Preparations within the Commission for its next MFF proposal, which is now expected in May next year, are well under way. Thinking on the shape of the next MFF began in January last year with the Dutch Presidency Conference on preparing for the next MFF. In December 2016 the High Level Group on the Future Finances of the EU produced its final report and recommendations for a reform of the own resources side of the MFF. In June 2017, the Commission produced its Reflections Paper on the Future of EU Finances. This was one of a series of Reflection Papers published by the Commission in the wake of its White Paper on the Future of Europe published in March 2017.

The Reflections Paper provides a coherent account of the challenges that the EU budget is required to address, including those that have recently emerged. In addition to classical areas such as investments in public goods managed at the EU level (including research and major infrastructure), economic and social cohesion and sustainable agriculture, the paper notes the growing importance of managing migration as well as external challenges in security, humanitarian aid and development. The Reflections Paper set out a number of scenarios for the evolution of the EU budget up to 2015 which were aligned with the scenarios for the future evolution of the Union set out in the White Paper.

Another issue which has been raised in the preliminary discussions not least by the European Parliament is the need for greater flexibility in the EU budget, to give it the capacity to respond more quickly to unforeseen crises. The system of pre-agreed ceilings for different headings in the MFF has contributed to greater stability around the annual budget decision-making process, but it has also constrained the EU’s response when faced with short-term crises.

Ian Begg has written a good summary of the current state of the debate on the next MFF in this short paper for the Stockholm Institute of European Studies. Another paper by Eulalia Rubio for the Parliament’s Budget Committee provides a good overview of the lessons from the use of flexibility in the 2014-2020 MFF to date and how it might be enhanced in the coming MFF.

The UK’s withdrawal from the EU (Brexit), given that it is the second largest net contributor to the EU (in cash terms though not as a proportion of GNI), adds yet another element of complexity to the mix. Last week, Politico.eu reported that the current Budget Commissioner Günther Oettinger reviewed studies undertaken within different Directorates-General on the impact of three different post-Brexit scenarios on their policy areas. The three options included the status quo, as well as cuts of 15% and 30%, respectively, in the current MFF totals.

In previous posts on this blog I have had a look at what Brexit might mean for the overall EU budget (here) and the CAP budget (here). More recently, the Research Department of the European Parliament commissioned Jörg Haas and Eulalia Rubio from the Notre Europe – Jacques Delors Institute to examine this issue in greater detail. Their excellent report notes that “There is no default method for adapting the current MFF to the departure of a Member.” They model the different consequences for individual Member States of closing the hole in the EU budget left by the UK’s departure depending on whether the gap is closed by increasing the gross contributions of the remaining Member States or by reducing expenditure (where they look particularly at the effects of cutting CAP expenditure by around 20%).

The very different distributional consequences between Member States of these options illustrates how difficult it will be to reach agreement in the European Council on the next MFF. The Budget Commissioner Günther Oettinger appears to be seeking a middle ground. In a blog post in October 2017 entitled “A new deal between net payers and net beneficiaries”, he called for a “fair 50:50 deal” in which “net payers would pay a little more into the EU pot for the guarantee that every single Euro paid is spent efficiently and has an added value. Net beneficiaries by contrast, would have to accept more control over their structural projects in exchange for avoiding drastic cuts”. It will only become clearer in the coming months whether such a middle ground has the prospect of gaining support.

In this post I re-examine the possible implications of these debates for the funding that might be made available for the CAP budget in the next MFF. Of course, the size of the future CAP budget will not be dependent on financial considerations alone. It will ultimately be decided on the basis of the political priorities of the European Council. The Commission Communication on the Future of Food and Farming published today can be, in part, interpreted as an attempt to hold on to as large a share of the next MFF for the CAP budget as possible, by showing that the CAP is ready to make adjustments to justify its continued relevance. Nonetheless, the financial parameters set constraints on what is possible, and it is these financial constraints that I wish to examine in this post.

How might the MFF evolve over time?

Let us take as a working assumption that the size of the next MFF remains ‘broadly stable’ and that the current status quo is maintained (recognising that this is the most optimistic of the three scenarios that Budget Commissioner Oettinger asked his departments to consider). This does not mean a constant budget in absolute terms, but rather one limited by the ‘political ceiling’ currently in place that payment appropriations cannot exceed 1 percentage point of EU GNI.

