Wales is one of the three devolved government regions which along with England make up the four countries in the UK. Its agricultural sector is, in absolute terms, small. Around 38,400 holdings farm an area of 1.9 million hectares, with an average farm size of 49 hectares. Just over 15,000 of these holdings receive support under Pillar 1 of the CAP as many of them are deemed to be ‘very small’ with insignificant agricultural activity. These farms produce output valued at £1.6 billion in 2017, contributing a gross value added of €457 million and a total income from farming (TIFF) of £276 million in that year (statistics taken from Wales Statistics and Research, Farming Facts and Figures, Wales 2018 and the Aggregate agricultural output and income web page).

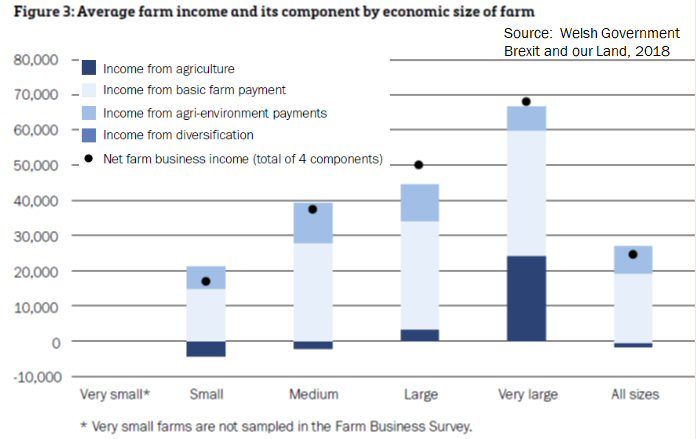

Total receipts under the Basic Payment Scheme (BPS) amounted to £234 million while agri-environment payments under the Glaistir scheme amounted to a further £55.7 million in 2017. The dependence on CAP support is obvious, and is well illustrated in the figure below. Only very large farms, measured in terms of economic size, have a positive net income from the sale of agricultural produce. For the agricultural sector as a whole, total income from farming is made up of the BPS payment and agri-environment payments.

Yet Wales could prove to be a test-bed for agricultural policy reform, with a significance far beyond its own borders. As part of its post-Brexit preparations, the Welsh Government issued a consultation paper on post-Brexit agricultural policy Brexit and our Land: Securing the Future of Welsh Farming on July 10 last.

While many of the ideas in this paper echo ideas put forward in the Defra consultation paper on Health and Harmony: the future for food, farming and the environment in a Green Brexit on ideas for a post-Brexit agricultural policy for England, the Welsh Government paper is much more detailed and specific in its proposals, and thus a much more interesting document to analyse.

Criticisms of CAP

The Welsh Government does not hold a candle for the CAP and particularly the BPS which it believes has been insufficiently targeted to make a useful contribution. In economic terms, the BPS has not done enough to improve farm productivity (the net margin per unit of production). The consultation paper points out that agricultural value-added in Wales has been decreasing, both in absolute terms and as a share of the economy. It believes this reflects the fact that BPS payments are not intended to support productivity improvements or wider benefit delivery.

It also argues, though on less clear evidence, that “the BPS is not structured to offset the financial impact from significant downside risks to the trading environment (which result from some Brexit scenarios). CAP is designed for land managers within the European Union; outside the EU, a different support system is needed”. It also identifies problems with the rules for agri-environment schemes, arguing that there is insufficient focus on addressing environmental challenges relevant for Wales, specifically the challenge of decarbonisation.

In summary, the paper concludes: “The BPS has not been a targeted intervention and is in essence a payment for holding land. It is too blunt a lever to improve economic performance, is too poorly targeted to keep farmers on the land and does not contribute sufficiently to our environmental resilience”.

Five principles

In putting forward proposals for an alternative agricultural policy, the paper is guided by five principles:

Principle 1. We must keep farmers, foresters and other land managers on the land.

Principle 2. Food production is vital for our nation and food remains an important product from our land. That means continuing to support the economic activities of farmers where it is sustainable and financially viable to do so.

Principle 3. This must be done in a way that builds a prosperous and resilient Welsh land management industry – especially agricultural (sic) and forestry.

Principle 4. In order to dramatically increase the services that Welsh society can receive from our land, future support will encompass the provision of additional public goods from land.

Principle 5. All land managers should be able to access new schemes; support will not be restricted only to current recipients of CAP funding. But land managers may need to do things differently in return for support.

Specifically, the consultation paper proposes a new Land Management Programme that will replace the CAP in its entirety. The Programme as proposed consists of two over-arching schemes: the Economic Resilience scheme and the Public Goods scheme.

“The Economic Resilience scheme will provide targeted investment to both land managers and their supply chains. The scheme will provide support to increase market potential, drive improvements in productivity, diversify, improve risk management and enhance knowledge exchange and skills. In doing so, it will help businesses to stand on their own two feet.

