was no pressure on the EU to change its farm policies in 2013 from the WTO side as you suggest.

In fact, questions could be raised over the green box status of both the basic farm payment and, even more particularly, the greening payment. The greening payment does not qualify as an agri-environment payment in the green box under WTO rules because it is not limited to the extra costs or income foregone by the farmer in complying with the programme. The Commission will report it as a decoupled income support, but it can be questioned if it complies with the requirement for decoupled income support that “the amount of such payments.. shall not be related to, or based on, the type or volume of production … undertaken by the producer”. The requirement to maintain the area of permanent grassland, for example, could be argued to favour livestock production as against crop production. Thus, if anything, making part of the direct payment to farmers a greening payment may make it more, and not less difficult, to defend the green box status of EU direct payments at the WTO.

Alan Swinbank has a very helpful chapter on these issues in the forthcoming book The Political Economy of the 2014-2020 Common Agricultural Policy : An Imperfect Storm edited by Jo Swinnen and to be published by the Centre for European Policy Studies in Brussels next week. It will be a free download, so look out for it.

Dear Alan,

Thank you for your publication.I think there is a confusion in how crop diversification is determined and the requirement to respect the fundamental principles of crop rotations.I don’t think this contradiction is helping too much improving the sustainability of agriculture,including the quality of the soil.

I think this topic is very acute and requires a special discussion.We can contribute with data from our long-term field experiments with crop rotations and monoculture in the conditions of the Republic of Moldova(longer than 50 years).I am curious if the diversification of crops as it is used at the moment has a scientific argumentation.

Thank you in advance for your comments.With respect Boris Boincean,Head of the Department of Sustainable farming Systems at Selectia Research Institute of Field Crops<Balti,Republic of Moldova

According to Matthews, recent studies have shown that the land area affected by crop diversification is tiny and any environmental benefits are correspondingly vanishingly small. Now the GAEC standard on crop rotation is extremely weak as is only a required standard for crop rotation where applicable, according to Matthews.

@Boris, Gustavo

Thank you for the comments. Indeed, crop rotation was what the Commission had first in mind as one of the greening measures when it proposed options for CAP reform in its 2010 Communication. However, when the legislative proposals were published in 2011, this had been changed to crop diversification The reason given in the Impact Assessment was that “Crop diversification may not bring the full environmental benefits of crop rotation, but is better suited for Pillar I as an annual measure.”. The Commission also noted that where crop rotation had been required under cross-compliance, experience showed that “showed the reluctance of many Member States to define standards which would affect income and the ‘freedom to farm’. In addition control issues played a role.”

So your point, Boris, about the superior benefits for soil fertility of crop rotation was recognised by the Commission but crop diversification was chosen as a second-best option because of administrative and political considerations.