This ‘political ceiling’ was first set out in a joint letter in December 2003 from six net contributor states (Austria, France, Germany, the Netherlands, Sweden and the United Kingdom) to Commission President Prodi when negotiations were beginning on the 2007-2013 MFF. This ceiling was also reflected in the Commission’s initial proposal for the 2014-2020 MFF. The European Council MFF conclusions in February 2013 agreed an even tighter ceiling, in that it limited commitment appropriations to 1% of EU GNI and payment appropriations to 0.95% of EU GNI.

For comparison, the MFF ceiling for commitment appropriations for the 2018 Union budget represents 1.02% of EU GNI and the MFF ceiling for payment appropriations 0.92% of EU GNI (using the new ESA 2010 methodology for calculating GNI). Although budgeted commitment and payment appropriations in the draft 2018 budget are a little below the MFF ceilings (more so for payment appropriations), when the figures are rounded they comprise the same percentage share of EU GNI as for the MFF ceilings.

The current recovery in the EU economy, if it continues into the coming decade, implies that there could be considerable buoyancy in the EU’s own resources even if limited to 1% of EU GNI. The latest economic forecasts from DG ECOFIN show that, compared to the 2001-2010 period when average annual growth in real GDP in the EU-28 was just 1.3% p.a., real GDP growth is now running at over 2% p.a. and is expected to do so until the end of the forecast period in 2019. We assume a real growth rate for GNI in the period 2021-2027 of 1.8% p.a.

Assume further that the next MFF will cover a seven-year period. The MFF can be stated in either constant or current price terms. In the following, we choose to state it in current prices in order to highlight the share of CAP spending. In preparing the MFF in current prices, the Commission uses a 2% annual price deflator. Combining this deflator with the assumed real growth rate of 1.8% p.a. yields a nominal growth rate in EU GNI of 3.8% p.a. over the period 2021-2027. If the Commission prepared its MFF proposal on this basis, total EU own resources under a ‘stable’ budget scenario would increase by 30% in nominal terms by the end of the period in 2027 (leaving aside for the moment the impact of Brexit).

CAP expenditure is composed of direct payments and market-related expenditure in Pillar 1 and rural development spending in Pillar 2. Direct payments make up 70% of the total CAP budget. Direct payment ceilings are fixed in nominal terms; there is no commitment to maintain them in line with inflation. One scenario for future CAP spending is to maintain the total budget (including Pillar 2) constant in nominal absolute terms based on 2020 levels.

This assumption about the CAP budget is made purely to illustrate the scenario; it is not necessarily a recommended outcome. It recognises the political difficulties there are in reducing payments to CAP beneficiaries in absolute terms, but strong arguments have also been made (e.g. in this RISE Foundation report CAP: Thinking out of the Box) for a major restructuring of CAP spending which might be accompanied by some reduction in the overall total.

The figure below shows the outcome of these assumptions. The starting point is the 2020 figures for total EU budget commitment appropriations and CAP spending in current prices as given in the forward projections contained in the Commission’s draft 2018 budget document. These are €168.8 billion and €58.6 billion, respectively. We assume that a stable budget implies maintaining the ratio of EU spending to EU GNI constant at the 2020 level (this ratio is not given in the draft 2018 budget document but, as noted earlier, the 2018 ratio for commitment appropriations was 1.02% of EU GNI). We further assume that EU GNI (and thus total EU budget spending) will increase by 3.8% annually over the period 2021-2027.

These assumptions allow non-CAP expenditure to grow by almost 50% (46%) over the seven year MFF period. Were this scenario to come about, the share of the CAP in the EU budget would fall from 34.7% in 2020 (the last year of the current MFF) to 26.7% in 2027 (assumed to be the last year of the next MFF). This would continue the steady decline in the CAP’s share of the EU budget since 2001.

I emphasise again the four key assumptions behind this analysis (i) that Member States agree to maintain the ratio of the EU budget to EU GNI at its 2020 level for the next MFF period; (ii) that the Commission proposal for the next MFF is based on an annual real growth rate of 1.8% and a nominal growth rate of 3.8%; (iii) that the CAP budget is held constant in nominal terms; (iv) and that no account is taken of Brexit. The next step is to identify the Brexit impact on these projections.

What is the scale of the Brexit budget gap?

The starting point is the size of the budget gap left when the UK net contribution is no longer paid into the EU budget after Brexit. Here we are concerned with the structural (long-term) impact of Brexit, and not the terms of the financial settlement to settle past liabilities that may be agreed with the UK as part of a withdrawal agreement under Article 50 TEU. The potential size of this funding gap in the future is uncertain, because of uncertainties over future economic growth rates in the UK (assuming it remained a part of the EU) and the future exchange rate between sterling and the euro.