The Public Goods scheme will provide support to deliver more public goods from the land. In return, it will provide a new income stream for land managers and make a significant contribution to addressing some of our most pressing challenges such as climate change, biodiversity decline, adverse air quality and poor water quality.

We therefore propose a phased transition plan to move from old to new schemes. We intend to bring forward detailed proposals by spring next year and publish legislation by the end of the Assembly term. Our ambition is to complete reform by 2025.”

Economic Resilience scheme

The proposal to replace CAP support in its entirety given that it makes up the totality of farm income in Wales is a bold move. The consultation paper believes that the two replacement policies can make up the gap, but in different ways.

The Economic Resilience scheme is based on the belief that area-based direct payments have cushioned the industry from making necessary investments to improve its competitiveness. It points to evidence from farm survey data that there is a huge gap in performance between the higher-performing farms and those in the lowest tiers.

Although total payments make up 100% of farm income, the consultation paper notes that they are a relatively small share of turnover.

“Commercial income is the major component of farm turnover but significant costs mean it makes only a small (or negative) contribution to net income. A relatively small change in turnover or costs would have a proportionately large impact on the net income position. As such, changes to turnover and costs could have the potential to alter the perceived “reliance” on CAP support….. It is also important to recognise there is often a significant difference between net farm business income and farm household income. For small farms, net farm business income (and hence support payments) make up a smaller proportion of income than non-farm income”.

The belief underlying this argument is that properly-targeted investment support (at least to those farms with the potential to be viable) can enable a sufficient lift in productivity to enable farms to earn a sufficient return from the market place. As the paper notes: “The ultimate aim is to help land management businesses stand on their own two feet”.

One of the objectives of the consultation paper is to seek views on the appropriate shape and scale of this support. The government expects it to be conditional on a credible business strategy, assessment of viability and potential for a return on investment. Five areas for potential support are outlined in the paper:

Area 1: increasing market potential.

Area 2: improving productivity.

Area 3: diversification.

Area 4: effective risk management.

Area 5: knowledge exchange, skills and innovation

In the absence of income support, then farmers must seek ways to increase their labour productivity, as this is the sole determinant of their income in the longer-run. There are two ways to increase labour productivity. One is through structural change, in which the individual farmer increases his or her individual earnings by farming more hectares. This approach would not be consistent with Principle 1 in the paper to keep farmers on the land.

The other way to increase labour productivity is to increase land productivity, or the income earned by the farm per hectare. This can be done by improving yields or reducing costs (Area 2), by adding value to existing production (Area 1) or by using some farm resources to earn non-farm income through diversification (Area 3).

The unanswered (and unanswerable) question is what is the potential to increase land productivity (the farm income generated per hectare of land)? As the consultation paper notes, Welsh farm income is small relative to the total value of output (£276 million compared to £1.6 billion). Therefore, an increase in the value of output of 17% (with no associated increase in on-farm costs) would generate the missing millions. (Other combinations are possible – reducing costs while maintaining the value of output, or using some under-employed farm resources to diversify or add value to existing output). There is clearly scope to improve farm incomes in these ways, also because farm input prices such as land rents would adjust to the elimination of direct payments, although the timespan over which these gains can be achieved remains uncertain.

Public Goods scheme

However, this is where the consultation paper introduces the second prong of its proposal, the Public Goods scheme. This scheme is intended to address pressing challenges such as climate change, habitat and species loss, adverse air quality, poor water quality and increased flood risk. However, it would also have the explicit objective “to provide a valuable new income stream for land managers, open to all and with payment for outcomes based upon the value society places upon them”.

The paper sets out a set of high-level design parameters for the Public Goods scheme, and seeks the views of stakeholders on the detailed design of scheme parameters. The parameters are:

Parameter 1. Scope of the scheme – which public goods

Parameter 2. Open to all – ensuring all land managers have the opportunity for eligibility

Parameter 3. Opportunities for action – taking a spatial approach

Parameter 4. Evidence-based public goods – ensuring value for money

Parameter 5. Additionality – a focus on active land management

Parameter 6. Advisory support for land managers – how to provide appropriate guidance

From our perspective in this post, the key innovation in the scheme is the intention that it would provide an income stream for farmers. The paper notes that EU agri-environment schemes are restricted to costs incurred and income foregone. As a result:

“Where agricultural incomes are marginal the quantum of funding is necessarily reduced to reflect a low or negative level of income foregone. This leaves insufficient incentive for participation, especially on land where intervention is most desirable. These schemes are also restricted in terms of scope, only supporting the delivery of environmental outputs and not social ends. This limited scope and the funding structure drives a focus on inputs rather than outcomes. It is therefore possible to have an agri-environment scheme where land managers fully meet the requirements of the scheme but without delivering the desired outcomes.”

Under the new Public Goods scheme land managers will be paid an appropriate value for both environmental and social outcomes rather than being compensated for input costs. The paper notes that valuation of outcomes will be important and new tools will be required to determine appropriate social values for the outcomes sought, as well as robust methodologies for measuring outcome delivery. The paper notes that any valuation in part should reflect the social value of keeping land actively managed through the retention of people on the land.

What is striking is that this proposal exactly echoes the eco-schemes proposed by the Commission in its legislative proposal to be funded by Member States from their Pillar 1 direct payment budgets. One of the options for the eco-scheme is to make payments additional to basic income support for farmers who voluntarily agree to pursue agri-environnment-climate measures on their land beyond the regulatory baseline. These payments would not be limited to costs incurred and income foregone (one difference is that under the Commission’s proposal only genuine farmers can benefit, while the Welsh consultation paper is clear that participation would be open to all land managers).

When a scheme is designed to achieve two objectives (income support and environmental objectives), there is clearly a tension between them. The more the emphasis is placed on providing income support, the less ambitious will be the environmental objectives achieved, and vice versa. In a worst case scenario, one can end up with something similar to the current greening payment, which is almost completely an income support payment with very limited environmental outcomes (as argued by the European Court of Auditors in its 2017 report Greening: a more complex income support scheme, not yet environmentally effective). How the Welsh government would navigate this dilemma after Brexit remains to be seen.

Uncertainties

The Welsh government’s consultation paper on post-Brexit agricultural policy is a substantive effort at re-thinking agricultural policy. Although it shares many of the ideas underlying the Commission’s legislative proposal for the CAP post 2020 (including the emphasis on targeting payments on results, the idea of an eco-scheme, and the need to put more emphasis on addressing lagging productivity, for example), it is far more consistent in following through on the logic of a results-based model than is the Commission.

In particular, it recognises that uniform area-based decoupled payments are not consistent with a results-based agricultural policy. It therefore proposes to do away with direct payments over a relatively short time horizon by 2025. If only the Commission had had similar courage (though, to be fair, there is little evidence of political backing for such a move in either the Council or Parliament at the present time). Also, the Commission’s proposal, in theory, leaves it open to a Member State to follow the Welsh model if it wanted as it could devote the bulk of its Pillar 1 ceiling to the eco-scheme as well as use the maximum flexibility to transfer funds to Pillar 2. Under the Commission’s proposal, this debate on priorities will take place at the Member State level.

Of course, the idea of using public goods payments also for income support suggests that the Welsh proposal may not be quite as radical as it sounds. But requiring payments to be linked to measurable outcomes is an important and necessary first step.

Many uncertainties remain over the implementation of the new Welsh model, which is still at the consultation stage. The paper makes clear that it wants funding for the new agricultural policy to be maintained at least at the same level as existing CAP funds. This will depend on the funding mechanism for agricultural policy agreed within the UK after Brexit, and there is no clarity on this at the present time.

Although the paper recognises the risks to trade relationships from Brexit, it assumes a relatively benign outcome both in that the UK would continue to maintain the same level of border protection for agricultural products as it does as an EU Member State and that favourable trade relationships will be maintained with the EU as its most important market.

If the UK leaves the EU under a disorderly Brexit, or if the UK government after Brexit moved to lower tariff protection, either unilaterally or as part of its strategy of concluding free trade agreements with major agricultural exporters, the market environment for this major policy experiment would be radically different.

On the other hand, a disorderly Brexit could lead to a fall in the value of sterling on foreign exchange markets which could help to cushion some of the adverse economic fall-out from increased trade barriers in EU markets.

It will be worth keeping an eye on the evolution of this debate in Wales in the coming months. Initial reactions from the Welsh Farmers’ Union NFU Cymru have been hesitant. It has emphasised the need for stability in policy and notes that “Removing direct payments would have a massive impact on the Welsh agricultural industry and because farming is so intrinsically linked to the well-being of Wales, it would consequently have a similarly detrimental effect on the people and communities of Wales.”

The consultation paper is open for responses until 30 October this year.

This post was written by Alan Matthews

Photo credit: Copyright Rudi Winter and licensed for reuse under this Creative Commons Licence.

Interesting and thought provoking analysis Alan.

For me the first principle is unclear. Keeping people on the land could be interpreted as entering some kind of time warp where everybody stays where they are, if so it rather limits the capacity for the industry participants to stand on their own two feet. It will be difficult enough adapting to the new post Brexit world without allowing the opportunity to introduce some scale efficiencies into the business.

Is keeping people on the land the outcome that is really being sought? Or is it a way of expressing a desire for maintaining rural communities (i.e. a social outcome) or for ensuring that the productive and aesthetic quality of the land is maintained (an environmental/economic outcome)? How you frame the desired outcomes can have a big effect on the policy tools you can employ.

“The ultimate aim is to help land management businesses stand on their own two feet”. If this is the objective, it is amusing that the strategy chosen is to provide payments from the public purse. If that really is the objective, investment in agriculture R&D aimed at increasing productivity is more likely to achieve it.