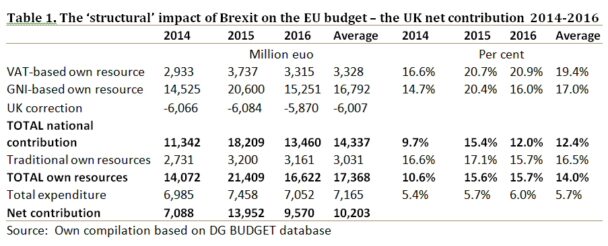

Also, there is considerable volatility in the UK net contribution from year to year, as can be seen from the table below (this updates the table given in this earlier post taking account of the recent publication of the 2016 net operating balances of Member States by DG BUDGET). Taking an average of the three years 2014-2016 suggests that the UK’s net contribution is around €10.2 billion annually. This compares to EU budget expenditure excluding expenditure in the UK in 2016 of €129 billion, or a gap of 7.9%. This net contribution would be expected to grow over time with economic growth in the UK.

Another point to note in this table is the disparity between the UK’s contribution to EU GNI (17.0%) and its share of EU expenditure (5.7%) (see last column). This means that, when the UK leaves, there will be an increase in the share of EU-27 expenditure relative to the remaining EU-27 GNI, assuming expenditure is kept unchanged. Expenditure has to be reduced by the equivalent of €10.2 billion (in 2016 prices) if an increase in Member States’ gross contributions is to be avoided. But, according to Haas and Rubio, the reduction would have to be €16 billion (in 2016 prices) if the ‘political ceiling’ of an EU budget not greater than 1% of EU GNI in the EU-27 (rather than the EU-28) is not to be breached. This would represent a much more severe constraint on the growth in EU spending in the coming MFF period.

What will be the impact of the Brexit budget gap?

Figure 1 made the point that the combination of economic growth in the EU and holding the CAP budget constant in nominal terms would give a ‘room for growth’ for non-CAP spending in the EU MFF to address new challenges of around 46% by the end of the period. The departure of the UK would considerably reduce this ‘room for growth’.

To assess the Brexit impact, we make the simplifying assumption that the UK net contribution of €10.2 billion (in 2016 prices) would grow in line with the growth in EU GNI over the period 2016-2027 (assumed to be 3.8% p.a.). In practice, the growth in the UK net contribution if the UK remained a Member State would depend on the growth in the UK GNI, the growth in non-EU imports into the UK (which would impact on the customs union tariff revenue transferred to Brussels), the growth in EU expenditure in the UK, and the way the UK rebate would be affected by future EU expenditure growth.

Under this assumption, the UK net contribution in 2020 (in nominal prices) would increase to €11.8 billion. Over the period to 2027, it would increase to a further €15.4 billion. Cumulating these net contributions (in nominal prices) over the full MFF period would amount to €96.5 billion. This amounts to exactly half of the anticipated ‘room for growth’ in non-CAP spending over this period of €195 billion. Thus Brexit, in one swoop, results in the disappearance of half of the expected ‘room for growth’ in non-CAP spending over the period 2021-2027.

If, in addition, the remaining EU-27 Member States agreed (presumably under pressure from the remaining net contributors) that the ‘political ceiling’ for the EU budget of 1% of the GNI of the remaining EU-27 Member States should be maintained, the ‘room for growth’ in non-CAP spending would fall by even more. The required €16 billion reduction in expenditure in 2016 (in 2016 prices) would be €18.6 billion in 2020 and this reduction would amount to €24.1 billion in expenditure in 2027. Cumulating the required reductions over the period 2021-2027 amounts to €151.4 billion, or nearly 80% of the projected ‘room for growth’ in non-CAP spending in the absence of Brexit.

In that scenario, it is hardly conceivable that the EU’s new political priorities for the coming period, including security and migration as well as growth, could be financed from the ‘room for growth’ made available by holding CAP spending constant in nominal terms. The likelihood of a cut in the absolute size of the CAP budget even in nominal terms would be overwhelming.

These are scenarios, not forecasts. They illustrate the likely impact of decisions that have yet to be taken. Key variables will be the Commission’s assumptions regarding future EU-27 growth when drawing up its MFF proposal, but even more whether the remaining net contributor Member States will be prepared to lift the ‘political ceiling’ on the size of the EU budget and by how much. This will only become clear when the MFF negotiations get under way.

This post was written by Alan Matthews

Photo credit: Sam Neill via Twitter

Europe's common agricultural policy is broken – let's fix it!